Get the free Small Business Accounts

Show details

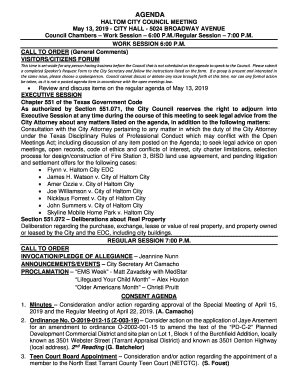

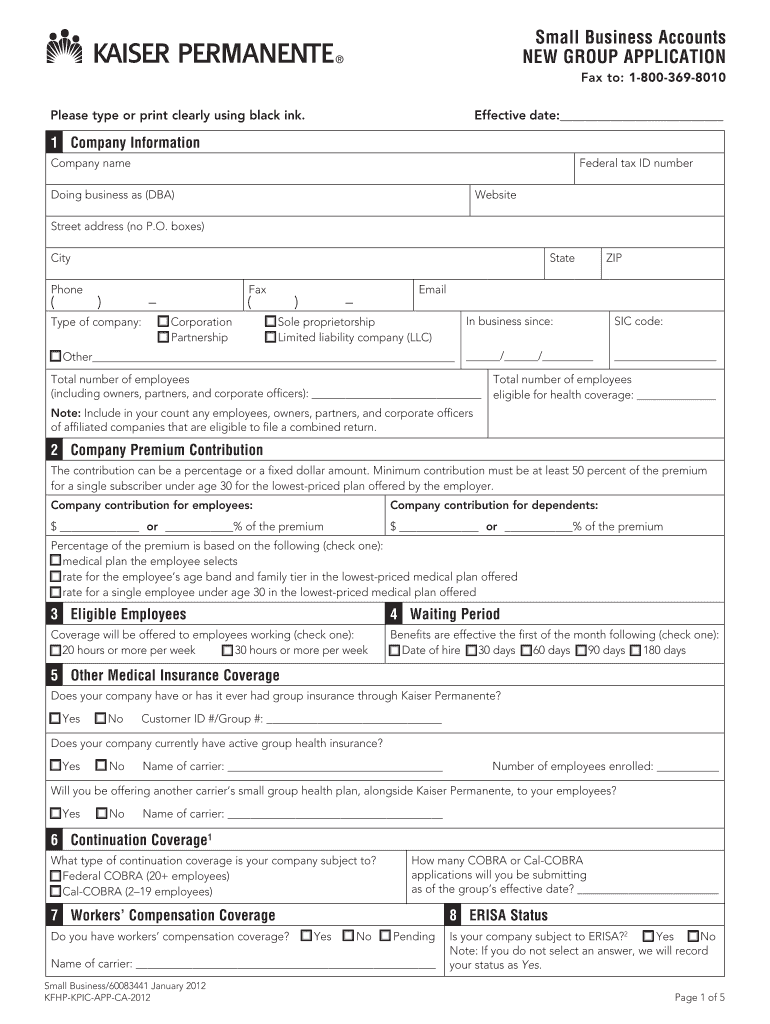

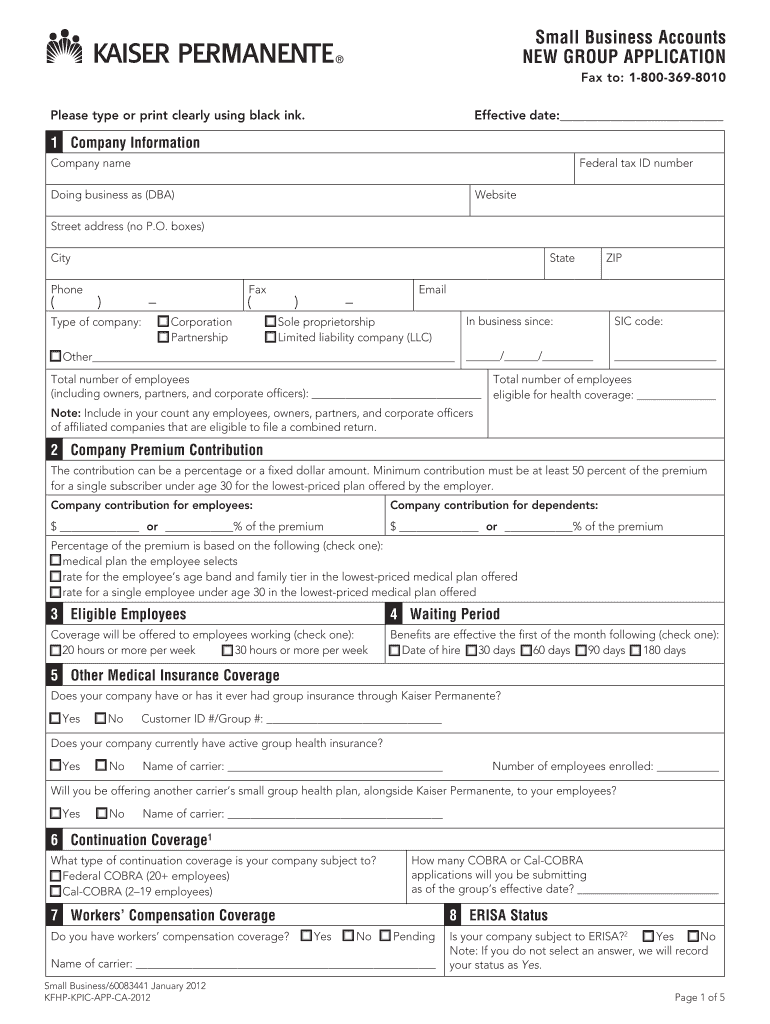

This document serves as an application for small businesses to enroll in group health insurance plans with Kaiser Permanente, detailing company information, employee eligibility, premium contributions,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business accounts

Edit your small business accounts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business accounts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit small business accounts online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit small business accounts. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business accounts

How to fill out Small Business Accounts

01

Gather all financial documents including income statements, balance sheets, and cash flow statements.

02

Organize your income by categorizing it into several streams such as sales revenue, service income, and any other sources.

03

List all business expenses, ensuring to categorize them into fixed and variable costs for better understanding.

04

Ensure that all bank statements and transactions are reconciled with your financial records.

05

Use accounting software or spreadsheets to create an overview of your financial position.

06

Fill out the Small Business Accounts template based on your organized financial information.

07

Double-check all calculations and ensure that all entries are accurate before submission.

08

Consult with a financial advisor if needed to ensure compliance with relevant regulations.

Who needs Small Business Accounts?

01

Small business owners looking to track their financial performance.

02

Entrepreneurs applying for loans or investment.

03

Businesses needing to prepare for tax filings.

04

Startups seeking to monitor cash flow and expenses.

05

Potential buyers of the business wanting to assess its financial health.

Fill

form

: Try Risk Free

People Also Ask about

What type of accountant is best for a small business?

A CPA usually has a specialization, be it audit or tax. Typically, small business owners use a CPA for filling out and filing tax returns. There are certain rules in regular financial accounting (GAAP) that differ from tax accounting rules. (These are called Book to Tax differences) that a CPA can help you navigate.

What is a small business bank account?

Open a business account when you're ready to start accepting or spending money as your business. A business bank account helps you stay legally compliant and protected. It also provides benefits to your customers and employees.

What is a small business account?

A business checking account gives you a place to store cash so you can make purchases and pay your employees. It also helps keep your personal finances separated from your business. Additionally, with business banking, there are a number of major advantages beyond the basics: Accurately track cash flow and expenses.

What qualifies you for a small business?

Meet size standards SBA assigns a size standard to each NAICS code. Most manufacturing companies with 500 employees or fewer, and most non-manufacturing businesses with average annual receipts under $7.5 million, will qualify as a small business. However, there are exceptions by industry.

What are the 4 types of bank accounts?

The four basic types are checking account, savings account, certificate of deposit and money market account. Each kind of account serves a different purpose. For instance, a checking account is geared toward covering everyday expenses, while a savings account is designed to help achieve short-term financial goals.

What type of accounting do small businesses use?

Most businesses use accrual-based accounting; however, if you have no cash flow, you may start with cash-based accounting and switch approaches later.

Can I use my personal account for a small business?

While you technically could use your personal bank account for business, it is generally not recommended. This is because mixing your personal and business finances could put your personal assets at risk if your business were to face legal issues.

What is basic accounting for a small business?

Basic small business bookkeeping includes tracking your expenses, recording the transactions, and reconciling your business bank statements. It can also include putting together the three key financial statements — the income statement, balance sheet, and cash flow statement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Small Business Accounts?

Small Business Accounts are financial statements that small businesses are required to prepare to provide a snapshot of their financial performance and position over a specific period.

Who is required to file Small Business Accounts?

Small businesses that meet certain criteria, often including having a turnover below a specified threshold, are required to file Small Business Accounts.

How to fill out Small Business Accounts?

To fill out Small Business Accounts, businesses must gather their financial records, including income and expenses, and complete the standardized form, ensuring all information is accurate and submitted within the required timeframe.

What is the purpose of Small Business Accounts?

The purpose of Small Business Accounts is to provide a clear and concise overview of the business's financial health, facilitate tax preparation, and satisfy legal requirements.

What information must be reported on Small Business Accounts?

Small Business Accounts must typically report information such as income, expenses, profit or loss, assets, liabilities, and any other relevant financial data as outlined by the local regulatory body.

Fill out your small business accounts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Business Accounts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.