Get the free Commercial Surety Short Form - Revised - June 2012 - Regina - westernsurety

Show details

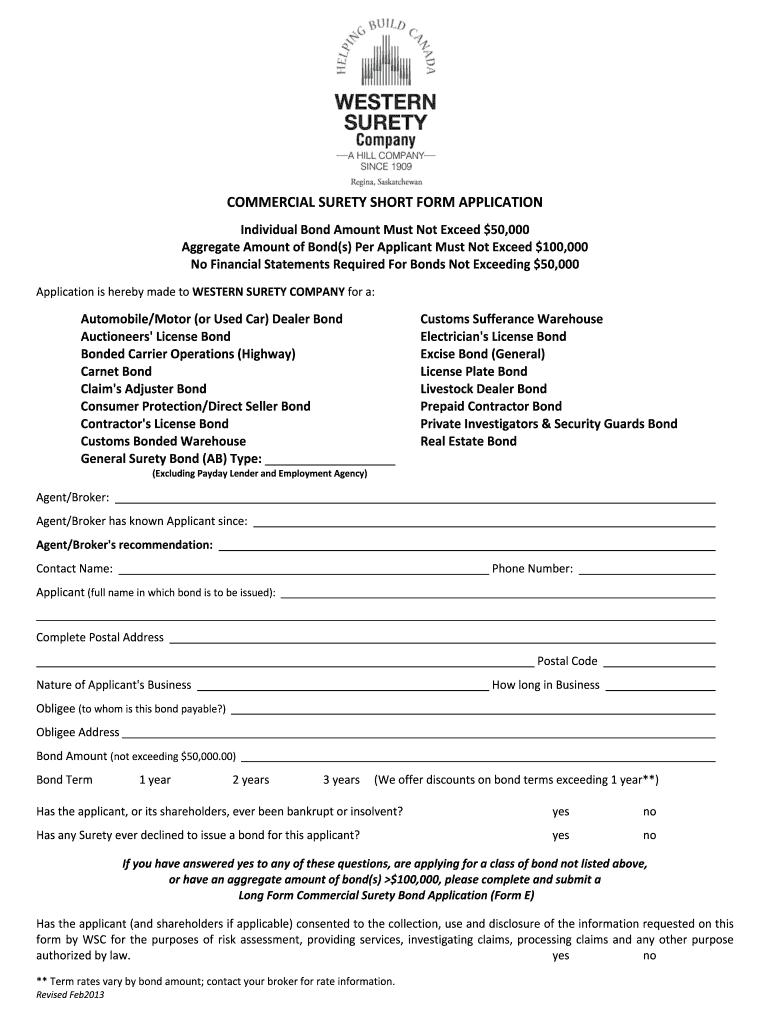

COMMERCIAL SURETY SHORT FORM APPLICATION Individual Bond Amount Must Not Exceed $50,000 Aggregate Amounts of Bond’s) Per Applicant Must Not Exceed $100,000 No Financial Statements Required For Bonds

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial surety short form

Edit your commercial surety short form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial surety short form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit commercial surety short form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit commercial surety short form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial surety short form

How to fill out commercial surety short form:

01

Start by gathering all the necessary information, such as the name and address of the principal (person or company), as well as the name and address of the obligee (the party who requires the surety).

02

Identify the type of surety bond required and locate the corresponding form for the commercial surety short form. This form can typically be obtained from the obligee or a reputable surety bond provider.

03

Carefully read and understand the instructions provided on the form. Familiarize yourself with the required fields and any specific instructions for completion.

04

Begin filling out the form by entering the requested information. This may include the bond amount, the contract or agreement details, and any other pertinent information specific to the bond.

05

Double-check all the information you have entered for accuracy and completeness. Ensure that you have provided all the necessary supporting documentation, if required (such as financial statements or indemnity agreements).

06

Review the form one more time to make sure you have not missed anything. Verify that all fields have been completed properly and that all necessary signatures and dates have been included.

07

Submit the completed commercial surety short form to the appropriate party. This may involve sending it to the obligee, a surety bond provider, or other relevant entities, depending on the instructions provided.

08

Keep a copy of the completed form and any supporting documents for your records.

Who needs commercial surety short form?

01

Contractors: Contractors often need to obtain commercial surety bonds as a requirement for bidding on public or private construction projects. These bonds provide financial protection to project owners and ensure that contractors fulfill their contractual obligations.

02

Business Owners: Business owners may require commercial surety bonds to satisfy licensing or permit requirements imposed by local, state, or federal government agencies. These bonds help guarantee compliance with applicable regulations and protect consumers.

03

Freight Brokers: Freight brokers who arrange transportation of goods for shippers may need commercial surety bonds. These bonds serve as a form of insurance, ensuring that brokers fulfill their financial obligations to carriers and shippers.

04

Notaries: Notaries public may need to obtain a commercial surety bond as a prerequisite for receiving their commission. This bond provides financial protection to the public in case the notary commits negligence or fraud in the performance of their duties.

05

Auto Dealers: Auto dealers are often required to carry commercial surety bonds. These bonds protect consumers by providing a financial safety net for any financial loss resulting from fraudulent or deceptive practices of the dealer.

06

Medicaid Providers: Medicaid providers may be required to obtain commercial surety bonds to comply with state-specific regulations. These bonds ensure that providers meet their financial obligations related to the provision of Medicaid services.

07

Mortgage Brokers: In many states, mortgage brokers must obtain commercial surety bonds as part of their licensing requirements. These bonds protect borrowers and provide recourse in case of any financial misconduct by the broker.

08

Appraisers: Real estate appraisers are often required to hold a commercial surety bond to protect consumers and provide compensation for any errors or omissions committed during the appraisal process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the commercial surety short form electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your commercial surety short form in seconds.

How do I complete commercial surety short form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your commercial surety short form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I complete commercial surety short form on an Android device?

On Android, use the pdfFiller mobile app to finish your commercial surety short form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is commercial surety short form?

The commercial surety short form is a document used to provide a guarantee of performance or payment for commercial transactions.

Who is required to file commercial surety short form?

Any party involved in a commercial transaction that requires a guarantee of performance or payment may be required to file a commercial surety short form.

How to fill out commercial surety short form?

The commercial surety short form can be filled out by providing the required information about the commercial transaction, the parties involved, and the surety provider.

What is the purpose of commercial surety short form?

The purpose of the commercial surety short form is to provide a guarantee of performance or payment for commercial transactions, ensuring that all parties fulfill their obligations.

What information must be reported on commercial surety short form?

The commercial surety short form must include details about the commercial transaction, the parties involved, the amount of the surety, and the terms of the guarantee.

Fill out your commercial surety short form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Surety Short Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.