Get the free Commercial Real Estate Financing 2007

Show details

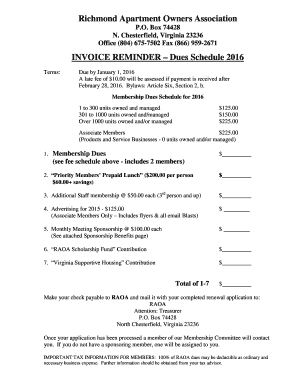

This document outlines a program focused on commercial real estate financing, detailing what borrowers and lenders need to know in 2007, including various topics on lending practices, legal considerations,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial real estate financing

Edit your commercial real estate financing form online

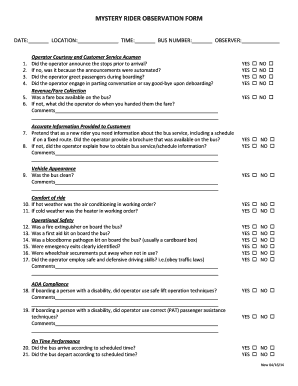

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial real estate financing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing commercial real estate financing online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit commercial real estate financing. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial real estate financing

How to fill out Commercial Real Estate Financing 2007

01

Gather all necessary financial documents including tax returns, profit and loss statements, and balance sheets.

02

Evaluate the property you are financing to determine its value and potential income.

03

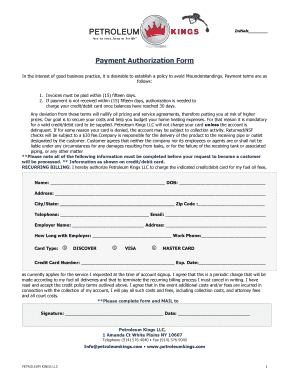

Fill out the application form with the required information, including personal and business details.

04

Provide information about the property in question, including its location, size, and current tenants.

05

Include details of your financial history, such as credit score, previous loans, and liabilities.

06

Specify the amount you are seeking to finance and the purpose of the financing.

07

Review the application for accuracy and completeness before submission.

08

Submit the application along with any required documentation to the lender.

Who needs Commercial Real Estate Financing 2007?

01

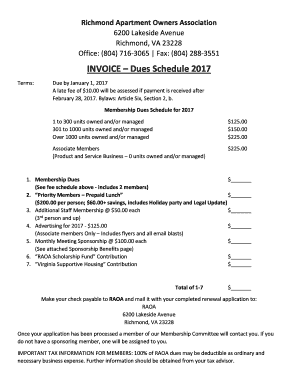

Real estate investors looking to purchase or refinance properties.

02

Property developers seeking funds for new construction projects.

03

Businesses needing to acquire commercial spaces for operations.

04

Individuals seeking to invest in rental properties for additional income.

05

Commercial property owners looking to leverage equity for growth.

Fill

form

: Try Risk Free

People Also Ask about

How did subprime mortgage loans contribute to the global financial crisis of 2007-2009?

Before the crisis, banks were issuing mortgages to subprime borrowers. As fears of these risky loans spread, credit markets froze and several banks failed, requiring government bailouts. Ensuring regulators have sufficient protection from political pressure would help to avoid such crises in future.

What led to the collapse of the housing market in the US in 2008?

The influx of new and largely unregulated subprime loans contributed to a massive bubble in the U.S. housing market. In 2008 the bubble burst in a flood of foreclosures, leading to a near collapse of the housing market.

What was the major decline of the housing sector in 2007?

As interest rates rose from 2004 to 2006, the cost of mortgages rose and the demand for housing fell; in early 2007, as more U.S. subprime mortgage holders began defaulting on their repayments, lenders went bankrupt, culminating in the bankruptcy of New Century Financial in April.

What is the maximum term for a commercial real estate loan?

The loan term is between 7 and 30 years. Conventional commercial mortgage loans given by traditional banks offer fixed and variable rates which are typically between 5% and 7%. To qualify for terms of 5 to 10 years, you would need a credit score of 660 or higher and a down payment of no less than 20%.

Which of the following factors contributed to the financial crisis of 2007-2009?

The Great Recession lasted from roughly 2007 to 2009 in the U.S., although the contagion spread around the world, affecting some economies longer. The root cause was excessive mortgage lending to borrowers who normally would not qualify for a home loan, which greatly increased risk to the lender.

What caused the market crash in 2007?

The catalysts for the GFC were falling US house prices and a rising number of borrowers unable to repay their loans. House prices in the United States peaked around mid 2006, coinciding with a rapidly rising supply of newly built houses in some areas.

What most contributed to the collapse of the housing market in 2007?

The expansion of mortgages to high-risk borrowers, coupled with rising house prices, contributed to a period of turmoil in financial markets that lasted from 2007 to 2010.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

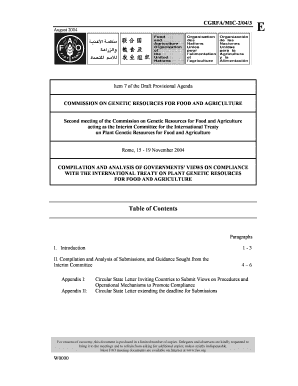

What is Commercial Real Estate Financing 2007?

Commercial Real Estate Financing 2007 refers to a specific reporting requirement in the United States for lenders and financial institutions that provide commercial real estate financing, aimed at gathering data on loans secured by commercial properties.

Who is required to file Commercial Real Estate Financing 2007?

Lenders who originate loans secured by commercial real estate are required to file the Commercial Real Estate Financing 2007 report, including banks, credit unions, and other financial institutions.

How to fill out Commercial Real Estate Financing 2007?

To fill out the Commercial Real Estate Financing 2007, the filer must complete the form with required data, including loan amounts, property types, geographic location, and borrower information, following the prescribed guidelines provided by regulatory authorities.

What is the purpose of Commercial Real Estate Financing 2007?

The purpose of Commercial Real Estate Financing 2007 is to collect data on commercial mortgage activities, enabling regulatory agencies to monitor the commercial real estate market and assess risks associated with lending practices.

What information must be reported on Commercial Real Estate Financing 2007?

The information required to be reported includes details such as the loan amount, type of property financed, terms of the loan, and demographic data of the borrower, among other relevant financial metrics.

Fill out your commercial real estate financing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Real Estate Financing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.