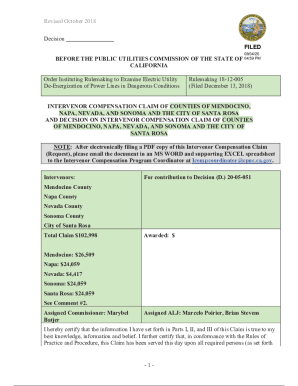

Get the free NOTICE OF CREDIT

Show details

This document serves as a formal notice of a lien claimed against a property, detailing the involved parties, property information, and terms of the lien, including a credit period for foreclosure

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice of credit

Edit your notice of credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice of credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice of credit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit notice of credit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice of credit

How to fill out NOTICE OF CREDIT

01

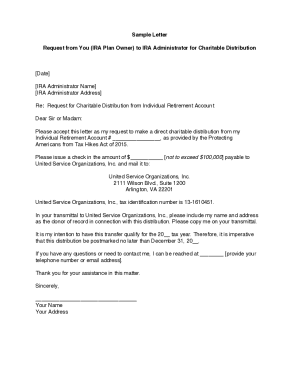

Begin by clearly stating the title 'NOTICE OF CREDIT' at the top of the document.

02

Include your name, address, and contact information in the header.

03

Identify the recipient's name, address, and any other relevant details.

04

State the date on which the notice is being issued.

05

Clearly specify the amount of credit being granted.

06

Provide a brief description of the reason for the credit.

07

Include any relevant reference numbers or account information.

08

Ensure to sign and date the document to validate it.

Who needs NOTICE OF CREDIT?

01

Businesses that extend credit to customers.

02

Individuals managing financial transactions.

03

Accounting departments for accurate record-keeping.

04

Clients who need a formal acknowledgment of credit applied.

Fill

form

: Try Risk Free

People Also Ask about

What is a letter of credit in English?

A letter of credit is essentially a financial contract between a bank, a bank's customer and a beneficiary. Generally issued by an importer's bank, the letter of credit guarantees the beneficiary will be paid once the conditions of the letter of credit have been met.

What is an example of a letter of credit?

What Is an Example of a Letter of Credit? Consider an exporter in an unstable economic climate, where credit risk is high. To reduce risk, a buyer of the exporter's goods arranges a letter of credit through their bank.

What is the simple definition of LC?

A Letter of Credit (LC) is a financial instrument used in international trade to provide payment security. It guarantees that the seller will receive payment from the buyer, as long as the seller fulfils the agreed-upon terms and conditions. LCs help mitigate risks for both parties involved in the transaction.

What is the purpose of an LC?

A Letter of Credit (LC) is a document that guarantees the buyer's payment to the sellers. It is issued by a bank and ensures timely and full payment to the seller. If the buyer is unable to make such a payment, the bank covers the full or the remaining amount on behalf of the buyer.

What is LC and BC in banking?

1. LC is one of the payment mode used in the International Trade between importer and exporter to cover third-party credit risk. Meaning if the importer defaults, his bank will have to pay on his behalf. Whereas, Buyers credit is a funding mechanism used by importer to funds his transaction.

What is LC in English?

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods.

What is LC with an example?

A Letter of Credit, commonly known as LC, is a formal document issued by a bank or financial institution. Its primary purpose is to ensure payment on behalf of the buyer to the seller in a business transaction. It acts as a safety net that guarantees the seller will receive payment for their goods or services.

What is a letter for credit?

A letter of credit is an instrument issued by a financial institution, usually a bank, which authorizes the bearer to demand payment from the institution. A letter of credit can be general, if it is not addressed to any specific person, or special, if it is addressed to a specific person or entity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NOTICE OF CREDIT?

A NOTICE OF CREDIT is a document issued by a tax authority that informs a taxpayer of the credit available to them, often related to tax payments or deductions.

Who is required to file NOTICE OF CREDIT?

Taxpayers who have received tax credits or who need to report credits to the tax authority are generally required to file a NOTICE OF CREDIT.

How to fill out NOTICE OF CREDIT?

To fill out a NOTICE OF CREDIT, you must provide your identifying information, details of the credits being claimed, and any relevant tax information as required by the tax authority's instructions.

What is the purpose of NOTICE OF CREDIT?

The purpose of a NOTICE OF CREDIT is to officially communicate tax credits to the taxpayer, ensuring proper documentation for tax filings and compliance.

What information must be reported on NOTICE OF CREDIT?

The information that must be reported on a NOTICE OF CREDIT typically includes taxpayer identification details, the type and amount of credits being claimed, and any relevant tax years.

Fill out your notice of credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Of Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.