Get the free Traditional IRA Account Application - Epiphany Funds

Show details

IRA

Individual Retirement Account

How to Establish Your IRA Plan

Please carefully review the Prospectus for the Epiphany Funds as well as the Custodial Agreement,

Disclosure Statement, and the Financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign traditional ira account application

Edit your traditional ira account application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your traditional ira account application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

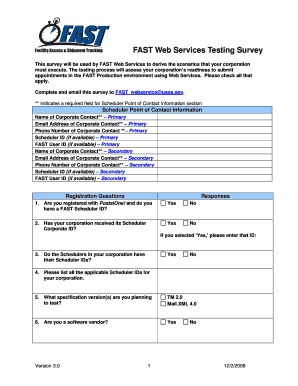

Editing traditional ira account application online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit traditional ira account application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out traditional ira account application

Question:

How to fill out a traditional IRA account application? Who needs a traditional IRA account application?

Steps to fill out a traditional IRA account application:

Gather necessary documents:

01

Social Security number

02

Valid identification (e.g., driver's license, passport)

03

Employment information

04

Financial information (e.g., tax returns, current retirement accounts)

Obtain the traditional IRA account application:

01

Contact a financial institution or brokerage firm that offers traditional IRA accounts.

02

Request an application form, which can often be downloaded from their website or sent by mail.

Provide personal information:

01

Fill out the required fields on the application form, including your full name, address, and contact information.

02

Enter your Social Security number and date of birth.

Select the type of traditional IRA account:

01

Determine whether you want a traditional deductible IRA or a traditional nondeductible IRA.

02

Consider consulting a financial advisor to help you understand the difference and choose the best option for your financial situation.

Provide employment information:

01

Enter your current or most recent employer's name, address, and contact information.

02

Include details about your occupation and annual income.

Disclose financial information:

01

Indicate whether you currently have any other retirement accounts.

02

Specify the value of your assets and investments.

03

Provide information about your financial goals and risk tolerance, if requested.

Review and sign the application:

01

Carefully read through the entire application form to ensure accuracy.

02

Check for any missing information or errors.

03

Sign and date the application form to certify its authenticity.

Who needs a traditional IRA account application?

Individuals planning for retirement:

01

A traditional IRA account can be an excellent tool for saving for retirement.

02

People who are looking to supplement their other retirement savings, such as employer-sponsored plans, may find a traditional IRA beneficial.

Those wanting tax advantages:

01

Traditional deductible IRA contributions may be tax-deductible, potentially lowering annual taxable income.

02

Earnings in a traditional IRA grow tax-deferred until withdrawal, allowing for potential tax savings over time.

Individuals interested in long-term financial security:

By contributing to a traditional IRA account, individuals can build a retirement nest egg that can help provide financial stability during their retirement years.

Those seeking investment opportunities:

01

Traditional IRA accounts allow individuals to invest in a variety of assets, such as stocks, bonds, mutual funds, and more.

02

The flexibility of investment options can help individuals tailor their portfolio to meet their specific financial goals.

Please note that it's always advisable to consult with a financial advisor or tax professional to understand the specific rules, regulations, and implications of opening and maintaining a traditional IRA account based on your unique financial circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in traditional ira account application?

The editing procedure is simple with pdfFiller. Open your traditional ira account application in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit traditional ira account application straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing traditional ira account application.

Can I edit traditional ira account application on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share traditional ira account application on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is traditional ira account application?

Traditional IRA account application is a form used to open a traditional Individual Retirement Account (IRA) with a financial institution.

Who is required to file traditional ira account application?

Individuals who want to open a traditional IRA account are required to file the application.

How to fill out traditional ira account application?

To fill out a traditional IRA account application, you need to provide personal information, select investment options, and sign the form.

What is the purpose of traditional ira account application?

The purpose of a traditional IRA account application is to establish a tax-advantaged retirement savings account for individuals.

What information must be reported on traditional ira account application?

Information such as name, address, social security number, beneficiary information, and investment selections must be reported on a traditional IRA account application.

Fill out your traditional ira account application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Traditional Ira Account Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.