Get the free Accountants Professional Liability Insurance Application

Show details

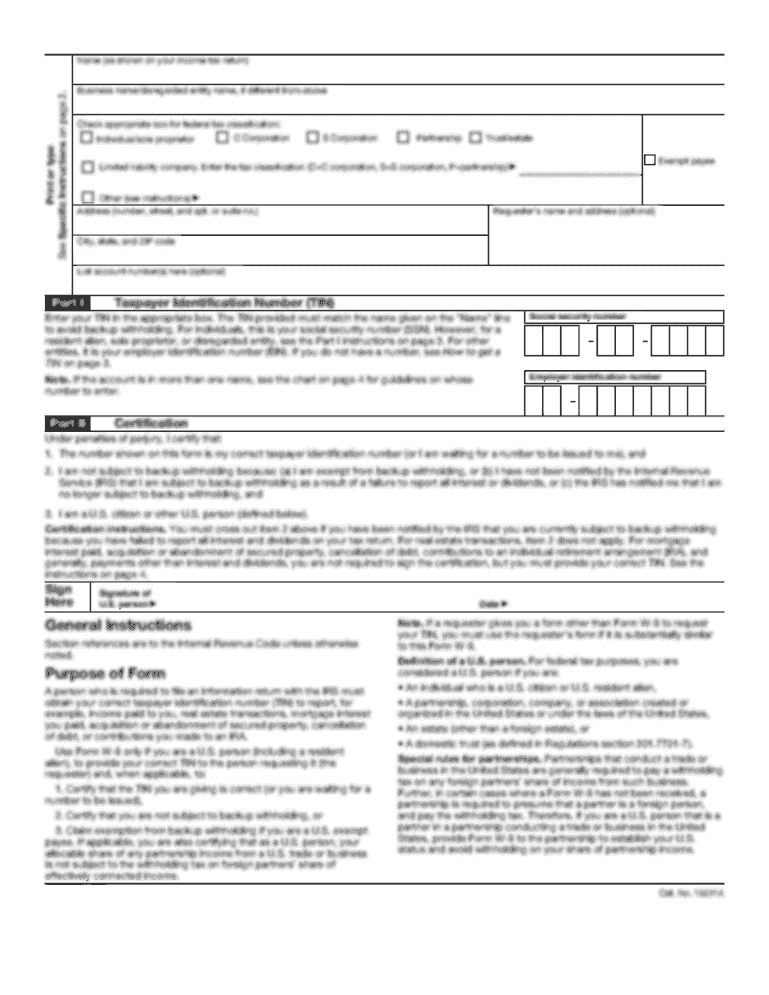

This document is an application for professional liability insurance specifically designed for accountants, outlining necessary information and declarations required for coverage.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accountants professional liability insurance

Edit your accountants professional liability insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accountants professional liability insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accountants professional liability insurance online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit accountants professional liability insurance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accountants professional liability insurance

How to fill out Accountants Professional Liability Insurance Application

01

Begin by gathering necessary documents, including your professional qualifications and financial statements.

02

Fill out your personal information, including your name, address, and contact details.

03

Provide details about your accounting business, such as the type of services offered and your client demographics.

04

Indicate any previous claims or legal actions related to professional liability.

05

Specify the limits of coverage you are seeking for your liability insurance.

06

Review the application thoroughly to ensure accuracy and completeness.

07

Submit the application along with any required documents and payment.

Who needs Accountants Professional Liability Insurance Application?

01

Accountants and accounting firms that provide professional services and want to protect themselves from claims of negligence, errors, or omissions.

02

Individuals or businesses that offer consulting services in finance or accounting.

03

Firms that are required by law or contract to maintain professional liability insurance.

Fill

form

: Try Risk Free

People Also Ask about

How to submit a liability claim?

Contact your insurance agent or provider As soon as an accident happens, you should contact your insurance broker. Often, the broker will recommend that you contact your insurance provider even if you haven't been sued yet. Advance notice makes it easier to investigate and resolve the claim.

How do I file a professional liability claim?

How to make a professional liability claim What are the steps for filing a professional liability claim? Contact your insurance agent or provider. Review your policy and details of the professional liability claim. Keep detailed records of the incident. Consult with an attorney. Consider your options and next steps.

What is a typical claim covered by professional liability insurance?

Professional liability policies typically cover legal defense costs associated with defending against claims of professional negligence. These costs can include attorney fees, court costs, and expert witness fees.

How to file a professional liability claim?

How to make a professional liability claim What are the steps for filing a professional liability claim? Contact your insurance agent or provider. Review your policy and details of the professional liability claim. Keep detailed records of the incident. Consult with an attorney. Consider your options and next steps.

Do accountants have to have professional indemnity insurance?

Whilst it is not a legal requirement for accountants to take out PI insurance, for many accountants (such as members of the ICAEW, ICAS or ACCA) it is a regulatory requirement to buy PI cover that complies with the respective association rules.

What is the professional liability of an accountant?

Accountants are liable for any misstatements that occurred while auditing and preparing financial documents for a client. Because accountants are held responsible for any inaccuracies and as a result can face legal charges or monetary losses, they often take out professional liability insurance.

How much is professional liability insurance for CPAs?

This type of insurance, also known as errors and omissions (E&O) insurance, can significantly safeguard your practice from financial losses due to professional mistakes or negligence claims. On average, accountant professionals might expect to pay between $500 to $2,000 annually for a robust E&O policy.

How to make an E&O claim?

How to make an errors and omissions claim Review your E&O / professional liability insurance policy. Contact your insurance agent or carrier. Ask questions. Gather records and documents that relate to the incident. Consult a lawyer. Limit your interactions. Don't beat yourself up.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Accountants Professional Liability Insurance Application?

The Accountants Professional Liability Insurance Application is a formal document that accountants must complete to apply for professional liability insurance. This insurance protects accountants against claims of negligence, errors, or omissions that may arise from their professional services.

Who is required to file Accountants Professional Liability Insurance Application?

Accountants who provide professional services, including certified public accountants (CPAs), auditors, and tax preparers, are typically required to file this application to obtain coverage for potential liability.

How to fill out Accountants Professional Liability Insurance Application?

To fill out the application, accountants must provide detailed information about their professional practice, including the types of services offered, client demographics, previous claims history, and risk management practices. It is important to answer all questions honestly and accurately.

What is the purpose of Accountants Professional Liability Insurance Application?

The purpose of the application is to gather necessary information to assess the risk associated with insuring the accountant's practice, determine premium rates, and provide coverage that meets the accountant's professional liability insurance needs.

What information must be reported on Accountants Professional Liability Insurance Application?

The application typically requires reporting on the accountant's practice structure, services provided, client base, claims history, loss prevention measures, and any prior insurance coverage details.

Fill out your accountants professional liability insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accountants Professional Liability Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.