Get the free Flag Order Form/Tax Invoice

Show details

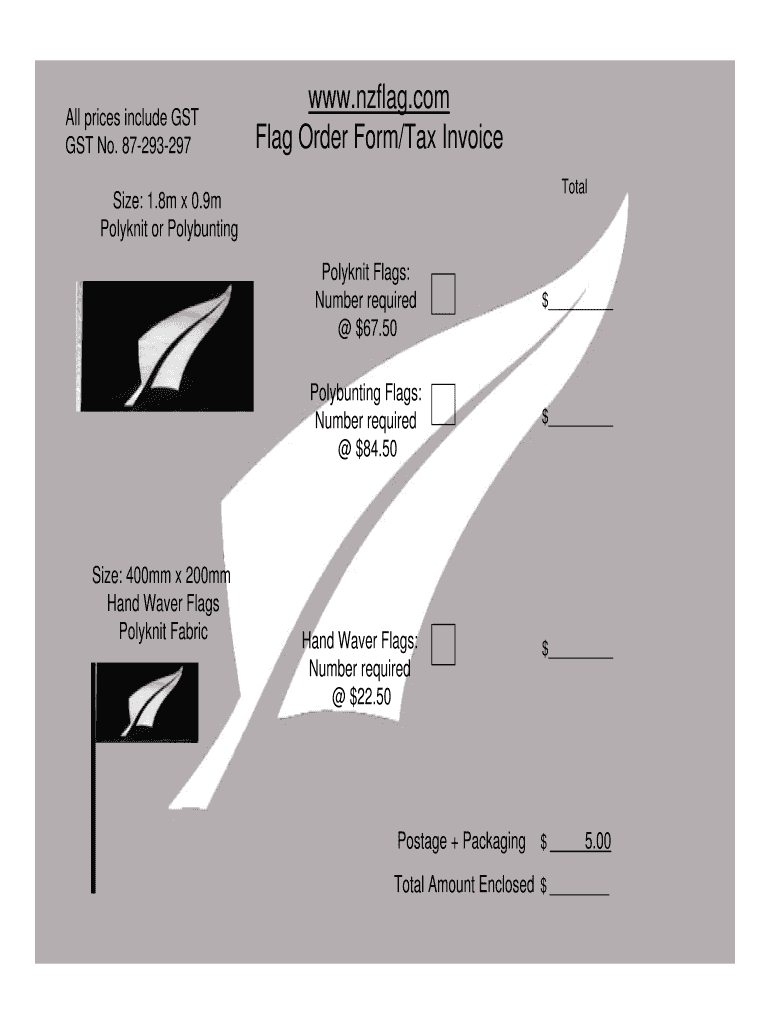

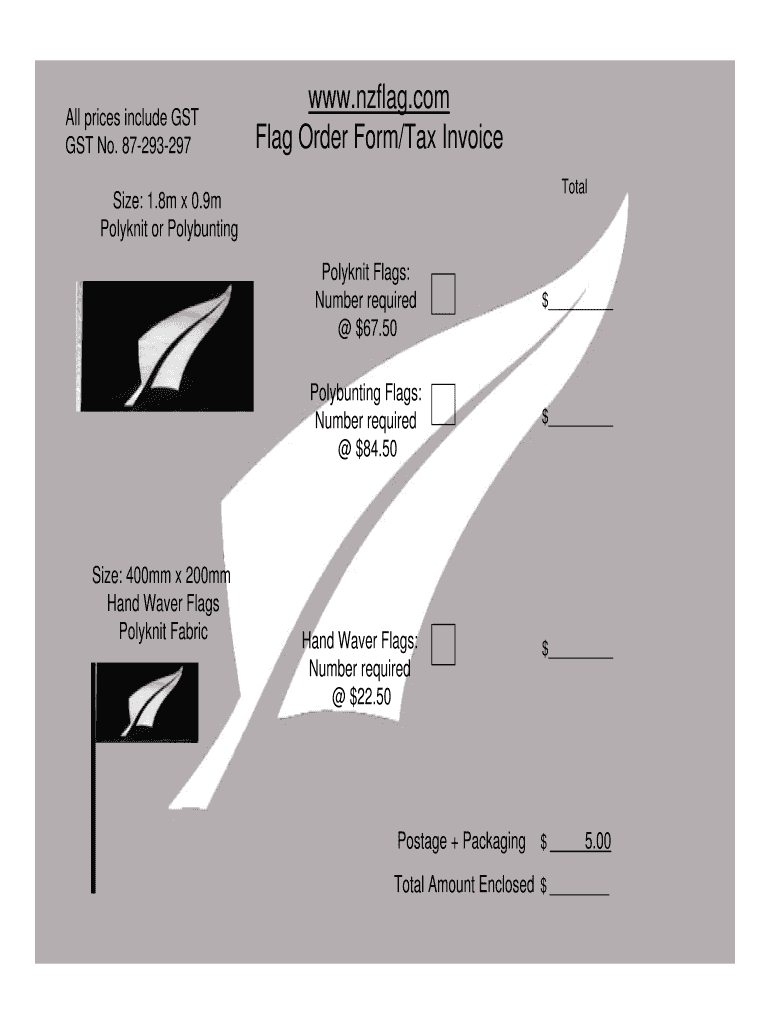

This document is an order form for purchasing flags including Polyknit, Polybunting, and Hand Waver Flags, and it serves as a tax invoice.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flag order formtax invoice

Edit your flag order formtax invoice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flag order formtax invoice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing flag order formtax invoice online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit flag order formtax invoice. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flag order formtax invoice

How to fill out Flag Order Form/Tax Invoice

01

Begin by entering your name and contact information at the top of the form.

02

Specify the quantity of flags you wish to order in the designated section.

03

Select the type of flags you want from the dropdown menu.

04

Fill in your shipping address to ensure proper delivery.

05

Review the terms and conditions and check the box to confirm your agreement.

06

Provide your payment information, including credit card details or other payment methods.

07

Double-check all the information for accuracy before submitting the form.

08

Submit the form and keep a copy for your records.

Who needs Flag Order Form/Tax Invoice?

01

Individuals purchasing flags for personal use.

02

Businesses ordering flags for promotional purposes.

03

Schools and organizations needing flags for events or ceremonies.

04

Government entities requiring flags for public display.

Fill

form

: Try Risk Free

People Also Ask about

How to fill out a tax invoice statement?

Date of issue: Include the date the invoice is issued. Customer information: List the buyer's name, address, and relevant contact information. Description of goods or services: Provide a detailed list of products or services, including quantities and prices. If applicable, show the tax rate and total tax for each item.

How to write an invoice statement?

These are the five steps to writing an invoice effectively and professionally. Personalize and make your invoice professional. Fill-out the appropriate contact information on your invoice. Select a due date on your invoice. Fill in the projects/ tasks you are invoicing the client for. Add payment information.

What is the difference between a tax invoice and an invoice?

2 Check what type of invoice you need There are two types of invoices: Tax invoices - If you're registered for GST, you're usually required to provide tax invoices. Regular invoices - If you run a business that is not registered for goods and services tax (GST), your invoices won't include a tax component.

What is the difference between a tax invoice and a proforma invoice?

A proforma invoice serves as a preliminary quote, helping buyers assess potential costs before a sale is finalised. On the other hand, a tax invoice is an official document that records the completion of a transaction and includes necessary tax details for compliance and accounting purposes.

How to make a proforma invoice?

How to create a proforma invoice Find costs. Create your proforma invoice. List the invoice items. Include agreement terms. Reach an agreement with the purchaser. Be detailed. Proofread your invoice. Customize your invoice.

How to write a tax invoice statement?

Date of issue: Include the date the invoice is issued. Customer information: Include the customer's name and address. Description of goods or services: Provide a detailed list of products or services, including quantities, prices, and the applicable VAT rate. Total amount: Show the total amount payable, including VAT.

How to write a tax invoice?

What Details Should a Tax Invoice Include? Invoice number and date. Customer name. Shipping and billing address. The words 'tax invoice' clearly displayed. Seller's identity and business number. A description of the goods and services, their quantities, and price. The tax applied for each item. The total value, including tax.

What is an example of a tax invoice?

Example of a Tax Invoice Imagine a company, RZ Electronics, selling a laptop to a customer XYM for ₹10,000. The tax invoice would itemize the buyer and seller details, invoice number, date, product details, quantity, and value. Additionally, it would specify the tax rates and amounts, such as an 18% GST.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Flag Order Form/Tax Invoice?

The Flag Order Form/Tax Invoice is a document used to record details of transactions that involve the sale of goods or services, serving as both an official record and a request for payment.

Who is required to file Flag Order Form/Tax Invoice?

Individuals and businesses that engage in taxable transactions, and are mandated by tax authorities to report sales and value-added tax (VAT) or goods and services tax (GST), are required to file the Flag Order Form/Tax Invoice.

How to fill out Flag Order Form/Tax Invoice?

To fill out the Flag Order Form/Tax Invoice, enter the seller's and buyer's details, including names, addresses, and tax identification numbers. Include the date, item descriptions, quantities, prices, applicable taxes, and total amounts due.

What is the purpose of Flag Order Form/Tax Invoice?

The purpose of the Flag Order Form/Tax Invoice is to document the specifics of a sale, facilitate payment, provide a legal record for tax compliance, and ensure transparency in financial transactions.

What information must be reported on Flag Order Form/Tax Invoice?

The Flag Order Form/Tax Invoice must report information such as the seller's and buyer's contact details, transaction date, descriptions of goods/services, quantities, unit prices, total amount, tax rates, and total taxes applied.

Fill out your flag order formtax invoice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flag Order Formtax Invoice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.