Get the free Annual Return of Financial Information - gov mb

Show details

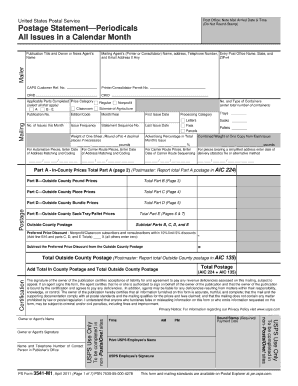

TAXICAB BMR. 209×91 SCHEDULE H (Section 55) ANNUAL RETURN OF FINANCIAL INFORMATION Re GUI r emen is 1. Part C of this annual return, the Statement of Revenue, Expenses, and Income, must be prepared

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual return of financial

Edit your annual return of financial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual return of financial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual return of financial online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit annual return of financial. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual return of financial

01

Start by gathering all the necessary financial documents, such as income statements, balance sheets, and cash flow statements. Ensure that these documents are accurate and up-to-date.

02

Review the specific requirements and guidelines for filling out the annual return of financial form. This may vary depending on your country or the governing regulatory body. Familiarize yourself with the specific sections that need to be completed.

03

Begin by filling out the basic information section of the form. This typically includes details such as the name of the company, its registered address, and the fiscal year for which the return is being filed.

04

Proceed to complete the income statement section, which details the company's revenues and expenses over the fiscal year. Include all relevant information, such as sales figures, operating costs, and any extraordinary gains or losses.

05

Move on to the balance sheet section, which provides a snapshot of the company's assets, liabilities, and shareholders' equity at the end of the fiscal year. Ensure that all assets and liabilities are accurately reported, including cash, accounts receivable, inventory, loans, and any other financial obligations.

06

Fill out the cash flow statement section, which outlines the company's cash inflows and outflows during the fiscal year. Include details such as operating activities, investing activities, and financing activities. Be sure to accurately report any cash inflows from operations, cash used for investments, and any financing activities such as issuing or repaying debt.

07

Double-check all calculations and ensure that the figures provided are accurate and in accordance with the accounting principles and regulations applicable to your company.

08

Once you have completed filling out the form, review it thoroughly to ensure that all sections are properly filled and that there are no errors or omissions.

09

Depending on the requirements of your jurisdiction or regulatory body, you may need to have the annual return of financial form audited by a qualified external auditor. If this is the case, engage the services of an auditor to review and validate your financial statements.

10

Once you are satisfied with the accuracy and completeness of the form, submit it according to the prescribed timelines and procedures. This may include filing it electronically or physically submitting it to the appropriate authorities.

Who needs annual return of financial?

01

Companies: Annual returns of financial are typically required to be filed by companies of all sizes and structures, including private limited companies, public companies, and non-profit organizations.

02

Regulatory Bodies: Government agencies and regulatory bodies often require companies to submit annual returns of financial as part of their oversight and compliance processes. These returns help ensure transparency, accountability, and proper financial management.

03

Shareholders and Investors: Annual returns of financial provide valuable information to shareholders and potential investors. These documents allow them to assess the financial health, performance, and stability of a company before making investment decisions.

04

Creditors and Lenders: Banks, financial institutions, and other creditors may request annual returns of financial to evaluate a company's creditworthiness and assess the risks associated with lending funds or extending credit.

05

Government Agencies: Government agencies, including tax authorities, may require annual returns of financial to verify income, assess tax liabilities, and enforce compliance with applicable laws and regulations.

Overall, the annual return of financial serves as an important tool for financial transparency, accountability, and compliance for various stakeholders, including companies, regulatory bodies, shareholders, investors, creditors, and government agencies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find annual return of financial?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific annual return of financial and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an eSignature for the annual return of financial in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your annual return of financial right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit annual return of financial on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign annual return of financial on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your annual return of financial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Return Of Financial is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.