Get the free Traditional IRA to a Roth IRA, transferring from an existing Roth IRA, rolling over ...

Show details

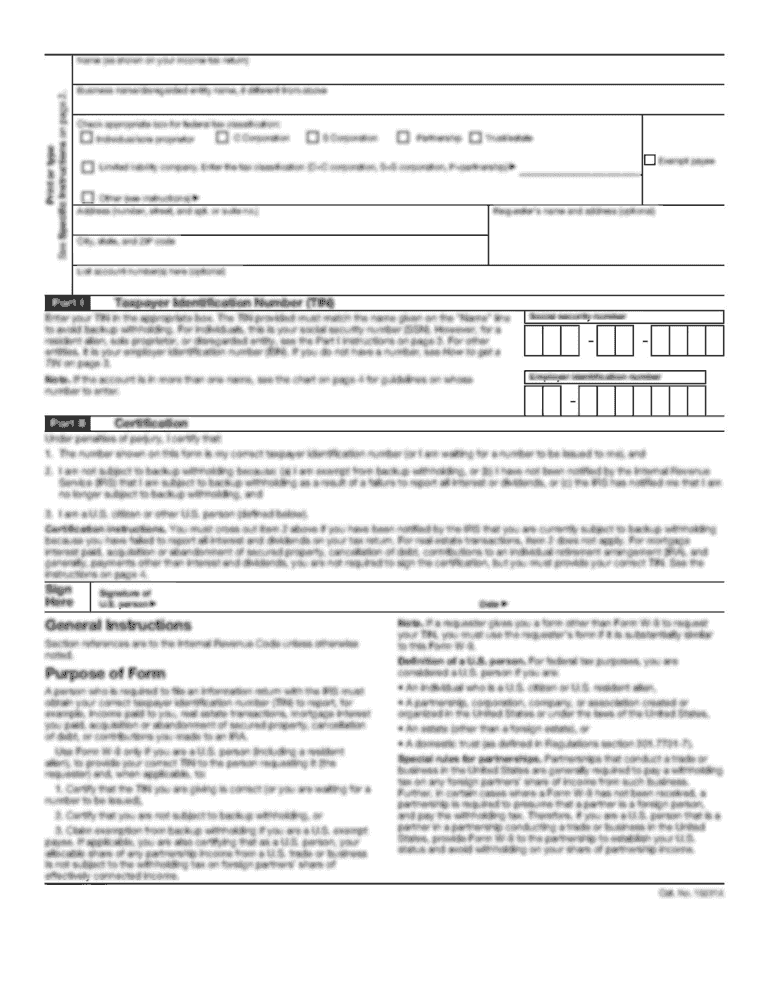

INDIVIDUAL RETIREMENT TRANSFER OF ASSETS FORM Please complete this form only if you are transferring assets directly to a new or existing CMG Funds IRA, converting from a Traditional IRA to a Roth

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign traditional ira to a

Edit your traditional ira to a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your traditional ira to a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing traditional ira to a online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit traditional ira to a. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out traditional ira to a

How to Fill Out a Traditional IRA to A:

Gather the necessary documents:

01

Identify your traditional IRA account information

02

Have your social security number and contact information ready

03

Gather any relevant tax forms, such as Form 1040 or Form 5498

Review contribution limits:

01

Understand the annual contribution limits set by the IRS for traditional IRAs

02

For 2021, the limit is $6,000 for individuals under 50 years old, with an additional $1,000 catch-up contribution for those 50 and older

Determine your eligibility:

01

Ensure you meet the eligibility criteria for contributing to a traditional IRA, such as having earned income during the year

02

Check if you qualify for any deductions based on your income and filing status

Choose a financial institution:

01

Select a reputable financial institution or brokerage firm where you want to establish your traditional IRA

02

Consider factors like fees, investment options, and customer service when making your choice

Open a traditional IRA account:

01

Complete the necessary paperwork provided by your chosen financial institution

02

Provide all required information and submit the application

Fund your traditional IRA:

01

Decide on the amount you want to contribute to your traditional IRA

02

Make a contribution by transferring funds from your bank account or another retirement account

03

Ensure you specify that the contribution is for a traditional IRA and provide any required details

Monitor your investments:

01

Keep track of your traditional IRA balance and performance over time

02

Review and adjust your investment portfolio if needed to align with your financial goals

Who needs a traditional IRA to A:

Individuals planning for retirement:

01

Traditional IRAs can be beneficial for individuals who want to save for retirement and potentially lower their taxable income

02

It provides a tax-advantaged way to accumulate funds over time for retirement expenses

People seeking tax deductions:

01

Contributions made to a traditional IRA may be tax-deductible, depending on factors such as income and filing status

02

This can provide immediate tax savings for individuals in higher tax brackets

Those looking for tax-deferred growth:

01

Traditional IRAs offer the advantage of tax-deferred growth, allowing investments to grow without being subject to annual taxes on capital gains, dividends, or interest

02

This can result in potential long-term tax savings

Remember, it's always advisable to consult with a financial advisor or tax professional to ensure you understand the specific rules and implications of filling out a traditional IRA to A based on your unique financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my traditional ira to a directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your traditional ira to a and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I execute traditional ira to a online?

Completing and signing traditional ira to a online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out traditional ira to a on an Android device?

On Android, use the pdfFiller mobile app to finish your traditional ira to a. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is traditional ira to a?

Traditional IRA stands for Individual Retirement Account, which is a tax-advantaged savings account designed to help individuals save for retirement.

Who is required to file traditional ira to a?

Individuals who have a traditional IRA account are required to file information about their contributions, withdrawals, and other transactions related to the account.

How to fill out traditional ira to a?

To fill out a traditional IRA form, individuals need to report their contributions, withdrawals, and other relevant information accurately and submit the form to the IRS by the deadline.

What is the purpose of traditional ira to a?

The purpose of a traditional IRA is to provide individuals with a tax-advantaged way to save for retirement by allowing them to contribute pre-tax income to the account.

What information must be reported on traditional ira to a?

Information such as contributions, withdrawals, gains, losses, and other transactions related to the traditional IRA account must be reported on the form.

Fill out your traditional ira to a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Traditional Ira To A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.