Get the free Third Party Fidelity Bond Application

Show details

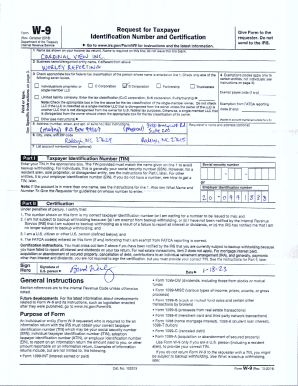

This document serves as an application for third-party fidelity bond coverage, designed to protect against employee theft from clients as well as first-party crime coverage for internal employee theft.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign third party fidelity bond

Edit your third party fidelity bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your third party fidelity bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing third party fidelity bond online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit third party fidelity bond. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out third party fidelity bond

How to fill out Third Party Fidelity Bond Application

01

Gather all necessary information about your business.

02

Provide details about the principal involved in the bond application.

03

List the names and addresses of all business owners and partners.

04

Include the types of services your business offers.

05

Specify the amount of coverage needed for the bond.

06

Provide information on prior bonding history, if applicable.

07

Fill out any required financial information and disclosures.

08

Review the completed application for accuracy.

09

Submit the application to the bonding company along with any required fees.

Who needs Third Party Fidelity Bond Application?

01

Businesses that handle clients' money, property, or sensitive information.

02

Companies providing services in which employees may have access to client assets.

03

Professionals operating in sectors where fidelity is critical, such as finance, insurance, and real estate.

Fill

form

: Try Risk Free

People Also Ask about

How to apply for a fidelity bond?

Online Fidelity Bonding System Download the form. Accomplish the form and affix required signatures. After successfully accomplishing the OFBS Enrollment form, submit the accomplished form to your designated BTr field office thru email and the enrollment form as file attachment.

How to qualify for a fidelity bond?

To qualify for a fidelity bond, the job seeker or employee must meet all of the following criteria: Provide verifiable proof of authorization to work in the United States. Have a firm job offer or commitment of employment with a reasonable expectation of permanence. Not be commercially bondable.

What is third party fidelity?

Third-party fidelity bonds protect businesses against intentionally wrongful acts committed by people working for them on a contract basis (e.g., consultants or independent contractors).

Can I buy I bonds on Fidelity?

Investors can purchase individual bonds or bond funds. Government, agency, and municipal bonds may offer some tax advantages. Corporate bonds are taxable.

What is a third party bond?

A Third Party Crime or Fidelity Surety Bond is used to protect the assets of a company other than your own. The Third Party Crime or Fidelity Surety Bond is typically required as part of a service contract when your employees are entering/working on the premises of another business.

How much does it cost to buy bonds on Fidelity?

For U.S. Treasury purchases traded with a Fidelity representative, a flat charge of $19.95 per trade applies. A $250 maximum applies to all trades, reduced to a $50 maximum for bonds maturing in one year or less.

How much does a fidelity bond cost?

The cost of a fidelity bond is usually a small percentage of the bond's total amount of coverage. For example, a bonding company might decide to charge you 1% of the total bond amount. That would mean a $2,000 bond would cost $20, and a $10,000 bond would cost $100 annually.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Third Party Fidelity Bond Application?

The Third Party Fidelity Bond Application is a document that is used to apply for a fidelity bond, which provides coverage against the risk of loss caused by dishonest or fraudulent acts of employees or third parties.

Who is required to file Third Party Fidelity Bond Application?

Typically, businesses that require protection against potential losses from employee dishonesty or fraudulent activities must file a Third Party Fidelity Bond Application.

How to fill out Third Party Fidelity Bond Application?

To fill out a Third Party Fidelity Bond Application, one must provide details about the business, the types of coverage sought, the amounts of coverage requested, and relevant information about the parties involved.

What is the purpose of Third Party Fidelity Bond Application?

The purpose of the Third Party Fidelity Bond Application is to formally request a fidelity bond that safeguards the business against losses from fraudulent activities, thereby providing financial security.

What information must be reported on Third Party Fidelity Bond Application?

The information that must be reported includes the name and address of the applicant, details about the business activities, the amount of coverage sought, and any claims history related to fidelity or dishonesty.

Fill out your third party fidelity bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Third Party Fidelity Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.