Get the free Basic Life Insurance Needs - First Trinity Financial Corporation

Show details

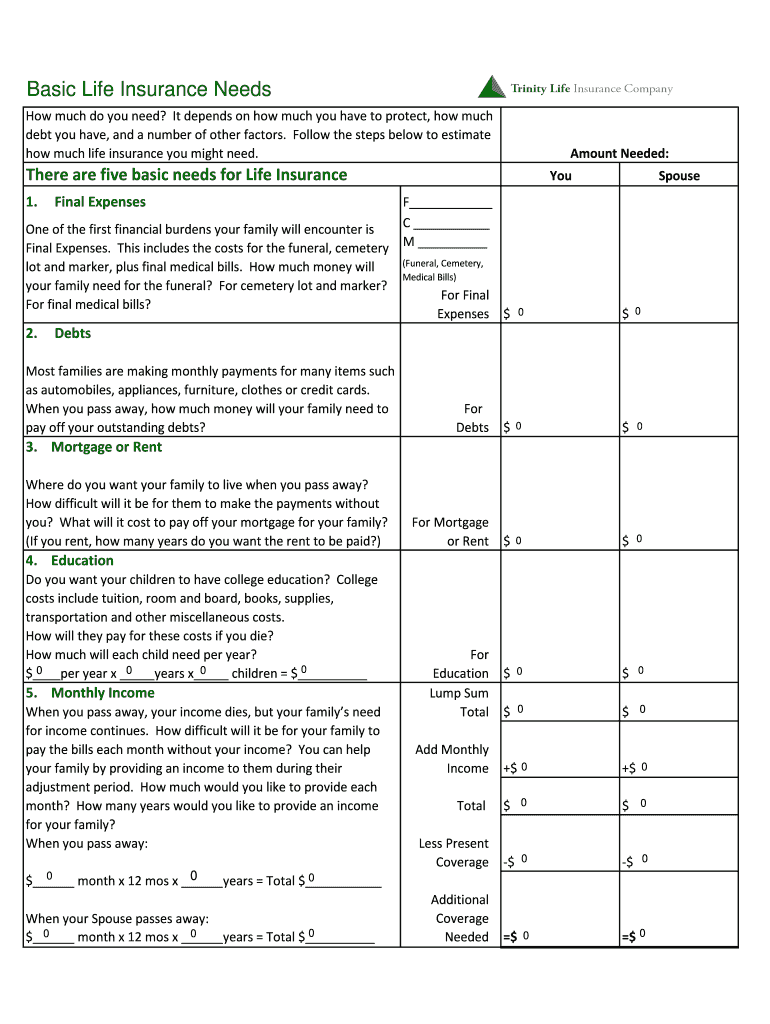

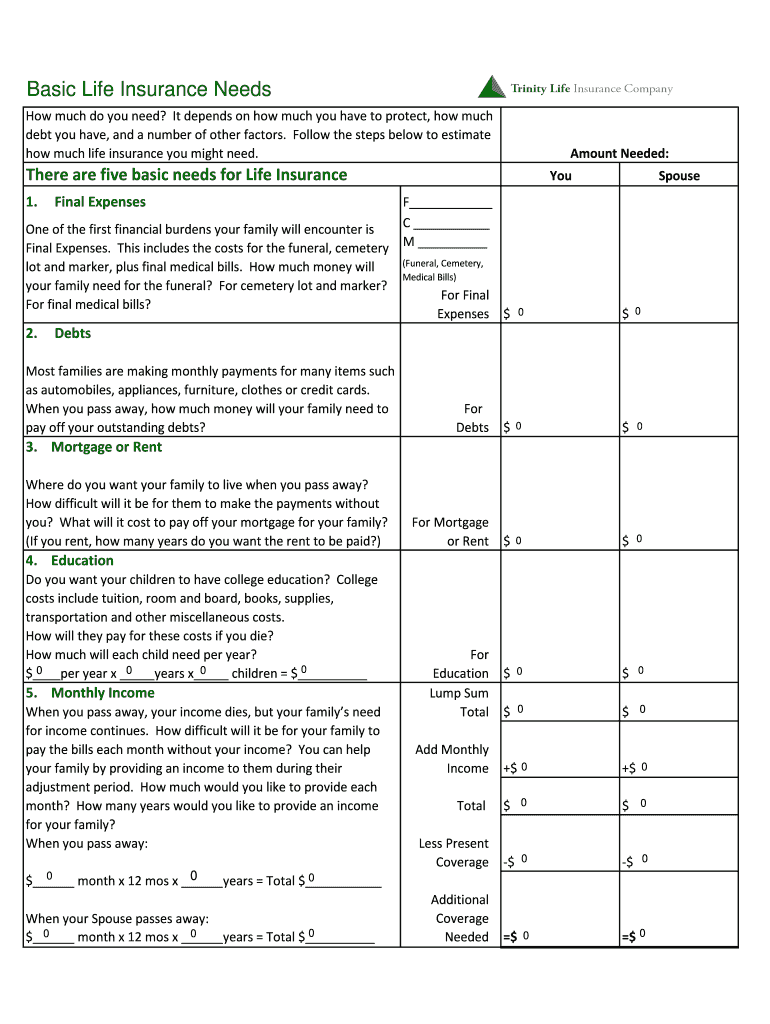

Basic Life Insurance Needs How much do you need? It depends on how much you have to protect, how much debt you have, and a number of other factors. Follow the steps below to estimate how much life

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign basic life insurance needs

Edit your basic life insurance needs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your basic life insurance needs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit basic life insurance needs online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit basic life insurance needs. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out basic life insurance needs

Point by point, here's how to fill out basic life insurance needs and who needs them:

How to fill out basic life insurance needs:

01

Assess your financial obligations: Start by determining how much money your dependents would need in the event of your death. Consider outstanding debts, daily living expenses, and future financial goals.

02

Determine the necessary coverage amount: Based on your financial obligations, calculate the appropriate coverage amount. This should be enough to support your loved ones financially and cover any outstanding debts or expenses.

03

Research different types of policies: Understand the different types of life insurance policies available, such as term life insurance or whole life insurance. Consider their features, costs, and benefits to determine the most suitable option for your needs.

04

Gather necessary documentation: To apply for life insurance, you'll typically need identification documents, financial records, and possibly medical records. Collect these documents to expedite the application process.

05

Compare insurance providers: Research various insurance companies to find one that offers competitive rates, strong financial stability, and a reputable claims process. Consider reading reviews and seeking recommendations from trusted sources.

06

Get quotes: Request quotes from multiple insurance providers based on the coverage amount and policy type you determined earlier. Compare the quotes to find the most affordable option without compromising necessary coverage.

07

Understand the policy details: Carefully read through the policy terms and conditions. Familiarize yourself with important aspects such as premium amounts, beneficiary designations, and any exclusions or limitations.

08

Fill out the application: Complete the life insurance application accurately and honestly. Pay close attention to the questions about your health and medical history, as these factors can affect your premium rates and eligibility.

09

Undergo the underwriting process: Following application submission, the insurance company will review your information. This may involve additional medical exams, lab tests, or interviews. Cooperate fully to ensure a smooth underwriting process.

10

Review and sign the policy: Once your application is approved, carefully review the policy document provided by the insurer. Confirm that the coverage, premium amount, and other details align with what was agreed upon. Sign the policy and make the initial premium payment.

Who needs basic life insurance needs?

01

Breadwinners: If you are the primary income earner in your household, life insurance can provide financial security for your dependents in case of your untimely death.

02

Parents: Life insurance is crucial for parents as it can help cover children's future educational expenses and other financial responsibilities.

03

Homeowners with mortgages: If you have a mortgage, life insurance can ensure that your loved ones can continue to afford the home if you pass away.

04

Business owners: Life insurance can help protect the financial stability of a business and provide funds for succession planning or buying out partners.

05

Individuals with debt: If you have outstanding debts like student loans or credit card bills, life insurance can prevent your loved ones from inheriting those financial burdens.

06

Those with dependents: Whether you have children, elderly parents, or other dependents who rely on your financial support, life insurance can provide for their ongoing needs.

Remember, it's essential to consult with a financial advisor or insurance professional to assess your specific needs and determine the appropriate life insurance coverage for your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit basic life insurance needs from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your basic life insurance needs into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for the basic life insurance needs in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your basic life insurance needs and you'll be done in minutes.

How do I edit basic life insurance needs straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing basic life insurance needs, you can start right away.

What is basic life insurance needs?

Basic life insurance needs refer to the amount of coverage required to provide financial protection for loved ones in the event of the policyholder's death.

Who is required to file basic life insurance needs?

Individuals who want to secure financial protection for their family or dependents are required to assess and file their basic life insurance needs.

How to fill out basic life insurance needs?

To fill out basic life insurance needs, individuals should consider factors such as their current financial obligations, future expenses, and the number of dependents they have.

What is the purpose of basic life insurance needs?

The purpose of basic life insurance needs is to ensure that loved ones are financially secure in the event of the policyholder's death, providing funds to cover expenses and maintain their quality of life.

What information must be reported on basic life insurance needs?

Information such as the policyholder's current financial situation, outstanding debts, future expenses, and number of dependents must be reported on basic life insurance needs.

Fill out your basic life insurance needs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Basic Life Insurance Needs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.