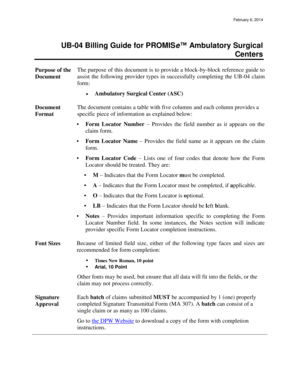

Get the free Long-Term Disability Income Insurance

Show details

This document provides detailed information about the Long-Term Disability Income Insurance plan offered by American Fidelity Assurance Company, specifically designed for Lamar CISD employees. It

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long-term disability income insurance

Edit your long-term disability income insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long-term disability income insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit long-term disability income insurance online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit long-term disability income insurance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long-term disability income insurance

How to fill out Long-Term Disability Income Insurance

01

Gather necessary documents, including personal identification and employment information.

02

Review your employer's Long-Term Disability Income Insurance policy details.

03

Complete the application form with accurate personal and employment information.

04

Provide medical documentation to support your claim, detailing your condition and its impact on your ability to work.

05

Submit the application and any required documents to the insurance provider.

06

Follow up with the insurance company to confirm receipt and check the status of your application.

07

Respond promptly to any requests for additional information from the insurer.

Who needs Long-Term Disability Income Insurance?

01

Individuals with jobs that involve physical or mental strain.

02

People in high-risk occupations or industries prone to injuries.

03

Those with a history of health issues that could affect their ability to work.

04

Employees without sufficient savings to cover long-term expenses in case of disability.

05

Anyone wanting to secure their income in the event of a serious illness or injury.

Fill

form

: Try Risk Free

People Also Ask about

Is disability income insurance worth it?

Your most valuable asset isn't your house, car or retirement account. It's the ability to make a living. Disability insurance pays a portion of your income if you can't work for an extended period because of an illness or injury. It's worth looking into if you rely on a paycheck for everyday and recurring expenses.

Is it worth buying long-term disability insurance?

Long-term disability is a good choice for most people because it reduces the risk of financial setbacks if you become disabled. If you don't have coverage, that period with no income could make it hard to pay bills, support your family, and save for retirement.

What is the long term disability insurance policy?

Long-Term Disability (LTD) can be used following Short-Term Disability (STD) plans or alone. Long-Term Disability coverage provides wage replacement that is between 50-70% percent of your earnings before a non-work-related injury or illness that impacts your ability to work.

Can I purchase long-term disability insurance?

Individual disability insurance This is typically a long term disability policy you purchase for yourself, so you can tailor it to your needs. As it's usually paid for with after-tax dollars, the replacement income it provides is also tax-free.

How much should long-term disability insurance cost?

As a general rule of thumb, an individual long term disability insurance costs about 1% to 3% of your annual salary. This chart below gives you an idea of approximately what you could expect to pay for your disability insurance based on your earnings.

Can I buy my own long-term disability insurance?

You can also buy individual coverage. An employer long-term disability insurance plan will likely limit your options. Buying your own individual long-term policy means you get to choose the elimination period and benefit period.

How much do most long-term disability insurance plans pay?

Long-term disability insurance usually pays you between 60-80% of your gross income for the length of your benefit period. Your benefit period can be as short as two years, or it can go all the way to retirement (or until you recover from being disabled), depending on the policy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Long-Term Disability Income Insurance?

Long-Term Disability Income Insurance is a type of insurance that provides income protection to individuals who become unable to work due to a long-term illness or injury.

Who is required to file Long-Term Disability Income Insurance?

Typically, individuals who are covered by a long-term disability plan provided by their employer or have purchased a personal long-term disability policy are required to file claims to receive benefits.

How to fill out Long-Term Disability Income Insurance?

To fill out a Long-Term Disability Income Insurance claim, individuals must complete the claim form provided by the insurance company, provide detailed information about their condition, treatment, and how it impairs their ability to work, and submit any required medical documentation.

What is the purpose of Long-Term Disability Income Insurance?

The purpose of Long-Term Disability Income Insurance is to provide financial support to individuals who cannot work due to a prolonged disability, helping them cover living expenses and maintain their quality of life.

What information must be reported on Long-Term Disability Income Insurance?

Information that must be reported includes personal identification details, employment history, medical diagnosis and details about the disability, treatment received, current medications, and any other relevant medical records.

Fill out your long-term disability income insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long-Term Disability Income Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.