Get the free Judgment Entry of Insolvency

Show details

This document outlines the court's findings on the insolvency of an estate, including the classification of claims, and orders the fiduciary on how to proceed with the claims against the estate.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign judgment entry of insolvency

Edit your judgment entry of insolvency form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your judgment entry of insolvency form via URL. You can also download, print, or export forms to your preferred cloud storage service.

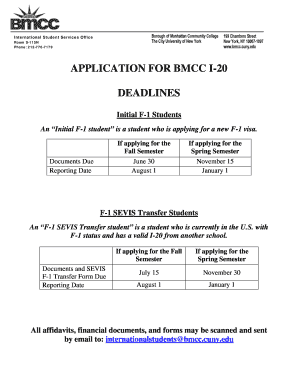

How to edit judgment entry of insolvency online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit judgment entry of insolvency. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

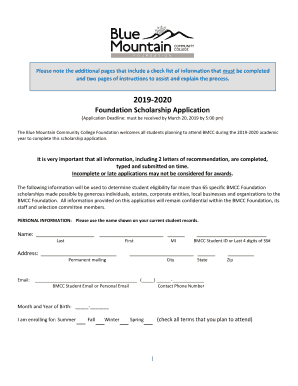

How to fill out judgment entry of insolvency

How to fill out Judgment Entry of Insolvency

01

Obtain the Judgment Entry form from the appropriate court or legal website.

02

Fill in the case caption at the top, including the names of the parties involved.

03

Provide the case number assigned to the insolvency proceedings.

04

Include the date of the judgment and the specific court where the ruling was made.

05

Clearly state the grounds for the insolvency judgment in the designated section.

06

List any relevant debts and obligations that are part of the insolvency case.

07

Ensure to sign and date the form as required before submission.

08

File the completed Judgment Entry of Insolvency with the court, following local filing procedures.

Who needs Judgment Entry of Insolvency?

01

Individuals facing bankruptcy or significant financial distress.

02

Businesses that are unable to meet their financial obligations.

03

Creditors seeking formal recognition of a debtor's insolvency.

04

Legal representatives handling bankruptcy or insolvency cases.

Fill

form

: Try Risk Free

People Also Ask about

Who gets paid first in insolvency in the UK?

Once the costs of placing the company into liquidation have been covered, the first class of creditor to be paid are secured creditors holding a fixed charge over some or all of the company's property and other assets.

What is the order of payment in insolvency?

When a company enters liquidation, each class of creditors must be paid in full (the exception being 'prescribed part' secured creditors) before funds are allocated to the next. Creditors are ranked as follows: Secured creditors with a fixed charge. Administrator/Liquidator fees.

What is a decision procedure in insolvency?

The process by which an insolvency office-holder asks creditors to make decisions in an insolvency proceeding.

What is insolvency in accounting?

In accounting, insolvency is the state of being unable to pay the debts, by a person or company (debtor), at maturity; those in a state of insolvency are said to be insolvent. There are two forms: cash-flow insolvency and balance-sheet insolvency.

What is the treatment of accounting insolvency?

What Is Accounting Insolvency? Accounting insolvency refers to a situation where the value of a company's liabilities exceeds the value of its assets. Accounting insolvency looks only at the firm's balance sheet, deeming a company "insolvent on the books" when its net worth appears negative.

What is the journal entry for insolvency?

In books of accounts, insolvency is recorded as bad debts and the journal entry that needs to passed to record insolvency involves debiting the bad debts account and crediting the debtors account.

What are the steps of the insolvency procedure?

How to implement a Corporate Insolvency Resolution Process (CIRP)? Step 1: Applying to the NCLT. Step 2: Appointment of an Interim Resolution Professional. Step 3: Moratorium. Step 4: Claims Verification. Step 5: Appointment of Resolution Professional. Step 6: Resolution Plan Approval.

What is the journal entry for bad debt?

Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. When you decide to write off an account, debit allowance for doubtful accounts and credit the corresponding receivables account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Judgment Entry of Insolvency?

Judgment Entry of Insolvency is a formal legal document issued by a court that declares an individual or entity is unable to pay its debts and is therefore legally recognized as insolvent.

Who is required to file Judgment Entry of Insolvency?

Individuals or entities that are facing insolvency and wish to have their status legally recognized by the court are required to file a Judgment Entry of Insolvency.

How to fill out Judgment Entry of Insolvency?

To fill out a Judgment Entry of Insolvency, one must provide details such as the name and address of the debtor, the amount of debts owed, the names of creditors, and any relevant financial information, along with signatures as required by the court.

What is the purpose of Judgment Entry of Insolvency?

The purpose of Judgment Entry of Insolvency is to legally establish a person's or entity's inability to repay debts, which may enable the debtor to seek relief through bankruptcy proceedings or other financial rehabilitation options.

What information must be reported on Judgment Entry of Insolvency?

Information that must be reported includes the debtor's full name and address, the amount and types of debts, a list of creditors, the debtor's assets, and any information about previous bankruptcy filings or legal proceedings.

Fill out your judgment entry of insolvency online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Judgment Entry Of Insolvency is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.