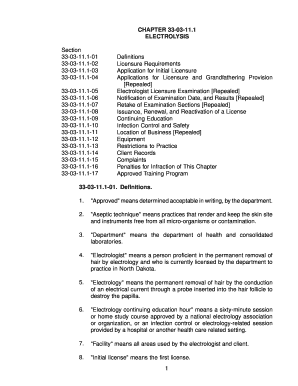

Get the free LIFE INSURANCE NEEDS ANALYSIS - Financial Horizons

Show details

TM LIFE INSURANCE NEEDS ANALYSIS ...your gateway to financial success ...your gateway to financial success Notes: Date: Client name: A B There may be assets which are Assets to be converted at death

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance needs analysis

Edit your life insurance needs analysis form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance needs analysis form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing life insurance needs analysis online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit life insurance needs analysis. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance needs analysis

How to fill out a life insurance needs analysis:

01

Gather personal and financial information: Start by collecting relevant personal and financial information such as your age, income, expenses, debts, assets, and any existing life insurance policies.

02

Determine your financial objectives: Identify your financial goals and objectives that you want to achieve through life insurance. This may include protecting your family's financial future, paying off debts, funding education expenses, or ensuring a comfortable retirement.

03

Estimate your future financial needs: Assess your financial obligations and estimate the amount of money required to fulfill them. This should include income replacement for your family, outstanding debts, funeral expenses, education costs, and any other financial responsibilities.

04

Evaluate your existing resources: Take into account any existing life insurance coverage, savings, investments, and other assets that can help meet your financial needs in case of an unforeseen event.

05

Consider inflation and future expenses: Adjust your estimated financial needs for inflation and factor in any future expenses that may arise, such as college tuition, healthcare costs, or mortgage payments.

06

Calculate the gap: Subtract your existing resources from your estimated financial needs to determine the financial gap that life insurance should cover.

07

Select the right type and coverage amount: Choose the appropriate type of life insurance policy based on your needs, whether it's term life insurance, whole life insurance, or a combination. Determine the coverage amount that adequately fills the financial gap.

08

Assess your budget: Evaluate your current financial situation and determine how much you can afford to spend on life insurance premiums. Ensure that the coverage you choose fits within your budget.

09

Review and update regularly: Life circumstances change over time, so it's important to review your life insurance needs analysis periodically, especially with major life events like marriage, having children, buying a home, or changes in income.

Who needs a life insurance needs analysis:

01

Individuals with dependents: If you have family members who rely on your income or financial support, it is crucial to assess the amount of life insurance coverage required to provide for their future financial stability.

02

Breadwinners and primary income earners: If you are the main source of income in your household, a life insurance needs analysis can help determine the amount of coverage necessary to replace your income and sustain your family's lifestyle in the event of your unexpected death.

03

Individuals with financial obligations: If you have outstanding debts such as mortgages, car loans, student loans, or credit card debt, a life insurance needs analysis can help in calculating the necessary coverage amount to pay off these financial obligations.

04

Business owners and partners: Business owners or partners may need a life insurance needs analysis to ensure business continuity and cover potential obligations, such as business loans, buy-sell agreements, or funding for key person insurance.

Remember, consulting a financial advisor or insurance professional can provide more personalized guidance based on your specific circumstances and financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get life insurance needs analysis?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific life insurance needs analysis and other forms. Find the template you need and change it using powerful tools.

How do I execute life insurance needs analysis online?

pdfFiller has made it easy to fill out and sign life insurance needs analysis. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit life insurance needs analysis in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing life insurance needs analysis and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is life insurance needs analysis?

Life insurance needs analysis is a process of evaluating an individual's financial situation and determining the amount of life insurance coverage needed to protect their loved ones in the event of death.

Who is required to file life insurance needs analysis?

Individuals who wish to purchase life insurance coverage or financial advisors assisting clients with their insurance needs are typically required to conduct a life insurance needs analysis.

How to fill out life insurance needs analysis?

To fill out a life insurance needs analysis, one must gather information about their current financial situation, future financial goals, debts, expenses, and assets. This information is used to calculate the appropriate amount of life insurance coverage.

What is the purpose of life insurance needs analysis?

The purpose of life insurance needs analysis is to ensure that individuals have adequate life insurance coverage to protect their beneficiaries financially in the event of the policyholder's death.

What information must be reported on life insurance needs analysis?

Information such as income, debts, expenses, assets, and financial goals must be reported on a life insurance needs analysis.

Fill out your life insurance needs analysis online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Needs Analysis is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.