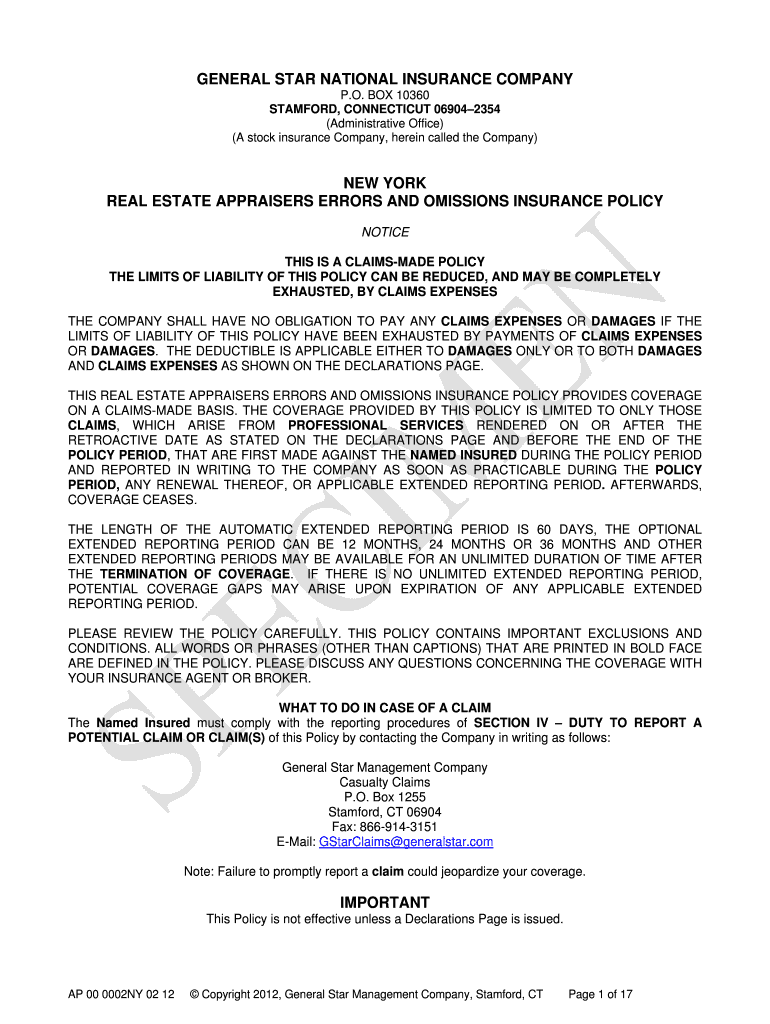

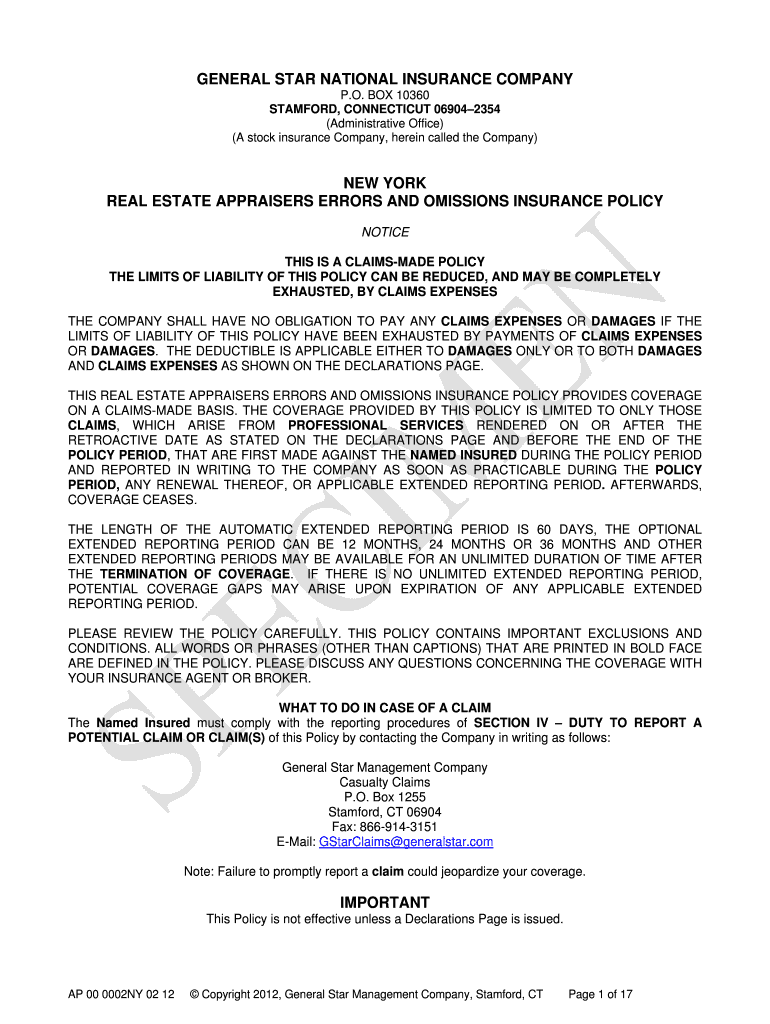

Get the free REAL ESTATE APPRAISERS ERRORS AND OMISSIONS INSURANCE POLICY

Show details

This document outlines the terms, coverage, exclusions, and conditions of a claims-made errors and omissions insurance policy designed for real estate appraisers in New York. It details the obligations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign real estate appraisers errors

Edit your real estate appraisers errors form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your real estate appraisers errors form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit real estate appraisers errors online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit real estate appraisers errors. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out real estate appraisers errors

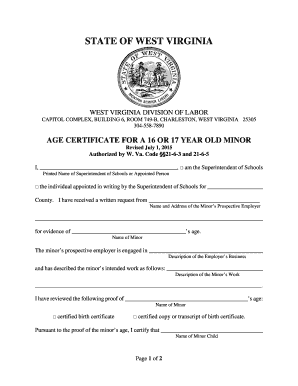

How to fill out REAL ESTATE APPRAISERS ERRORS AND OMISSIONS INSURANCE POLICY

01

Gather necessary documents such as your real estate license and appraisal reports.

02

Research different insurance providers to compare coverage options and costs.

03

Fill out the application form with accurate information regarding your practice.

04

Specify the coverage limits and the type of policy you require.

05

Review the policy exclusions and conditions carefully.

06

Provide any additional information or documentation requested by the insurer.

07

Submit your application and wait for the insurance provider to process it.

08

Review the policy terms once received, ensuring all details are correct.

09

Make the initial premium payment to activate your insurance coverage.

Who needs REAL ESTATE APPRAISERS ERRORS AND OMISSIONS INSURANCE POLICY?

01

Real estate appraisers who provide property valuation services.

02

Independent appraisers running their own practices.

03

Real estate firms that employ appraisers as part of their operations.

04

Appraisers looking to protect themselves against claims of negligence or errors.

Fill

form

: Try Risk Free

People Also Ask about

What is appraiser E&O insurance?

Errors and omissions (E&O) insurance may also be known as professional liability insurance. This type of coverage protects appraisers financially if a legal claim arises due to a mistake at work.

What is an insurance appraiser?

An insurance appraiser is a field representative who works for an insurance firm. They gather information about an insurance claim by assessing the value of a person's property and the amount of property loss or damage.

Do I really need E&O insurance?

Errors and omissions insurance helps protect businesses from mistakes or errors in the professional services they provide. So, any small business that regularly gives their customers advice or offers services to clients should get this coverage.

Who is usually the most protected by errors and omissions insurance?

E&O is most used by those in real estate, insurance, IT professionals, and tax preparers. Professional liability coverage is typically used by architects, consultants, engineers, and accountants and CPAs.

What is covered under errors and omissions insurance?

Professional Liability insurance, also known as Errors and Omissions (E&O) coverage, is designed to protect your business against claims that professional advice or services you provided caused a customer financial harm due to actual or alleged mistakes or a failure to perform a service.

What does E&O mean in insurance?

Errors and omissions insurance, also known as E&O insurance and professional liability insurance, helps protect your business from lawsuits that claim you made a mistake in your professional services.

What is the meaning of appraisal in insurance?

An insurance appraisal is performed by a third party to determine the value of the insured item. Arbitration is when you and your insurance company disagree on a loss. The arbitrator listens to arguments from both sides, reviews evidence and determines the outcome of the claim. Their final decision is binding.

What is best covered by errors and omissions insurance?

Errors and omissions insurance covers claims related to: Breach of contract. Missed deadlines. Mistakes and oversights. Misrepresentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is REAL ESTATE APPRAISERS ERRORS AND OMISSIONS INSURANCE POLICY?

REAL ESTATE APPRAISERS ERRORS AND OMISSIONS INSURANCE POLICY is a type of professional liability insurance that protects appraisers from claims of negligence or mistakes in their valuation services. It covers legal defense costs and settlements arising from errors or omissions in the appraisal process.

Who is required to file REAL ESTATE APPRAISERS ERRORS AND OMISSIONS INSURANCE POLICY?

Real estate appraisers, especially those who are licensed or certified, are often required to obtain and file REAL ESTATE APPRAISERS ERRORS AND OMISSIONS INSURANCE POLICY to comply with state regulations and to protect themselves from potential legal claims.

How to fill out REAL ESTATE APPRAISERS ERRORS AND OMISSIONS INSURANCE POLICY?

To fill out the policy, appraisers should provide their personal and business information, including license numbers, details about their appraisal practice, coverage limits desired, and any previous claims history. It is also essential to understand the terms and conditions provided by the insurance carrier.

What is the purpose of REAL ESTATE APPRAISERS ERRORS AND OMISSIONS INSURANCE POLICY?

The purpose of REAL ESTATE APPRAISERS ERRORS AND OMISSIONS INSURANCE POLICY is to protect real estate appraisers from financial loss due to claims made by clients or third parties for alleged mistakes, negligence, or failure to perform their duties properly in real estate appraisals.

What information must be reported on REAL ESTATE APPRAISERS ERRORS AND OMISSIONS INSURANCE POLICY?

Information that must be reported includes appraiser's contact and license information, the nature of their appraisal business, prior claims or lawsuits, the types of properties they typically appraise, and any risk management practices the appraiser has in place.

Fill out your real estate appraisers errors online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Real Estate Appraisers Errors is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.