Get the free Term Life Insurance

Show details

This document provides a detailed overview of the Term Life Insurance plan offered by Unum to active full-time employees of Georgetown ISD, including eligibility criteria, coverage amounts, premium

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign term life insurance

Edit your term life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your term life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing term life insurance online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit term life insurance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out term life insurance

How to fill out Term Life Insurance

01

Gather personal information such as your name, date of birth, and contact details.

02

Assess your financial needs by considering your debts, living expenses, and future financial obligations.

03

Decide on the coverage amount based on your financial responsibilities.

04

Choose the term length (10, 20, or 30 years) that suits your financial goals.

05

Research and compare different insurance providers for terms and conditions, premiums, and customer reviews.

06

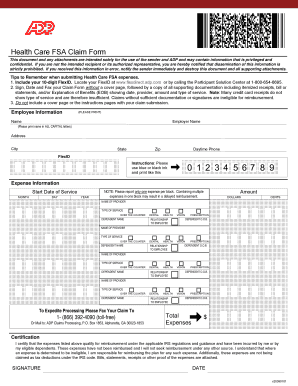

Fill out the application form, providing all necessary personal, health, and lifestyle information.

07

Undergo a medical examination if required by the insurer.

08

Review the policy details once approved, ensuring all information is accurate.

09

Pay the first premium to activate the policy.

10

Keep a copy of the policy documents for your records.

Who needs Term Life Insurance?

01

Individuals with dependents who rely on their income, such as spouses or children.

02

Homeowners with a mortgage who want to ensure their family's home is paid off.

03

People with outstanding debts such as loans or credit cards.

04

Parents wanting to cover education costs for their children.

05

Business owners who need to cover business debts or provide for business partners.

06

Anyone wanting to leave a financial legacy for their loved ones.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of term life insurance?

Choosing between term and whole life insurance comes down to how long you want coverage and how much you can afford. Term life is more affordable but lasts only for a set period of time. On the other hand, whole life insurance tends to have higher premiums but never expires.

Do you get your money back at the end of a term life insurance?

If you outlive your term (let's hope this is the case), then typically one of two things happens: The policy will simply end, and you'll no longer owe payments or be covered, or. The insurer might allow you to keep your coverage by converting all or a portion of the policy into permanent life insurance.

What is the term life insurance?

Term life insurance is a temporary policy that can provide you with coverage ranging from 10 to 30 years. If the policyholder passes away while a term life insurance plan is active, loved ones will receive a death benefit to replace lost income, pay off debts, and more.

Do you get money back at the end of term life insurance?

The Bottom Line Term life insurance can help protect your family from the risk of surviving without your income. That's the benefit of your policy. Even if it never pays out, you've reduced the financial risk to your loved ones.

What is the main disadvantage of term life insurance?

Term Life insurance Cons: If you outlive the term length, your coverage will end and you won't receive any benefits. You will not be covered your entire lifetime and your policy will not accumulate cash value like an investment account does.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Term Life Insurance?

Term life insurance is a type of life insurance policy that provides coverage for a specified term or period, typically ranging from 10 to 30 years. If the insured individual passes away during this term, the beneficiaries receive a death benefit, but if the policyholder survives the term, the coverage expires without any payout.

Who is required to file Term Life Insurance?

Generally, individuals who want to secure financial protection for their dependents or beneficiaries in the event of their death may choose to purchase term life insurance. There are no specific legal requirements mandating individuals to file for term life insurance; however, it is advisable for those with financial obligations or dependents to consider it.

How to fill out Term Life Insurance?

To fill out a term life insurance application, you typically need to provide personal information such as your name, address, and contact information, as well as details regarding your health history, lifestyle, occupation, and the amount of coverage desired. It may also require you to answer questions about your family's health history and undergo a medical examination.

What is the purpose of Term Life Insurance?

The purpose of term life insurance is to provide financial protection for dependents by ensuring that they receive a death benefit if the policyholder passes away during the policy term. This can help cover living expenses, debts, education costs, and other financial obligations.

What information must be reported on Term Life Insurance?

When applying for term life insurance, you must report personal information such as age, gender, and health status, including any pre-existing conditions, smoking habits, and lifestyle choices. You may also need to provide information about your occupation and potentially a family medical history.

Fill out your term life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Term Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.