Get the free New Jersey Easy Order NON PROFIT Corporation Fax Form

Show details

This document is a fax form for ordering the incorporation of a Non Profit Corporation in New Jersey, including necessary information and optional services for incorporation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new jersey easy order

Edit your new jersey easy order form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new jersey easy order form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new jersey easy order online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit new jersey easy order. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new jersey easy order

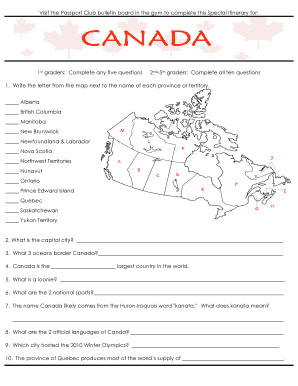

How to fill out New Jersey Easy Order NON PROFIT Corporation Fax Form

01

Obtain the New Jersey Easy Order NON PROFIT Corporation Fax Form from the New Jersey Division of Revenue and Enterprise Services website.

02

Fill out the top section with the corporation's name, type of business, and main office address.

03

Provide the name and address of the registered agent in the appropriate fields.

04

Indicate the purpose of the corporation in a brief statement.

05

List the names and addresses of the individuals who will serve as the initial directors.

06

Include any necessary additional details such as the duration of the corporation and any other pertinent information.

07

Sign and date the form where indicated, ensuring that it is completed by an authorized representative.

08

Prepare a cover sheet with your contact information and a brief explanation of the submission.

09

Fax the completed form along with the cover sheet to the designated number provided on the form.

Who needs New Jersey Easy Order NON PROFIT Corporation Fax Form?

01

Individuals or groups looking to establish a non-profit corporation in New Jersey.

02

Organizations intending to operate as non-profits for charitable, educational, or other beneficial purposes.

03

Founders of non-profit entities seeking to ensure legal compliance while filing for incorporation.

Fill

form

: Try Risk Free

People Also Ask about

How much does it cost to start a nonprofit in New Jersey?

?How much does it cost to start a 501c3 in New Jersey? This will depend upon several factors, including the size and layout of your organization. There are general filing fees associated with the filing of Form 1023: $600 for the standard and $275 for the 1023-EZ.

Who regulates non-profit organizations in New Jersey?

The Division of Consumer Affairs' Charities Registration and Investigation Section registers and regulates charitable organizations, professional fund raisers, and fund raising counsels operating in New Jersey.

Are non-profits tax exempt in NJ?

If a nonprofit organization is incorporated and operating as a nonprofit corporation, the nonprofit corporation is exempt from the New Jersey Corporation Business Tax (N.J.S.A.

How to change an LLC to a nonprofit in New Jersey?

Steps to Convert an LLC to a Nonprofit Choose a Name for Your Nonprofit. Make sure that your name identifies with your charitable cause. Create a Business Plan. Assign a Board of Directors. File Articles of Incorporation. Transfer Assets. File for 501(c)(3) Status.

How to form a non-profit organization in NJ?

How to Start a Nonprofit in New Jersey Name Your Organization. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) Store Nonprofit Records. Establish Initial Governing Documents and Policies.

How do I start a non-profit in NJ?

Paperwork Public Records Filing for New Business Entity. IRS Form SS-4: Apply for EIN. IRS Form 1023: Application for 501(c)(3) Exemption. IRS Determination Letter. Form NJ-REG: Business Registration Form. Form REG-1E: Sales Tax Exemption Application. URS Charitable Registration, if applicable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is New Jersey Easy Order NON PROFIT Corporation Fax Form?

The New Jersey Easy Order NON PROFIT Corporation Fax Form is a simplified form used by non-profit organizations in New Jersey to streamline the process of filing for incorporation or making changes to their corporate status.

Who is required to file New Jersey Easy Order NON PROFIT Corporation Fax Form?

Organizations that seek to establish a non-profit corporation in New Jersey or existing non-profit corporations that need to update their information are required to file this form.

How to fill out New Jersey Easy Order NON PROFIT Corporation Fax Form?

To fill out the form, one must provide specific details about the organization, including its name, address, purpose, and the names of board members. It is important to follow the instructions provided with the form carefully to ensure all required information is included.

What is the purpose of New Jersey Easy Order NON PROFIT Corporation Fax Form?

The purpose of the form is to facilitate the incorporation of non-profit entities in New Jersey, ensuring they meet the legal requirements for operation and compliance with state regulations.

What information must be reported on New Jersey Easy Order NON PROFIT Corporation Fax Form?

The form typically requires the organization's name, address, mission statement, the names and addresses of directors and officers, and any other required statutory information relevant to the non-profit corporation's operation.

Fill out your new jersey easy order online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Jersey Easy Order is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.