Get the free Application for Personal Pension

Show details

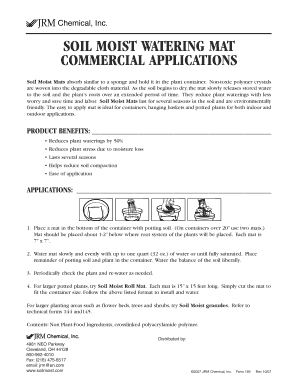

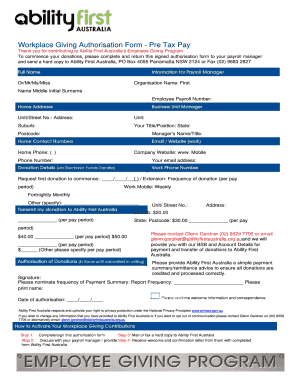

This document serves as an application form for individuals seeking to enroll in the Aviva Personal Pension scheme. It includes sections for personal details, adviser information, payment instructions,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for personal pension

Edit your application for personal pension form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for personal pension form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for personal pension online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for personal pension. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for personal pension

How to fill out Application for Personal Pension

01

Gather necessary personal information such as your full name, address, date of birth, and social security number.

02

Obtain the application form for Personal Pension, which can be downloaded from the official website or requested from the pension provider.

03

Fill out the personal information section accurately without any errors.

04

Provide details about your employment history including past employers, job titles, and duration of employment.

05

Indicate your preferred contribution amount and frequency (monthly, annually, etc.).

06

Attach any required documentation, such as proof of income or identification, as specified in the application instructions.

07

Review the completed application for any mistakes or missing information.

08

Submit the application as directed, whether online, via mail, or in person, and keep a copy for your records.

Who needs Application for Personal Pension?

01

Individuals looking to secure their retirement income through a personal pension plan.

02

People who are self-employed or do not have access to a company pension scheme.

03

Those who want more control over their retirement savings and investment choices.

04

Individuals planning for a comfortable retirement and aiming to supplement their state pension.

Fill

form

: Try Risk Free

People Also Ask about

When can I draw my personal pension in the UK?

Personal and workplace pensions. When you can take money from your pension pot will depend on your pension scheme's rules, but it's usually after you're 55. You may be able to take money out before this age if either: you're retiring early because of ill health.

How long does it take to process a State Pension claim in the UK?

Once you have applied for new State Pension you will get a letter from the Department for Work and Pensions. They will ask you for details of your bank or building society account. Your new State Pension will be paid into this account. You should get your first payment within 5 weeks of reaching State Pension age.

How do I contact the UK pension from abroad for free?

Online. You can contact the International Pension Centre (IPC) by email, using the online enquiry form. It is taking longer than usual to reply to online queries. You need to report changes to your personal details (such as your address or bank details) by telephone or letter.

Can I apply for my British pension online?

You can claim your State Pension online on GOV.UK. The service is available 24/7 and is safe and secure. Your letter from the Pension Service should include a code – you can use this to easily make a an online claim. You can call the helpdesk on 0800 169 0154 if you have any difficulty using the service.

How do I apply for my State Pension in England?

Call the Pension Service. Telephone: 0800 731 7898 Textphone: 0800 731 7339 Page 11 Page 12 The line is open Monday to Friday 8am to 6pm. Relay UK used to be known as Next Generation Text (NGT). You will get a letter from the Department for Work and Pensions to tell you how much new State Pension you will get.

How to claim British pension from abroad?

Make a claim You must be within 4 months of your State Pension age to claim. To claim your pension, you can either: contact the International Pension Centre. send the international claim form to the International Pension Centre (the address is on the form)

How do I apply for my British pension from abroad?

Make a claim You must be within 4 months of your State Pension age to claim. To claim your pension, you can either: contact the International Pension Centre. send the international claim form to the International Pension Centre (the address is on the form)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Personal Pension?

An Application for Personal Pension is a formal request submitted by individuals to establish a personal pension plan, allowing them to save for retirement and receive benefits based on their investment contributions.

Who is required to file Application for Personal Pension?

Individuals seeking to create a personal pension plan and are eligible to contribute to such plans are required to file an Application for Personal Pension.

How to fill out Application for Personal Pension?

To fill out the Application for Personal Pension, individuals need to provide personal information, employment details, contribution amounts, and any other required documentation as specified by the pension provider.

What is the purpose of Application for Personal Pension?

The purpose of the Application for Personal Pension is to initiate the process of setting up a personal pension plan that helps individuals accumulate savings for their retirement.

What information must be reported on Application for Personal Pension?

The Application for Personal Pension must report information such as personal identification details, financial status, contribution preferences, and beneficiary designations.

Fill out your application for personal pension online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Personal Pension is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.