Get the free Manatee County Tax Collector

Show details

Formulario para solicitar un permiso de conducir o un carnet de identidad en el Condado de Manatee, incluyendo detalles sobre los requisitos, tipos de servicios, tarifas y pasos a seguir.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign manatee county tax collector

Edit your manatee county tax collector form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your manatee county tax collector form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing manatee county tax collector online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit manatee county tax collector. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

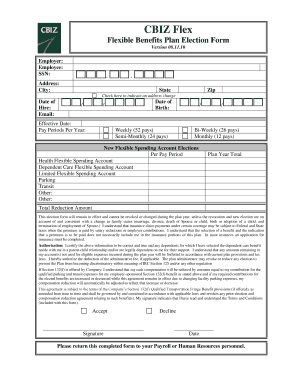

How to fill out manatee county tax collector

How to fill out Manatee County Tax Collector

01

Visit the Manatee County Tax Collector's official website.

02

Download or request the necessary forms for tax collection.

03

Fill out the forms with accurate information, including your name, address, and tax identification number.

04

Provide documentation that may be required, such as proof of residency or business ownership.

05

Review the completed forms for accuracy and completeness.

06

Submit the forms online, by mail, or in person at the Manatee County Tax Collector's office.

07

Keep a copy of the submitted forms for your records.

08

Pay any required fees associated with the tax collection.

Who needs Manatee County Tax Collector?

01

Residents of Manatee County who are required to pay property taxes.

02

Businesses operating in Manatee County that need to fulfill tax obligations.

03

Individuals seeking to obtain a tax receipt for transactions.

04

Property owners looking to appeal their property tax assessments.

Fill

form

: Try Risk Free

People Also Ask about

What is the senior exemption in Manatee County property tax?

What is the Low Income Senior Homestead Exemption? This is an additional homestead exemption of up to $50,000 which may be adopted by the county and cities for qualified persons 65 and over. The Manatee Board of County Commissioners has approved an exemption of $25,000 from county millage for qualified seniors.

How do I pay my property taxes in Manatee County?

You can also make payments at the Manatee County Tax Collector's Office, 819 301 Boulevard West, Bradenton, FL 34205, during lobby hours (Monday through Friday, 9:00 a.m. to 5:00 p.m.). Amscot and Walmart also accept payments with a convenience fee, with payment processing times varying based on the time of day.

What happens if you don't pay your property taxes on time in Florida?

Typically, if a property owner is behind on their property taxes, the government will take the property and liquidate it, sell the property, or sell the tax lien, using the funds to pay off the tax bill. (Usually, the purchaser of the lien can later initiate a sale process if the taxes aren't paid.)

What is the best way to pay property taxes?

Pay Your Local Tax Office Directly Most jurisdictions offer several payment options: Pay in person at your local tax collector's office. Mail a check or money order. Make an electronic check payment (eCheck) through your jurisdiction's website.

How often do you have to pay property tax in Florida?

According to Florida law, it is the responsibility of the property owner to see that the bill is received, and taxes are paid. Tax bills are sent to the owner and address of record by November 1st each year.

When should I receive my property tax bill in Florida?

Tax statements are mailed on or about November 1 of each year, with the following discounts in effect for early payment in person or online: 4% discount for payments postmarked or made in person in the month of November. 3% discount in December. 2% discount in January.

How do I pay my property taxes in Florida?

You can pay online, in person, by mail, or in installments. If you can't afford to pay your taxes, please note that there is no provision in Florida law for your value to be reduced because of personal hardship or inability to pay.

Do you need an appointment for Manatee County Tax Collector?

All in-person services at our Tax Collector branches require an appointment and are available to Manatee County residents only. Schedule your appointment today!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Manatee County Tax Collector?

The Manatee County Tax Collector is a governmental office responsible for collecting property taxes and other local taxes, managing tax-related services for residents of Manatee County, Florida.

Who is required to file Manatee County Tax Collector?

Property owners in Manatee County who are subject to local taxes are required to file with the Manatee County Tax Collector's office.

How to fill out Manatee County Tax Collector?

To fill out documents for the Manatee County Tax Collector, individuals can visit the official website for guidelines and forms, or visit the office in person for assistance.

What is the purpose of Manatee County Tax Collector?

The purpose of the Manatee County Tax Collector is to ensure the collection of taxes in a fair and efficient manner, providing essential funding for local services and governmental functions.

What information must be reported on Manatee County Tax Collector?

Individuals must report relevant property information, tax identification numbers, ownership details, and any exemptions they may qualify for when dealing with the Manatee County Tax Collector.

Fill out your manatee county tax collector online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Manatee County Tax Collector is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.