Get the free PAS NON-BROKERAGE ACCOUNT APPLICATION

Show details

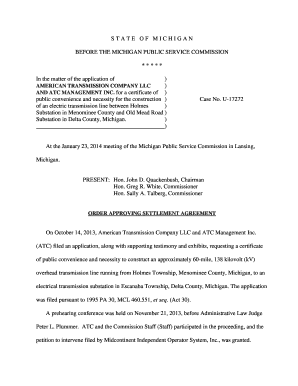

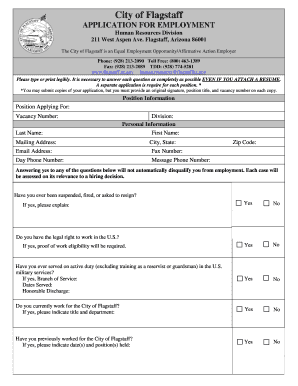

This document is an application form for establishing a non-brokerage account, requiring information about the applicant's account registration details, financial information, investment objectives,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pas non-brokerage account application

Edit your pas non-brokerage account application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pas non-brokerage account application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pas non-brokerage account application online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pas non-brokerage account application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pas non-brokerage account application

How to fill out PAS NON-BROKERAGE ACCOUNT APPLICATION

01

Gather all necessary personal information, including your full name, address, date of birth, and Social Security number.

02

Provide your employment information, including your employer's name, address, and your job title.

03

Specify your financial information, such as annual income, net worth, and investment experience.

04

Review the account type and ensure it's the correct option for your needs (e.g., individual, joint, retirement).

05

Carefully read and understand the terms and conditions associated with the PAS Non-Brokerage Account.

06

Sign and date the application to confirm your agreement with the provided information and terms.

07

Submit the application through the designated portal or address as instructed.

Who needs PAS NON-BROKERAGE ACCOUNT APPLICATION?

01

Individuals looking to open a non-brokerage account for investment purposes.

02

People who prefer to manage their investments without a broker.

03

Clients intending to invest in specific financial products that require this type of account.

Fill

form

: Try Risk Free

People Also Ask about

What's the difference between a brokerage account and a normal bank account?

0:14 11:57 Account that's more used for everyday funding of your life right you're going to be paying billsMoreAccount that's more used for everyday funding of your life right you're going to be paying bills from there you're going to be buying. Groceries. Whatever you need and you use the debit.

What is a brokerage account?

A brokerage account is an investment account that allows you to buy and sell investments like stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Many people have other investment accounts, such as a 401(k) through an employer, an IRA (traditional or Roth), or a health savings account (HSA).

What is the difference between a brokerage and a non-brokerage account?

Brokerage accounts are generally less restrictive than IRAs or retirement accounts: They have no contribution limits, and you can withdraw your money at any time for any reason. However, brokerage accounts are often not tax advantaged — you may have to pay taxes on any earnings you receive.

Can I have a US brokerage account if I live abroad?

You can open an online trading account with a US broker, even as a foreigner, but more documentation is needed. Alternatively, you can make use of local financial institutions that have access to the US stock market. It is also important that you learn the relevant tax policies. Happy trading!

How to open a US brokerage account as a non-resident?

Non-US residents can access the US market through: Opening a local brokerage account with access to US stock markets. Opening an account with a US broker (options are limited). Investing in US stocks through mutual funds or exchange-traded funds (ETFs) offered by local brokers.

What is an example of a nonqualified account?

Money invested into a non-qualified account is money that has already been received through income sources and income tax has been paid. The type of investments that can be held in non-qualified accounts are annuities, mutual funds, equities, etc.

What is a non brokerage account?

Non-Brokerage Account means an account that is exempted from the definition of Account in this Code, such as the employee's NorthStar 401(k), a retirement plan sponsored by a previous employer, a Family Member's employer sponsored retirement plan, accounts held directly at a mutual fund company, 529 or other college

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PAS NON-BROKERAGE ACCOUNT APPLICATION?

The PAS NON-BROKERAGE ACCOUNT APPLICATION is a form used to open an investment account that does not involve a brokerage, allowing individuals to manage and invest funds directly.

Who is required to file PAS NON-BROKERAGE ACCOUNT APPLICATION?

Individuals or entities looking to establish a non-brokerage investment account are required to file the PAS NON-BROKERAGE ACCOUNT APPLICATION.

How to fill out PAS NON-BROKERAGE ACCOUNT APPLICATION?

To fill out the PAS NON-BROKERAGE ACCOUNT APPLICATION, complete the required fields with personal and financial information, including identification and investment preferences, and submit it as instructed.

What is the purpose of PAS NON-BROKERAGE ACCOUNT APPLICATION?

The purpose of the PAS NON-BROKERAGE ACCOUNT APPLICATION is to provide a streamlined process for individuals to open and manage non-brokerage investment accounts directly.

What information must be reported on PAS NON-BROKERAGE ACCOUNT APPLICATION?

The information to be reported includes personal identification details, financial background, investment goals, and any relevant documentation as required by the application.

Fill out your pas non-brokerage account application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pas Non-Brokerage Account Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.