Get the free Tax Agent Services Act 2009 No

Show details

Tax Agent Services Act 2009 No. 13, 2009 An Act to establish the Tax Practitioners Board and to provide for the registration of tax agents and BAS agents, and for related purposes Note: An electronic

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax agent services act

Edit your tax agent services act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax agent services act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax agent services act online

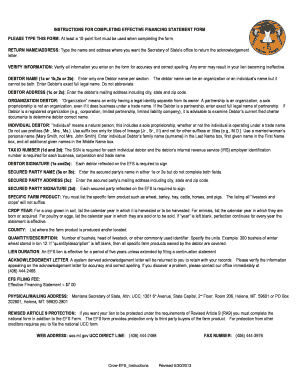

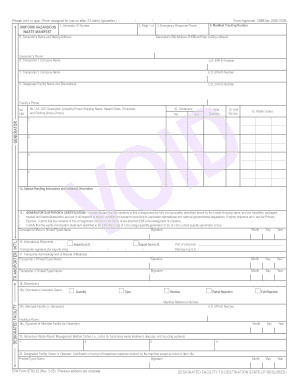

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax agent services act. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax agent services act

Point by point, here is how to fill out the Tax Agent Services Act:

01

Understand the purpose: Familiarize yourself with the Tax Agent Services Act (TASA) to grasp its objectives and regulations. This will give you a foundation for accurately completing the necessary steps.

02

Review licensing requirements: Determine if you meet the criteria for becoming a tax agent or if you need to engage the services of a licensed tax agent. TASA outlines the qualifications and obligations for individuals providing tax agent services.

03

Familiarize yourself with registration: If you are eligible to register under TASA, navigate the registration process. This involves completing the necessary forms, providing required documentation, and paying any applicable fees.

04

Obtain professional indemnity insurance: Ensure you have the appropriate professional indemnity insurance coverage as mandated by TASA. This protects you and your clients against any legal liabilities that may arise during the provision of tax agent services.

05

Comply with the Code of Professional Conduct: The Code of Professional Conduct, a critical component of TASA, outlines the ethical standards and professional behavior expected from tax agents. Ensure you familiarize yourself with and adhere to these guidelines.

06

Maintain ongoing professional education: Stay up to date with changes in tax laws, regulations, and policies. TASA expects tax agents to engage in continuous professional development to ensure they provide accurate and reliable tax advice.

Who needs the Tax Agent Services Act?

01

Individuals providing tax agent services: Tax agents who assist others in preparing tax returns, provide tax advice and lodgments, or represent clients in dealing with tax matters must abide by TASA. It is essential for them to understand and adhere to the requirements set forth by this legislation.

02

Businesses engaging tax agents: Businesses and individuals who engage the services of tax agents to handle their tax affairs are indirectly affected by TASA. By ensuring their tax agents comply with TASA regulations, they safeguard their interests and ensure the accuracy and legality of their tax obligations.

03

Regulatory bodies and authorities: The Tax Agent Services Act serves as a guideline and regulatory framework for government bodies and authorities responsible for overseeing the provision of tax agent services. Compliance with TASA ensures the industry operates ethically and maintains the integrity of the taxation system.

In summary, filling out the Tax Agent Services Act involves understanding its purpose, fulfilling licensing requirements, completing the registration process, complying with the Code of Professional Conduct, obtaining professional indemnity insurance, and engaging in continuous professional education. Tax agents and businesses utilizing their services are directly impacted by TASA, while regulatory bodies and authorities rely on it to administer and regulate tax agent services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax agent services act without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your tax agent services act into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make edits in tax agent services act without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your tax agent services act, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit tax agent services act on an Android device?

You can edit, sign, and distribute tax agent services act on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is tax agent services act?

The Tax Agent Services Act is legislation that regulates the provision of tax agent services in Australia.

Who is required to file tax agent services act?

Tax agents and BAS agents in Australia are required to comply with the Tax Agent Services Act.

How to fill out tax agent services act?

Tax agents and BAS agents can fill out the Tax Agent Services Act by providing accurate and complete information about their services.

What is the purpose of tax agent services act?

The purpose of the Tax Agent Services Act is to ensure that tax agents and BAS agents provide high quality services to their clients.

What information must be reported on tax agent services act?

Tax agents and BAS agents must report information about their services, fees, qualifications, and compliance with the Tax Agent Services Act.

Fill out your tax agent services act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Agent Services Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.