Get the free A mutual fund (fonds voor gemene rekening) under the laws of The Netherlands

Show details

A mutual fund (finds poor gene evening) under the laws of The Netherlands Subscription Form Commodity Discovery Fund Dear Administrator, We are pleased to confirm our subscription application through

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a mutual fund fonds

Edit your a mutual fund fonds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a mutual fund fonds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing a mutual fund fonds online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit a mutual fund fonds. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a mutual fund fonds

How to fill out a mutual fund fonds?

01

Research: Start by researching different mutual fund options and understanding their investment objectives, risk levels, and historical performance. This will help you narrow down the funds that align with your investment goals.

02

Determine your risk tolerance: Assess your risk tolerance by considering factors such as your investment knowledge, time horizon, and financial goals. This will help you choose funds that match your comfort level with risk.

03

Set investment goals: Determine your investment goals, whether it's saving for retirement, buying a house, or funding your child's education. Your goals will shape your investment strategy and help you choose the appropriate mutual funds.

04

Select the right fund(s): Based on your research and risk tolerance, choose the mutual fund(s) that align with your investment goals. Look for funds with a strong track record, experienced fund managers, and a diversified portfolio.

05

Understand the fees and expenses: Mutual funds come with fees and expenses, such as management fees and sales charges. Make sure you understand these costs before investing to avoid any surprises and ensure they align with your investment strategy.

06

Complete the application: Fill out the mutual fund application form provided by the fund company. Provide accurate and complete information, including personal details, investment amount, and account type (e.g., individual, joint, retirement account).

07

Set up a payment method: Choose how you will fund your mutual fund investment, whether through a lump sum payment or periodic contributions. Set up automatic investments if you want to regularly add to your fund.

08

Review and sign the documents: Carefully review all the documents provided, including the prospectus and any additional disclosures. Ensure you understand the terms and conditions before signing them.

09

Submit the application: Send the completed application and any required supporting documents to the mutual fund company. Follow the instructions provided by the company for submission.

10

Monitor and review your investment: Once your mutual fund investment is set up, regularly monitor its performance and review your investment strategy. Make adjustments as needed to stay on track with your goals.

Who needs a mutual fund fonds?

01

Individuals looking for diversification: Mutual funds offer investors access to a diversified portfolio of stocks, bonds, or other assets. This diversification helps reduce the risk associated with investing in a single security.

02

Investors seeking professional management: Mutual funds are typically managed by experienced professionals who make investment decisions on behalf of the fund. This relieves investors from the need to actively manage their investments.

03

Those with limited investment knowledge: Mutual funds provide an opportunity for individuals with limited investment knowledge to participate in the financial markets. The fund managers handle the complexities of investing, making it easier for investors.

04

Investors with different risk profiles: Mutual funds offer a range of investment options to suit different risk tolerance levels. Whether you are a conservative investor seeking stable income or an aggressive investor looking for high returns, there are mutual funds designed to meet your needs.

05

Individuals with long-term investment goals: Mutual funds are well-suited for individuals with long-term investment goals, such as retirement planning or saving for a child's education. The ability to regularly contribute to the fund helps build wealth over time.

06

Those seeking liquidity: Mutual funds provide investors with the opportunity to easily buy or sell their shares. This liquidity makes them a suitable investment option for individuals who may need access to their money in the short term.

07

Investors looking for transparency: Mutual funds are required to disclose information about their holdings, performance, and fees. This transparency allows investors to make informed decisions based on the fund's track record and strategy.

08

Individuals seeking convenience: Investing in mutual funds is relatively simple and convenient. Investors can access their funds online, receive regular statements, and benefit from professional management without the need for extensive research and analysis.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit a mutual fund fonds from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your a mutual fund fonds into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make edits in a mutual fund fonds without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your a mutual fund fonds, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I complete a mutual fund fonds on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your a mutual fund fonds. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is a mutual fund fonds?

A mutual fund fonds is an investment vehicle that pools money from different investors to purchase a diversified portfolio of securities.

Who is required to file a mutual fund fonds?

Mutual fund fonds are required to be filed by the fund manager or the company responsible for managing the fund.

How to fill out a mutual fund fonds?

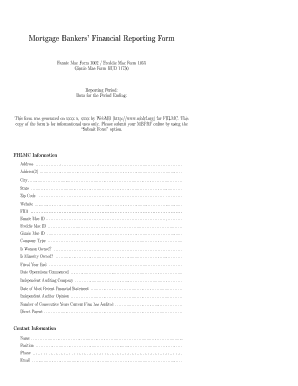

To fill out a mutual fund fonds, the fund manager or company must provide detailed information about the fund's investments, performance, and operations.

What is the purpose of a mutual fund fonds?

The purpose of a mutual fund fonds is to provide investors with a way to invest in a diversified portfolio of securities without having to directly manage their investments.

What information must be reported on a mutual fund fonds?

Information that must be reported on a mutual fund fonds includes the fund's holdings, performance, fees, and expenses.

Fill out your a mutual fund fonds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A Mutual Fund Fonds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.