Get the free Rate Lock Application - Gateway Credit Union

Show details

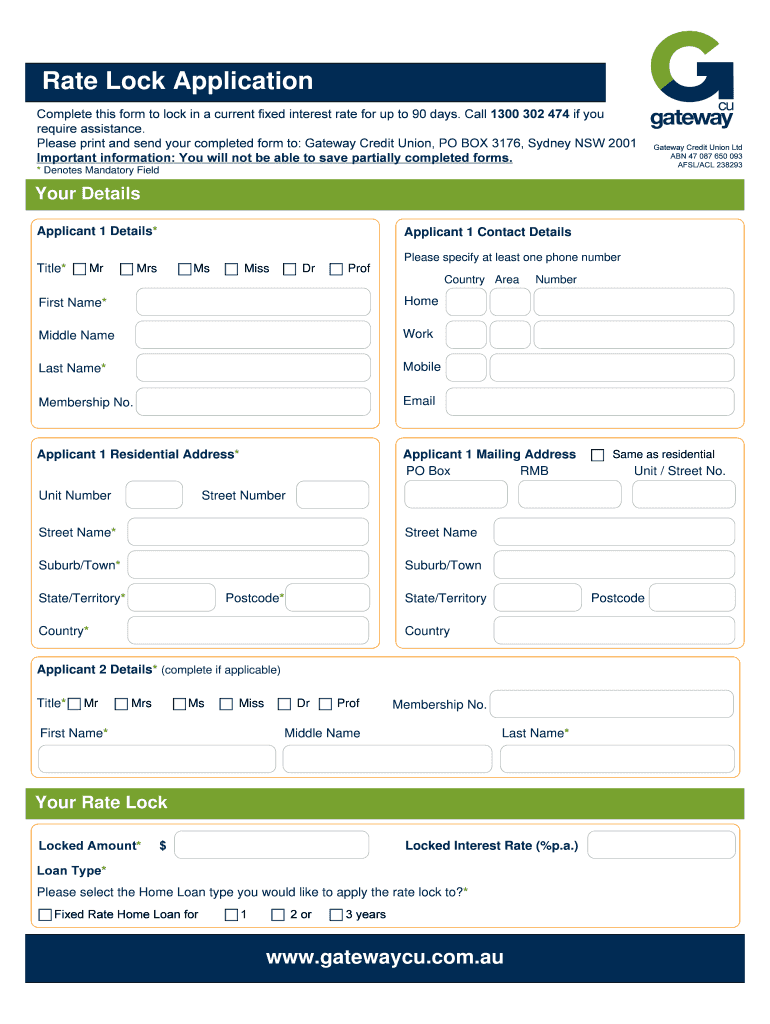

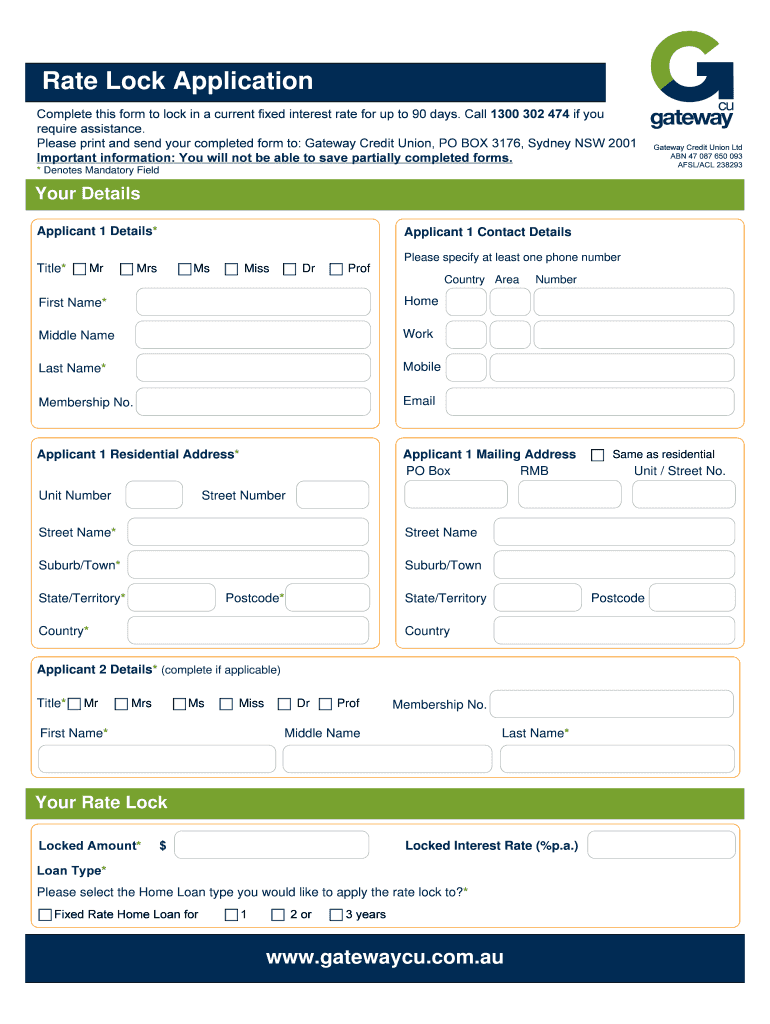

Rate Lock Application Complete this form to lock in a current fixed interest rate for up to 90 days. Call 1300 302 474 if you require assistance. Please print and send your completed form to: Gateway

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rate lock application

Edit your rate lock application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rate lock application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rate lock application online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rate lock application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rate lock application

How to fill out a rate lock application:

01

Start by gathering all necessary information and documents. This may include personal identification, income documentation, employment history, and any other relevant financial information.

02

Read the application carefully and understand each section before proceeding. Make sure you have all the required information readily available to avoid any delays or mistakes.

03

Begin by filling out the applicant's personal details, such as name, address, contact information, and social security number. Provide accurate information to ensure smooth processing of the application.

04

Proceed to the section regarding the loan details. This may include the loan amount, purpose of the loan, and loan type. Provide accurate and clear information to avoid any confusion in the future.

05

If you are applying for a rate lock, there will likely be a specific section dedicated to this. Fill in the details regarding the desired interest rate, duration of the lock, and any other relevant information requested.

06

Carefully review all the information entered before submitting the application. Double-check for any errors or missing information. It is crucial to submit an accurate and complete application to avoid any complications during the rate lock process.

07

Sign and date the application where required. This confirms that you have completed the form accurately and consent to the terms and conditions of the application.

08

Submit the application through the designated channel provided by the lender. This may include mailing the application, submitting it online, or visiting a branch office. Follow the instructions provided to ensure the application reaches the appropriate department promptly.

Who needs a rate lock application?

01

Homebuyers - When purchasing a home, individuals may seek a rate lock application to secure a specific interest rate for a certain period. This allows them to protect themselves from potential interest rate increases during the home buying process.

02

Refinancers - Those looking to refinance their existing mortgage may opt for a rate lock application to secure a favorable interest rate during the refinancing process. It helps protect against market fluctuations that could result in higher rates.

03

Investors - Real estate investors often use rate lock applications when purchasing investment properties. This allows them to secure a favorable interest rate, ensuring the property's profitability and reducing uncertainties related to loan costs.

04

Borrowers with credit concerns - Individuals with less-than-ideal credit scores or credit history may face challenges in obtaining a mortgage at a competitive interest rate. A rate lock application can help secure a reasonable rate before any potential changes in the borrower's creditworthiness.

05

Homeowners seeking equity - Homeowners who want to tap into their home equity through a home equity loan or line of credit might benefit from a rate lock application. It allows them to protect against interest rate fluctuations as they access the funds for various purposes like renovations, college tuition, or debt consolidation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find rate lock application?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific rate lock application and other forms. Find the template you need and change it using powerful tools.

How can I edit rate lock application on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing rate lock application.

Can I edit rate lock application on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share rate lock application from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is rate lock application?

Rate lock application is a request by a borrower to a lender for a guaranteed interest rate for a specified period of time.

Who is required to file rate lock application?

Borrowers who want to secure a specific interest rate on their loan before closing are required to file a rate lock application.

How to fill out rate lock application?

To fill out a rate lock application, borrowers typically need to provide personal information, details about the loan, desired interest rate, and lock-in period.

What is the purpose of rate lock application?

The purpose of a rate lock application is to protect borrowers from potential interest rate increases before closing on a loan.

What information must be reported on rate lock application?

Information such as borrower's name, loan amount, desired interest rate, lock-in period, and any specific terms or conditions must be reported on a rate lock application.

Fill out your rate lock application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rate Lock Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.