Get the free APPLICATION FOR CLAIMS-MADE INSURANCE

Show details

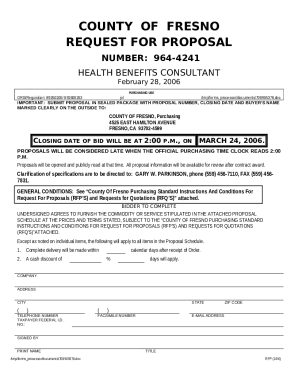

This document is an application for claims-made insurance for professional liability, requiring detailed responses for underwriting and pricing evaluation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for claims-made insurance

Edit your application for claims-made insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for claims-made insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for claims-made insurance online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for claims-made insurance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for claims-made insurance

How to fill out APPLICATION FOR CLAIMS-MADE INSURANCE

01

Start with your personal information: Fill in your name, address, phone number, and email.

02

Specify the type of claims-made insurance you are applying for.

03

Provide details about your business or practice: Include the name, nature of your business, and any relevant identification numbers.

04

List your coverage history: Indicate previous insurance coverage and mention any gaps or lapses.

05

Describe the activities or services you provide: Include specifics about your professional work.

06

Answer health history questions: Some applications may require information about past claims or incidents.

07

Review and sign the application: Ensure all information is accurate before signing and dating the document.

08

Submit the application to the insurer along with any required documentation or payment.

Who needs APPLICATION FOR CLAIMS-MADE INSURANCE?

01

Individuals or businesses providing professional services such as healthcare providers, consultants, or contractors.

02

Professionals in industries with potential liability risks that want protection against claims made during the policy period.

03

Those seeking to ensure coverage for work done before the policy's effective date.

Fill

form

: Try Risk Free

People Also Ask about

How to request for an insurance claim?

Step-by-step procedure to file a claim Contact your insurer. The first step of claim process is to contact your insurer and intimate about the claim. Fill your claim form and attach the relevant documents. A surveyor conducts damage evaluation. Acceptance of your claim. Get the claim amount.

What is a powerful opening sentence for a cover letter?

State clearly in your opening sentence the purpose for your letter and a brief professional introduction. Specify why you are interested in that specific position and organization. Provide an overview of the main strengths and skills you will bring to the role.

What is an example of a cover letter for insurance claims?

I am applying for the Claim Adjuster position I saw advertised. I have worked in insurance for a while now and think I would be a good fit for the job. I have done various tasks related to claims and am familiar with the necessary paperwork. I am looking for a new opportunity and hope to work for a company like yours.

How do I write a claim application?

Here is a detailed guide to help you draft a complete and compelling claim letter: Begin with Your Contact Details and Date. Address the Letter Appropriately. State the Purpose Clearly with a Subject Line. Introduce Yourself and Reference Your Policy. Describe the Incident or Expense in Detail.

What is a claims-made form in insurance?

Insurance companies commonly write policies on a claims-made form. This means your insurer helps cover claims filed during your policy period. There are two features of a claims-made policy that can affect coverage: Retroactive date: Your policy provides coverage if an incident occurs on or after a specified date.

How do you write a letter for an insurance claim?

How to Write a Letter to a Health Insurance Company for a Claim? Identify Your Basic Information. Compose a Formal Greeting. Express the Purpose of Your Letter. Brief Description of Medical Treatment. Provide Details of the Costs Involvement. Attach Required Documents. Prompt Processing Request. Closing Statement.

What do you say when making an insurance claim?

When you file a claim, you'll be asked to provide some basic details, such as where and when the accident or incident took place, contact information for everyone involved and a description of what happened. You might also be asked to give an estimated cost of the damage from the accident — if you have that available.

How do I write an application letter for an insurance claim?

How to Write a Letter to a Health Insurance Company for a Claim? Identify Your Basic Information. Compose a Formal Greeting. Express the Purpose of Your Letter. Brief Description of Medical Treatment. Provide Details of the Costs Involvement. Attach Required Documents. Prompt Processing Request. Closing Statement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR CLAIMS-MADE INSURANCE?

APPLICATION FOR CLAIMS-MADE INSURANCE is a form used by individuals or businesses to apply for insurance coverage that only applies to claims made during the policy period, as opposed to incidents that occurred during the policy period.

Who is required to file APPLICATION FOR CLAIMS-MADE INSURANCE?

Entities or individuals seeking claims-made insurance coverage, typically professionals such as doctors, lawyers, or consultants, are required to file this application.

How to fill out APPLICATION FOR CLAIMS-MADE INSURANCE?

To fill out the application, applicants need to provide personal or business details, describe their professional activities, disclose past claims or incidents, and outline the desired coverage limits.

What is the purpose of APPLICATION FOR CLAIMS-MADE INSURANCE?

The purpose of the application is to assess the applicant's risk profile and eligibility for claims-made insurance, ensuring that insurers have all necessary information to offer coverage.

What information must be reported on APPLICATION FOR CLAIMS-MADE INSURANCE?

The application must report details such as the applicant's qualifications, years of experience, types of services provided, and any previous claims or incidents that might affect their insurance coverage.

Fill out your application for claims-made insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Claims-Made Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.