Get the free Group Life Claims

Show details

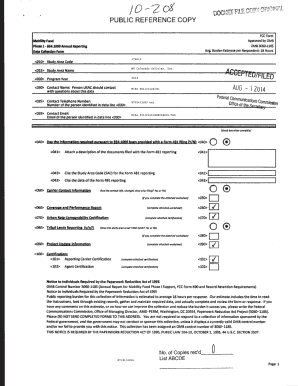

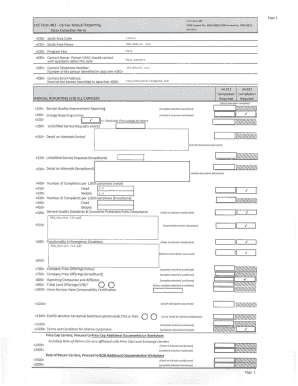

This document outlines the steps employers and beneficiaries need to follow to file claims for group life insurance with MetLife, including completing necessary forms and submitting them along with

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group life claims

Edit your group life claims form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group life claims form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit group life claims online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit group life claims. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group life claims

How to fill out Group Life Claims

01

Obtain the Group Life Claims form from your employer or insurance provider.

02

Fill out the employee's information section, including full name, address, and employee ID.

03

Provide details of the deceased's information, including name, date of birth, and relationship to the claimant.

04

Attach the necessary documentation, such as the death certificate and any relevant policy documents.

05

Complete the benefits section, indicating the amount of coverage and any deductions.

06

Review the completed form for accuracy and completeness.

07

Submit the form and documentation to the designated claims department as instructed.

Who needs Group Life Claims?

01

Employees who are covered under a group life insurance policy.

02

Beneficiaries of deceased employees entitled to claim group life insurance benefits.

03

Family members or dependents of the insured who seek financial support after a death.

Fill

form

: Try Risk Free

People Also Ask about

What do you mean by group life insurance?

What Is the Purpose of Group Life Insurance? Group life insurance is a common employee benefit that provides a death benefit to the insured's beneficiaries if they die while part of the organization. The purpose is to provide financial support to the families of such employees.

How to claim group insurance?

Then your insurer will ask you to submit the following documents: Duly filled claim form. Final hospital bill (Original copy) Doctor's prescription recommending admission to a hospital. Discharge card by hospital. Medical bills. Prescription supporting medical bills. Surgical implant invoice, if any.

What is the most common group life insurance?

Basic group term life insurance – Basic group term life insurance is usually employer paid. However, there are sometimes that employees may have to contribute a nominal amount to the cost of the coverage. This is the most common group life benefit.

What does group policy mean in insurance?

Wednesday, September 13, 2023 17:15 Posted by Admin. Group policy insurance is a type of coverage provided to a group of individuals or members by organizations or employers, offering affordability and comprehensive benefits.

What is the difference between group life insurance and term life insurance?

Essentially, group term life insurance offers the lowest premium but is tied directly to your employment or membership to the group, while individual term life insurance is sold directly from the insurer to you as an individual.

Can you cash out a group life insurance policy?

As with other forms of permanent life insurance, you can access the cash value of a group universal life insurance policy while you're still alive. Your options for doing this will vary from policy to policy. You may be able to borrow against the cash value or make withdrawals against it that lower the death benefit.

What is a life claim?

A life insurance claim is a request from the beneficiary to receive the life insurance death benefit payout upon the policyholder's death. The beneficiary must contact the insurer and submit the proper paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Group Life Claims?

Group Life Claims are claims made by beneficiaries to receive benefits from a group life insurance policy upon the death of an insured member.

Who is required to file Group Life Claims?

Typically, the beneficiaries of the deceased or an authorized representative are required to file Group Life Claims.

How to fill out Group Life Claims?

To fill out Group Life Claims, the claimant must complete a claims form provided by the insurance company, providing necessary details such as the insured's identification, cause of death, and any required documentation.

What is the purpose of Group Life Claims?

The purpose of Group Life Claims is to provide financial support to the beneficiaries of the insured member in the event of their death.

What information must be reported on Group Life Claims?

The information that must be reported on Group Life Claims includes the insured's name, policy number, date of death, cause of death, and identification of beneficiaries.

Fill out your group life claims online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Life Claims is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.