Get the free Liability Conditions & Exclusions

Show details

This document outlines the liability conditions and exclusions for the transportation of vehicles by VDS, detailing coverage limitations, claims procedures, and client responsibilities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign liability conditions exclusions

Edit your liability conditions exclusions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your liability conditions exclusions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

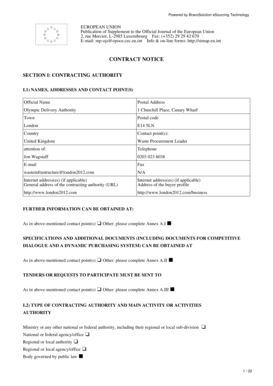

Editing liability conditions exclusions online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit liability conditions exclusions. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

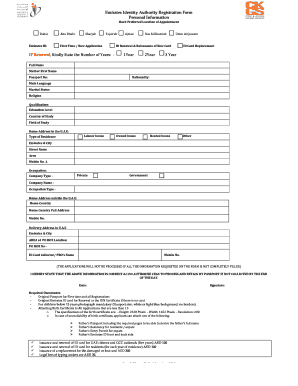

How to fill out liability conditions exclusions

How to fill out Liability Conditions & Exclusions

01

Read the document carefully to understand its purpose and requirements.

02

Start with the heading 'Liability Conditions & Exclusions'.

03

Identify and list each condition relevant to liability.

04

Clearly define any exclusions that list circumstances where liability does not apply.

05

Use clear and concise language to promote understanding.

06

Refer to any related documents or clauses for context.

07

Provide examples, if applicable, to clarify complex conditions or exclusions.

08

Review the filled-out document for completeness and accuracy.

09

Seek legal advice if necessary before finalizing the document.

Who needs Liability Conditions & Exclusions?

01

Businesses and organizations looking to define their liability in contracts.

02

Insurance providers needing to outline coverage limits.

03

Legal professionals drafting or reviewing contracts.

04

Clients seeking to understand their rights and obligations.

05

Any entity involved in activities that may incur liability risks.

Fill

form

: Try Risk Free

People Also Ask about

What is exclusion of liability in practical law?

A clause which excludes or restricts liability (section 13(1), Unfair Contract Terms Act 1977). This term includes clauses which: Make the liability or its enforcement subject to restrictive or onerous conditions, for example, requirements for notification within a limited time.

What does exclude all liability mean?

Exclude liability by specifying a time limit before the expiry of which the other party must make a claim or give notice of a breach. Exclude or limit any right or remedy in respect of the liability — an example is excluding the right to set-off.

What is the difference between exclusion clause and limitation of liability clause?

Exclusion and Limitation Clauses. As their name suggests, exclusion clauses seek to exclude specific types of liability from the contract. Limitation clauses seek to impose limitations and caps on liability, either for specific types of losses or as an overall cap on liability.

What is the exclusion clause for liability?

Exclusion clauses can also serve to exclude liability altogether for certain risks. Some common examples of exclusion clauses include: Capping the financial liability of a party acting negligently. Excluding liability for specific types of losses resulting from negligence, such as harm to goodwill or reputation.

What is the exclusion of liability agreement?

This means inserting clauses in your contracts that reduce your legal responsibility if something goes wrong. These are known as limitation of liability or exclusion of liability clauses. For example, these clauses could reduce the amount of money you have to pay in compensation.

What are the exceptions to the liability clause?

Examples of exclusions from limitations of liability include losses resulting from a breach of confidentiality, refusal to provide services, death, bodily injury, damage to tangible property, violation of applicable law, gross negligence or willful misconduct.

What is exclusion of liability in English law?

An exclusion clause will limit a party's liability in the case the other party sues them. They can also help you manage risk when entering into agreements.

What is the exemption of liability?

An exemption clause is a stipulation in a contractual agreement between two parties that limits the liability of one party in the case of breach of contract or contract default. There are a few different types of exemption clauses, but the three most common are: Limitation clauses. Indemnity clauses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Liability Conditions & Exclusions?

Liability Conditions & Exclusions refer to the specific terms outlined in an insurance policy that define what is covered and what is not covered in terms of liability claims.

Who is required to file Liability Conditions & Exclusions?

Insurance companies are required to file Liability Conditions & Exclusions as part of their policy documentation. Additionally, policyholders must be aware of these conditions when entering into an agreement.

How to fill out Liability Conditions & Exclusions?

To fill out Liability Conditions & Exclusions, review your insurance policy documentation carefully, identify relevant sections regarding liability, and provide necessary details as outlined in the policy terms.

What is the purpose of Liability Conditions & Exclusions?

The purpose of Liability Conditions & Exclusions is to clarify the scope of coverage provided by the insurance policy, including potential limitations and exclusions that could affect the insured party's ability to file a claim.

What information must be reported on Liability Conditions & Exclusions?

Information that must be reported includes specific liabilities covered, exclusions of certain types of damages or claims, and any conditions that must be met for coverage to apply.

Fill out your liability conditions exclusions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Liability Conditions Exclusions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.