Get the free Transfer of payroll costs between accounts recap - Payroll Services - payroll tamu

Show details

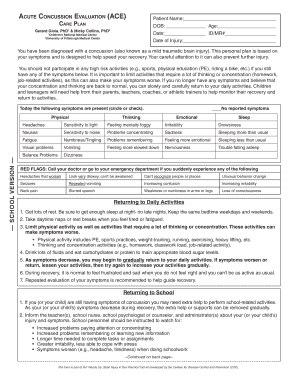

TRANSFER OF PAYROLL COSTS BETWEEN ACCOUNTS RECAP FOR PAYROLL SERVICES USE ONLY Prepared by Reviewed by EMPLOYEE INFORMATION Employee IN PAY PERIODS Cycle (Monthly×BY) Date Paid Pay Date Processed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer of payroll costs

Edit your transfer of payroll costs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer of payroll costs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit transfer of payroll costs online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit transfer of payroll costs. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transfer of payroll costs

How to fill out transfer of payroll costs:

01

Start by gathering all relevant payroll information, including employee names, salaries, wages, and any additional payroll expenses.

02

Identify the purpose of the transfer. Determine if the costs are being transferred to a different department within your organization or to an external entity.

03

Consult your organization's financial policies and procedures to understand any specific guidelines or requirements for filling out the transfer of payroll costs form.

04

Begin filling out the form by providing the necessary identification information, such as your name, department, and contact details.

05

Specify the period for which the payroll costs are being transferred. This could be a specific month, quarter, or year.

06

List each employee's name, salary or wage amount, and any additional payroll expenses separately.

07

Calculate the total payroll costs for the specified period by adding up the salaries and wages of all employees and any additional payroll expenses.

08

If necessary, provide a brief explanation or justification for the transfer of payroll costs. This could include a project code, departmental reallocation, or any other relevant information.

09

Review the completed form for accuracy and make any necessary corrections or adjustments.

10

Obtain any required approvals or signatures from appropriate personnel, such as your supervisor or a finance manager, before submitting the form for further processing.

Who needs transfer of payroll costs?

01

Organizations that have multiple departments or cost centers may need to transfer payroll costs to accurately allocate expenses and track spending within each department.

02

Companies that provide services or products on a project basis may need to transfer payroll costs to specific projects for accurate cost accounting and project profitability analysis.

03

Nonprofit organizations that receive grants or funding from various sources may need to transfer payroll costs to the appropriate funding source to ensure compliance with grant requirements and reporting obligations.

04

Organizations undergoing internal reorganizations or restructuring may need to transfer payroll costs to reflect the changes in departmental responsibilities and budgets.

05

Government agencies or contractors that are required to provide detailed breakdowns of expenses may need to transfer payroll costs to different activities, functions, or projects for reporting and audit purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit transfer of payroll costs online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your transfer of payroll costs to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit transfer of payroll costs straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing transfer of payroll costs.

How can I fill out transfer of payroll costs on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your transfer of payroll costs, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is transfer of payroll costs?

The transfer of payroll costs refers to the process of moving labor expenses from one cost center or account to another.

Who is required to file transfer of payroll costs?

Employers or organizations that need to reallocate labor expenses within their accounting records are required to file transfer of payroll costs.

How to fill out transfer of payroll costs?

Transfer of payroll costs can be filled out by detailing the amount of labor expenses being moved, the reason for the transfer, and the accounts involved in the reallocation.

What is the purpose of transfer of payroll costs?

The purpose of transfer of payroll costs is to accurately reflect the allocation of labor expenses within an organization's financial records.

What information must be reported on transfer of payroll costs?

The information to be reported on transfer of payroll costs includes the amount of labor expenses being transferred, the accounts affected, and the justification for the reallocation.

Fill out your transfer of payroll costs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transfer Of Payroll Costs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.