Get the free TILA-RESPA Integrated Disclosure Rule FAQs for Wholesale Brokers

Show details

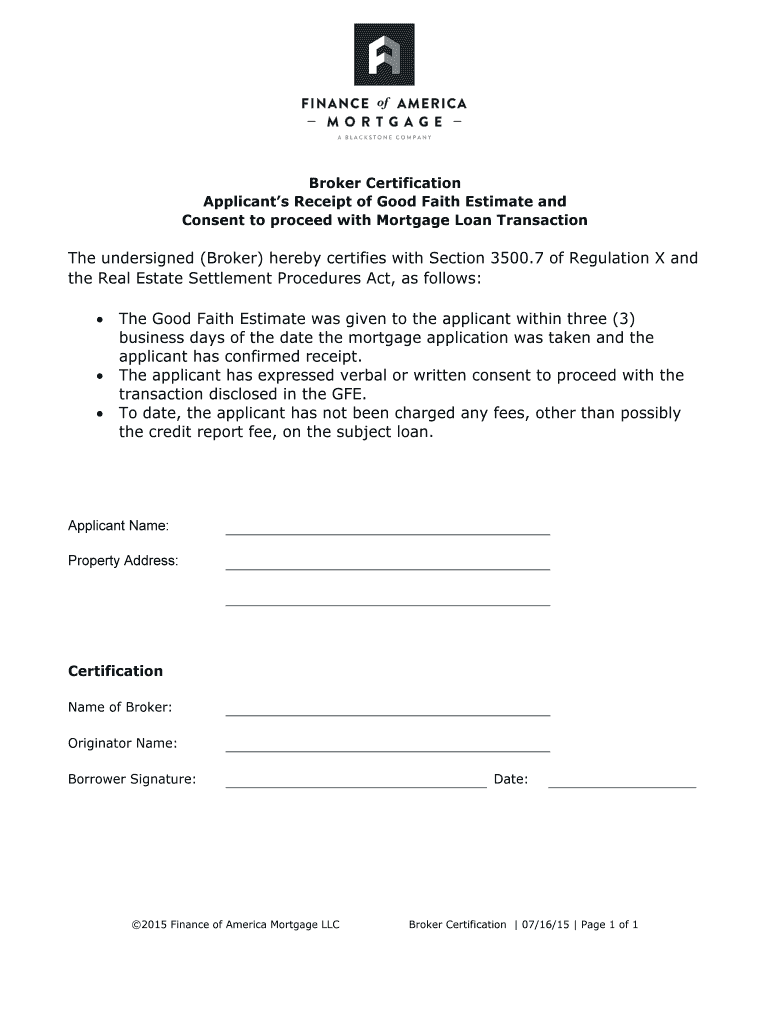

Broker Certification Applicants Receipt of Good Faith Estimate and Consent to proceed with Mortgage Loan Transaction The undersigned (Broker) hereby certifies with Section 3500.7 of Regulation X and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tila-respa integrated disclosure rule

Edit your tila-respa integrated disclosure rule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tila-respa integrated disclosure rule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tila-respa integrated disclosure rule online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tila-respa integrated disclosure rule. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tila-respa integrated disclosure rule

How to fill out TILA-RESPA Integrated Disclosure Rule:

01

Understand the purpose and requirements of the rule - Familiarize yourself with the TILA-RESPA Integrated Disclosure Rule, also known as TRID. This rule combines the disclosure requirements of the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA) into a single set of forms.

02

Gather necessary information - Collect all the relevant information needed to complete the forms. This may include details about the loan, such as loan amount, interest rate, and loan term, as well as information about the property, such as its address and estimated value.

03

Complete the Loan Estimate form - Start by filling out the Loan Estimate form, which provides an overview of the loan terms, estimated closing costs, and other important details. Ensure that all required fields are filled accurately and completely. Use the provided instructions and resources to understand how to complete each section.

04

Provide accurate cost estimates - Estimate the costs associated with the loan, including fees charged by the lender, third-party services, and any other expenses. It's crucial to provide accurate estimates to avoid misleading or confusing the borrower.

05

Review and finalize the Loan Estimate - Carefully review the completed Loan Estimate form for any errors or omissions. Verify that all the figures and details are correct before finalizing the form. Make sure to explain any complex terms or calculations to the borrower, if needed.

06

Complete the Closing Disclosure form - Once the loan is approved and ready to close, fill out the Closing Disclosure form. This form provides the final details of the loan terms, closing costs, and other important information. Pay close attention to the timing requirements for providing the Closing Disclosure to the borrower.

07

Double-check the information - Review the completed Closing Disclosure form for accuracy and completeness. Ensure that all the required details are included, such as loan terms, fees, and other financial information. Make sure any revisions or changes are properly documented.

08

Provide the Closing Disclosure to the borrower - Deliver the final Closing Disclosure form to the borrower within the required time frame before closing. Allow the borrower enough time to review the document and ask any questions they might have. Be prepared to address any concerns or provide further clarification.

Who needs TILA-RESPA Integrated Disclosure Rule?

01

Lenders - Lenders are required to comply with the TILA-RESPA Integrated Disclosure Rule when extending certain types of mortgage loans to consumers. They must provide accurate and timely Loan Estimates and Closing Disclosures to borrowers.

02

Borrowers - Borrowers benefit from the TILA-RESPA Integrated Disclosure Rule as it ensures that they receive clear and comprehensive information about their loan terms, costs, and other important details. This allows borrowers to make more informed decisions and compare loan offers from different lenders.

03

Real estate professionals - Real estate agents and brokers should be familiar with the TILA-RESPA Integrated Disclosure Rule to better assist and educate their clients. Understanding the rule can help them explain the loan terms and associated costs to buyers or sellers, thus facilitating a smoother closing process.

04

Settlement service providers - Professionals involved in the settlement process, such as title companies, escrow agents, and attorneys, need to be aware of the TILA-RESPA Integrated Disclosure Rule. They must provide accurate information and cooperate with lenders to ensure the timely delivery of the required disclosures to borrowers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tila-respa integrated disclosure rule for eSignature?

Once you are ready to share your tila-respa integrated disclosure rule, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I get tila-respa integrated disclosure rule?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the tila-respa integrated disclosure rule in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an eSignature for the tila-respa integrated disclosure rule in Gmail?

Create your eSignature using pdfFiller and then eSign your tila-respa integrated disclosure rule immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is tila-respa integrated disclosure rule?

The TILA-RESPA Integrated Disclosure rule is a mortgage disclosure rule that combines and simplifies mortgage disclosures required under the Truth in Lending Act (TILA) and Real Estate Settlement Procedures Act (RESPA).

Who is required to file tila-respa integrated disclosure rule?

Lenders are required to provide the TILA-RESPA Integrated Disclosure to consumers who are applying for a mortgage loan.

How to fill out tila-respa integrated disclosure rule?

To fill out the TILA-RESPA Integrated Disclosure, lenders need to provide key loan information, such as loan terms, costs, and other details in a clear and easy-to-understand format.

What is the purpose of tila-respa integrated disclosure rule?

The purpose of the TILA-RESPA Integrated Disclosure rule is to help consumers better understand the terms and costs of their mortgage loan, allowing them to make more informed decisions.

What information must be reported on tila-respa integrated disclosure rule?

The TILA-RESPA Integrated Disclosure must include the loan amount, interest rate, monthly payments, closing costs, and any other fees associated with the mortgage loan.

Fill out your tila-respa integrated disclosure rule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tila-Respa Integrated Disclosure Rule is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.