Get the free Verified Claim and Surety Bond Claim

Show details

This document serves as notice pursuant to Colorado Revised Statutes that a claimant is making a claim for unpaid labor, materials, and services provided for a specific project, including verification

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign verified claim and surety

Edit your verified claim and surety form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your verified claim and surety form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing verified claim and surety online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit verified claim and surety. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

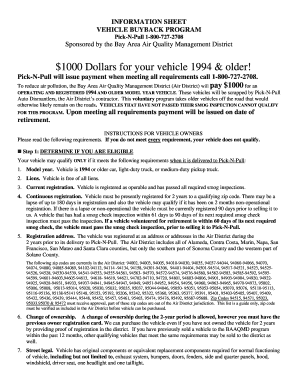

How to fill out verified claim and surety

How to fill out Verified Claim and Surety Bond Claim

01

Gather all necessary documentation related to the claim.

02

Fill out the claimant's information accurately, including name, address, and contact details.

03

Provide details of the bond, including the bond number and issuing date.

04

Clearly articulate the reason for the claim, including any supporting evidence.

05

Itemize the losses and damages claimed, specifying amounts where applicable.

06

Sign and date the claim form to certify its accuracy.

07

Submit the claim to the surety company as per their guidelines, ensuring to keep a copy for your records.

Who needs Verified Claim and Surety Bond Claim?

01

Individuals or businesses that have incurred losses covered by a surety bond.

02

Contractors who have a contract requiring a surety bond.

03

Project owners seeking to claim against a surety bond for non-performance or defaults by contractors.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of surety?

The term surety refers to any party that guarantees the payment of a debt or performance of a contract. A financial institution, surety company, or underwriter is only one example of a surety. Any person or firm that is putting up the money or collateral on behalf of the principal is eligible to be a surety.

What is the meaning of surety?

A surety is a person or entity that assumes direct liability for another's obligation. Financial creditors may require the debtor to find a surety, who then signs the loan agreement along with the debtor. A financial surety's liability arises as soon as the agreement is closed.

What is the difference between a bond and a surety bond?

The main difference between a cash bond and a surety bond is the number of parties involved. Cash bonds only involve two parties, you and the owner. In a surety bond, there is a third party, the surety company. The term surety refers to any party that guarantees the payment of a debt or performance of a contract.

How do you verify a surety bond?

It outlines a simple, two-step process for verifying the authenticity of contract surety bonds before acceptance. The steps are: (1) check the surety's authority to issue the bond and (2) confirm the surety's authorization of the bond's issuance.

What is a surety claim?

A Surety Bond Claim is a legal demand that an Obligee (often the owner of a construction project) makes against a Principal (often the contractor) alleging that the Principal has failed to meet its obligations under the bond, or that the Principal has violated the law or acted unethically.

What is the main purpose of a surety bond?

Surety bonds help small businesses win contracts by providing the customer with a guarantee that the work will be completed. Many public and private contracts require surety bonds, which are offered by surety companies.

What is an example of a surety bond claim?

Sample Surety Bond Claim Letter [Your Company's Name] has a claim against this bond due to [details of the breach of obligations by the principal]. As per our contract with [Principal's Name], we have supplied [goods/services] and have not been compensated as agreed. The total amount outstanding is [Claim Amount].

What are surety claims?

When a claim is made against a surety bond, the surety may pay the obligee to cover the costs of the principal's failure to meet their obligations. However, unlike insurance, the principal is legally obligated to repay the surety for any claims paid out.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Verified Claim and Surety Bond Claim?

A Verified Claim is a formal request for payment under a contract or a legal obligation, submitted with documentation that verifies the claim's validity. A Surety Bond Claim is a specific type of Verified Claim related to a surety bond where a claimant seeks payment from the surety for a defaulted obligation by the principal.

Who is required to file Verified Claim and Surety Bond Claim?

Generally, any party that has a legitimate claim under a contract or against a surety bond must file a Verified Claim or Surety Bond Claim. This often includes contractors, subcontractors, suppliers, or anyone providing goods or services covered by the bond.

How to fill out Verified Claim and Surety Bond Claim?

To fill out a Verified Claim or Surety Bond Claim, gather all necessary documentation, complete the claim form by providing accurate details about the work performed or services rendered, the amount owed, and attach supporting evidence such as invoices, contracts, and any relevant correspondence.

What is the purpose of Verified Claim and Surety Bond Claim?

The purpose of a Verified Claim and Surety Bond Claim is to formally notify the responsible party or surety of the claim and to seek payment for damages, unpaid services, or materials provided, thereby providing a legal mechanism to assert rights and recover costs.

What information must be reported on Verified Claim and Surety Bond Claim?

The information that must be reported usually includes the claimant's name and contact information, details about the principal and surety, a description of the claim, the amount claimed, evidence supporting the claim, and a statement verifying the accuracy of the information provided.

Fill out your verified claim and surety online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Verified Claim And Surety is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.