Get the free Roth IRA Application - First Bankers Trust Services

Show details

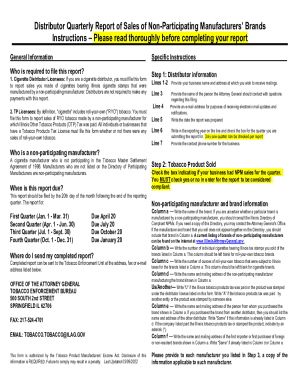

About Printing Requirements Reset Show Field Borders Roth IRA Application 1 ROTH IRA OWNER INFORMATION (Custodian's/Trustee's name, address, and phone number above) NAME, ADDRESS, CITY, STATE, AND

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign roth ira application

Edit your roth ira application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your roth ira application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing roth ira application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit roth ira application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out roth ira application

How to fill out a Roth IRA application:

01

Gather necessary information: Before starting the application, gather important documents such as your Social Security number, date of birth, employment information, and banking details. You may also need to provide information about your spouse or beneficiaries if applicable.

02

Choose a financial institution: Decide which financial institution you want to open your Roth IRA with. Research and compare different institutions to find the one that best meets your needs in terms of fees, investment options, and customer service.

03

Access the application: Once you have chosen the financial institution, visit their website or contact them to access the Roth IRA application. Some institutions may provide paper applications that can be mailed in, while others allow online applications.

04

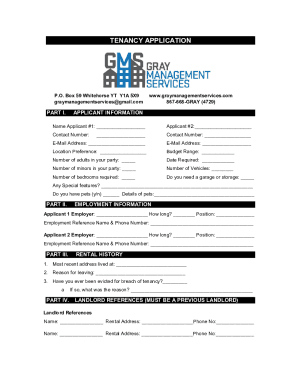

Fill in personal information: The application will typically start by asking for basic personal information such as your name, address, phone number, and email address. Provide accurate and up-to-date information to ensure smooth processing of your application.

05

Provide employment details: The next section of the application may require you to provide information about your current and previous employment. This may include details such as your employer's name, address, and contact information.

06

Choose your investment options: One crucial aspect of a Roth IRA is the ability to invest your contributions. Review the investment options provided by the financial institution and select the ones that align with your financial goals and risk tolerance. You may have the option to allocate your contributions among different asset classes like stocks, bonds, or mutual funds.

07

Designate beneficiaries: Another important step is designating beneficiaries for your Roth IRA. This ensures that your account passes to your chosen individuals or entities in the event of your death. Provide the necessary information for each beneficiary, such as their full name, date of birth, and relationship to you.

08

Review and submit: Before submitting your application, carefully review all the information you have entered to ensure accuracy. Look for any errors or omissions that could delay the processing of your application. Once you are satisfied, submit the application according to the instructions provided by the financial institution.

Who needs a Roth IRA application?

01

Individuals planning for retirement: Roth IRAs are a popular retirement savings vehicle. If you are looking to start saving for retirement and want tax-free withdrawals in the future, you may need a Roth IRA application.

02

Those looking for tax advantages: Roth IRAs offer tax advantages, as contributions are made with after-tax dollars and qualified withdrawals are tax-free. If you want to take advantage of these tax benefits, a Roth IRA application is necessary.

03

Young adults starting their careers: Starting your Roth IRA early in your career can provide significant long-term benefits due to the power of compound interest. If you are a young adult just starting out in the workforce, a Roth IRA application can help you kickstart your retirement savings.

04

Individuals seeking flexibility: Roth IRAs offer more flexibility than traditional IRAs when it comes to withdrawals. If you anticipate needing access to your contributions before retirement age without penalties, a Roth IRA application may be appropriate for you.

05

Those who meet income eligibility requirements: To contribute to a Roth IRA, individuals must meet specific income eligibility requirements. If you fall within the income limits set by the IRS, a Roth IRA application can help you take advantage of this retirement savings option.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in roth ira application?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your roth ira application to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I sign the roth ira application electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your roth ira application in minutes.

Can I create an electronic signature for signing my roth ira application in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your roth ira application and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is roth ira application?

The Roth IRA application is a form used to open a Roth Individual Retirement Account (IRA).

Who is required to file roth ira application?

Anyone who wants to open a Roth IRA account is required to file the Roth IRA application.

How to fill out roth ira application?

To fill out the Roth IRA application, you will need to provide personal information, designate beneficiaries, choose investment options, and sign the form.

What is the purpose of roth ira application?

The purpose of the Roth IRA application is to establish a retirement savings account that offers tax-free growth and withdrawals in retirement.

What information must be reported on roth ira application?

The Roth IRA application will require information such as name, address, social security number, employment details, and beneficiary information.

Fill out your roth ira application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Roth Ira Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.