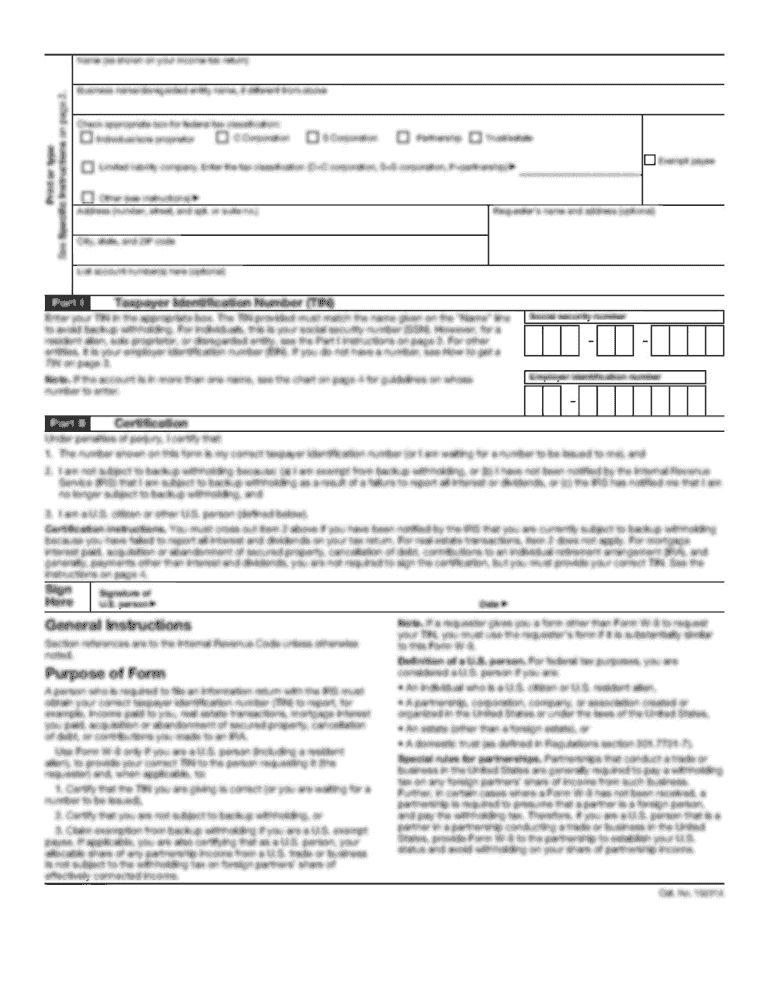

Get the free Circular to Creditors

Show details

This document serves to inform creditors about the appointment of administrators for the Proserpine Co-Operative, detailing their responsibilities, creditor meetings, and necessary actions regarding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign circular to creditors

Edit your circular to creditors form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your circular to creditors form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit circular to creditors online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit circular to creditors. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out circular to creditors

How to fill out Circular to Creditors

01

Gather all necessary financial information, including assets, liabilities, and creditor details.

02

Draft the Circular to Creditors, clearly stating the purpose and background of the financial situation.

03

Include a summary of the company's financial status and any proposed plans for resolution.

04

List out all creditors with the amounts owed to each.

05

Provide instructions for creditors on how to respond or participate in the process.

06

Distribute the Circular to all identified creditors via mail or email.

07

Keep a record of all communications sent and received regarding the Circular.

Who needs Circular to Creditors?

01

Businesses experiencing financial distress or insolvency.

02

Companies seeking to restructure their debts.

03

Individuals acting as personal representatives in bankruptcy situations.

04

Creditors who need to be informed about the financial status of a debtor.

Fill

form

: Try Risk Free

People Also Ask about

Is voluntary liquidation bad?

Creditors' Voluntary Liquidation can be initiated by company directors, and although clearly not the best outcome for any company, the process does offer some protection for both creditors and directors. If you're unsure whether or not your business is insolvent, minimising creditor losses is of paramount importance.

What are the consequences of voluntary winding up?

Upon the commencement of the voluntary winding-up, the company will cease to carry on business except that which may be required for the benefit of winding- up smoothly. The legal status and powers of the company will continue until it is dissolved.

How does a creditors voluntary winding up work?

Company may opt for a creditors' voluntary winding up if the directors believe that it cannot, by any reason its liabilities, continue its business. The company will appoint a liquidator, to wind up its affairs of the company and distributing its assets.

What does creditors voluntary winding up mean?

creditors' voluntary liquidation - your company cannot pay its debts and you involve your creditors when you liquidate it. compulsory liquidation - your company cannot pay its debts and you apply to the courts to liquidate it. members' voluntary liquidation - your company can pay its debts but you want to close it.

What is the procedure for creditors voluntary winding up?

The liquidator must invite the creditors and contributors to submit their claims in writing. The claims must be submitted within a specified period, usually 30 days from the date of the notice. The liquidator must verify the claims and make a list of the claims that are admitted and the claims that are rejected.

What are the disadvantages of a CVA?

DISADVANTAGES OF A CVA The company's credit rating is affected. Obtaining stakeholder and creditor acceptance can be difficult. The agreement may run for a long period of time. Secured creditors are not bound by the agreement. Failure of a CVA.

What is the meaning of creditors in accounting in English?

A term used in accounting, 'creditor' refers to the party that has delivered a product, service or loan, and is owed money by one or more debtors. A debtor is the opposite of a creditor – it refers to the person or entity who owes money.

Is a creditors voluntary liquidation bad?

Is Voluntary liquidation bad? Whilst voluntary liquidation is inevitably a difficult process for all stakeholders, it is not inherently bad, and indeed under the Companies Act 2006 directors are obligated to take steps to deal with the company's affairs where they perceive the company is, or may about to be, insolvent.

What will trigger a creditors voluntary liquidation?

A company entering into a CVL will be insolvent. This can be because either: The company is unable to pay its debts at the time they are due for payment. Liabilities are greater than assets.

Who pays for creditors voluntary liquidation?

In many cases a voluntary liquidation by way of a CVL can be funded using the assets of the company which will be sold off as part of the liquidation process meaning directors will not be required to pay the liquidation fees personally.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Circular to Creditors?

A Circular to Creditors is a formal document sent by a company or organization to its creditors to inform them about financial matters, including insolvency, reorganization plans, or any significant changes that may impact the creditors' interests.

Who is required to file Circular to Creditors?

Entities that are undergoing insolvency proceedings or restructuring, including companies in financial distress, are typically required to file a Circular to Creditors to provide transparency and communication to their creditors.

How to fill out Circular to Creditors?

To fill out a Circular to Creditors, the issuer needs to include details about the company's current financial status, a description of the situation, a timeline for proposed actions, and any steps creditors should take in response to this information.

What is the purpose of Circular to Creditors?

The purpose of a Circular to Creditors is to inform creditors about the financial condition of the company, to facilitate communication, to outline the steps being taken to address financial issues, and to ensure that creditors are aware of their rights and obligations.

What information must be reported on Circular to Creditors?

A Circular to Creditors must report information such as the company's financial status, reasons for financial difficulties, proposed plans for restructuring or repayment, deadlines for creditor responses, and any legal implications for creditors.

Fill out your circular to creditors online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Circular To Creditors is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.