Get the free Mortgage Brokers Supplement

Show details

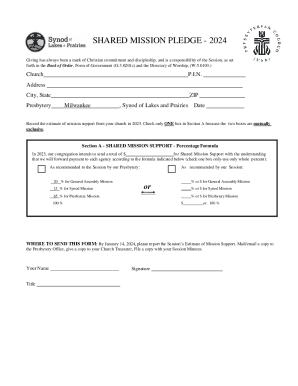

This document serves as a questionnaire for mortgage brokers to provide details about their operations, including amounts handled, affiliations, and compliance procedures.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage brokers supplement

Edit your mortgage brokers supplement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage brokers supplement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage brokers supplement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mortgage brokers supplement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage brokers supplement

How to fill out Mortgage Brokers Supplement

01

Obtain the Mortgage Brokers Supplement form from the official website or your company.

02

Read the instructions carefully to understand the required information.

03

Fill in your personal details, including your name, contact information, and license number.

04

Provide details about your mortgage brokerage, including its address and type of services offered.

05

Include any relevant experience or qualifications you have as a mortgage broker.

06

Answer any questions related to compliance or regulatory requirements.

07

Double-check all information for accuracy and completeness.

08

Sign and date the form as required before submission.

09

Submit the completed form by the specified deadline, either electronically or by mail.

Who needs Mortgage Brokers Supplement?

01

Mortgage brokers seeking to operate legally within their jurisdiction.

02

Individuals or companies looking to renew or maintain their mortgage brokerage license.

03

Brokers who need to demonstrate compliance with local regulations and industry standards.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of a mortgage broker?

Using a mortgage broker doesn't guarantee that you are receiving the best possible offer. Traditional banks may provide better loans than mortgage brokers can access for some borrowers. Because of their connections to lenders, brokers sometimes have biases.

Is there any downside to using a mortgage broker?

Disadvantages of Mortgage Brokers Not every lender works with mortgage brokers, so you may still find a better product and rate by shopping around. Securing a mortgage through a broker may take longer and may require more paperwork, since you don't have an existing relationship with them like you may have with a bank.

Should you use a mortgage broker or not?

Choosing between a mortgage broker or a bank depends on your circumstances. You should consider using a broker if you're keen to access multiple lenders, need tailored advice, or have a complex financial situation (such as an irregular income or poor credit).

What are the risks of using a mortgage broker?

Disadvantages of Mortgage Brokers Not every lender works with mortgage brokers, so you may still find a better product and rate by shopping around. Securing a mortgage through a broker may take longer and may require more paperwork, since you don't have an existing relationship with them like you may have with a bank.

What's the best CRM for mortgage brokers?

Mortgage CRM Comparison Table CRMBest ForType Shape All-in-one teams Mortgage-specific Insellerate Scalable growth teams Mortgage-specific Total Expert Enterprise marketing + compliance Mortgage-specific HubSpot Tech-savvy LOs & marketers General-use6 more rows • May 30, 2025

What are the benefits of using a mortgage broker?

Mortgage brokers or independent financial advisers They can offer mortgages from lots of different lenders and often know what criteria you need to meet to be accepted. They will deal with the lender on your behalf. Some brokers are 'whole of market' and they can offer a wider range of products.

Is it better to use a mortgage broker or do it yourself?

Absolutely use a broker. There is no advantage dealing directly with the banks. Brokers are neutral and know about all the deals being offered from the banks and also other financial institutions. They only get paid if they secure a mortgage for you. You will get a better deal for sure.

What not to say to a mortgage broker?

0:00 1:26 Anything about property or negotiations. Because this is not their area of expertise. Don't ask themMoreAnything about property or negotiations. Because this is not their area of expertise. Don't ask them whether you should buy a brand new apartment or a house and land package.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mortgage Brokers Supplement?

Mortgage Brokers Supplement is a regulatory document that provides a detailed account of a mortgage broker's activities, transactions, and compliance with state regulations.

Who is required to file Mortgage Brokers Supplement?

Mortgage brokers who engage in lending activities and are licensed or registered with the appropriate state authority are required to file the Mortgage Brokers Supplement.

How to fill out Mortgage Brokers Supplement?

To fill out the Mortgage Brokers Supplement, brokers should complete each section accurately, providing information about their business operations, transactions, and compliance with applicable laws, and submit it through the designated state online portal or in accordance with state guidelines.

What is the purpose of Mortgage Brokers Supplement?

The purpose of the Mortgage Brokers Supplement is to ensure transparency and accountability in the mortgage brokerage industry, enabling regulators to monitor broker activities and ensure compliance with consumer protection laws.

What information must be reported on Mortgage Brokers Supplement?

The information that must be reported on the Mortgage Brokers Supplement includes details of mortgage transactions, loan amounts, borrower information, compliance with regulations, and any other relevant operational data as required by the state.

Fill out your mortgage brokers supplement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Brokers Supplement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.