Get the free Delinquent

Show details

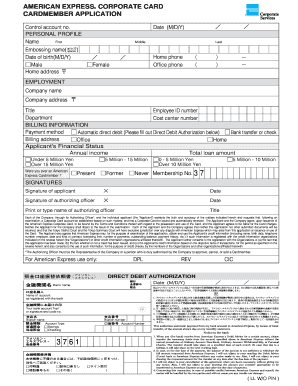

CREDITAPPLICATION ClientInformation FULLLEGALBUSINESSNAME PHONENUMBER STREETADDRESS CITY COUNTY STATE ZIP NETWORK ANNUALGROSSSALES TYPEOFBUSINESS SOLEPROPRIETORSHIP YEARSINBUSINESS PARTNERSHIP LLC

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign delinquent

Edit your delinquent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your delinquent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit delinquent online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit delinquent. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out delinquent

How to fill out delinquent:

01

Gather all necessary information: Collect all relevant financial records, including income statements, bank statements, tax forms, and any other documents that provide an overview of your financial situation.

02

Assess your current financial status: Evaluate your income, liabilities, and expenses to determine the extent of your delinquency and how it has affected your overall financial health. This analysis will help you understand the severity of your situation and guide your decision-making process.

03

Prioritize your debts: Determine which debts are most critical to address immediately. This may include outstanding bills, loans with high interest rates, or debts that could lead to severe consequences if left unpaid (e.g., utility bills that could result in service disconnection).

04

Communicate with your creditors: Contact each creditor and explain your financial hardship. Be honest and transparent about your situation, and discuss potential options for repayment. Some creditors may be willing to negotiate payment plans, temporary deferments, or even debt settlements to help you get back on track.

05

Create a budget: Develop a realistic budget that reflects your current financial capabilities. Consider cutting back on discretionary expenses, seeking additional sources of income, or reallocating funds to prioritize debt repayment. A budget can provide a clear roadmap for managing your finances and ensuring that you meet your repayment obligations.

06

Explore assistance programs: Research and inquire about any assistance programs or resources available to individuals dealing with delinquent debt. These programs can vary depending on your location and the type of debt you owe but can provide helpful alternatives, such as debt counseling, refinancing options, or government aid.

Who needs delinquent:

01

Individuals with overdue payments: Delinquent individuals are those who have failed to meet their financial obligations within the specified timeframes. This can include individuals who have missed credit card payments, fallen behind on mortgage or rent payments, or failed to pay utility bills on time.

02

Those facing financial hardships: Delinquency often arises from financial difficulties, such as job loss, medical emergencies, or unexpected expenses. People experiencing these challenges may find themselves unable to meet their financial obligations, leading to delinquency.

03

Borrowers in default: Delinquency can also apply to borrowers who have defaulted on their loans. This can include individuals who have stopped making payments on student loans, car loans, or personal loans. Defaulting on loans can have severe consequences, such as damaged credit scores or legal actions from creditors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify delinquent without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your delinquent into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I get delinquent?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific delinquent and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete delinquent online?

pdfFiller has made it simple to fill out and eSign delinquent. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

What is delinquent?

Delinquent refers to someone who fails to pay a debt or fulfill an obligation on time.

Who is required to file delinquent?

Individuals or entities who have missed a deadline for submitting a required report or payment may be required to file delinquent.

How to fill out delinquent?

To fill out a delinquent report, individuals or entities must provide the necessary information and submit it by the required deadline.

What is the purpose of delinquent?

The purpose of filing delinquent is to ensure that missed obligations are addressed and resolved in a timely manner.

What information must be reported on delinquent?

Delinquent reports typically require information related to the missed payment or obligation, as well as any relevant details or documentation.

Fill out your delinquent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Delinquent is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.