Get the free PROMISSORY NOTE & INSTALLMENT AGREEMENT

Show details

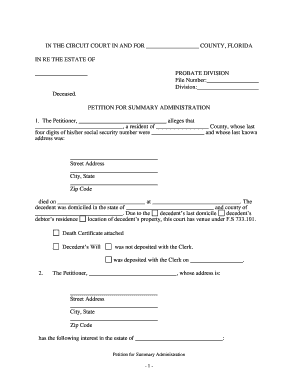

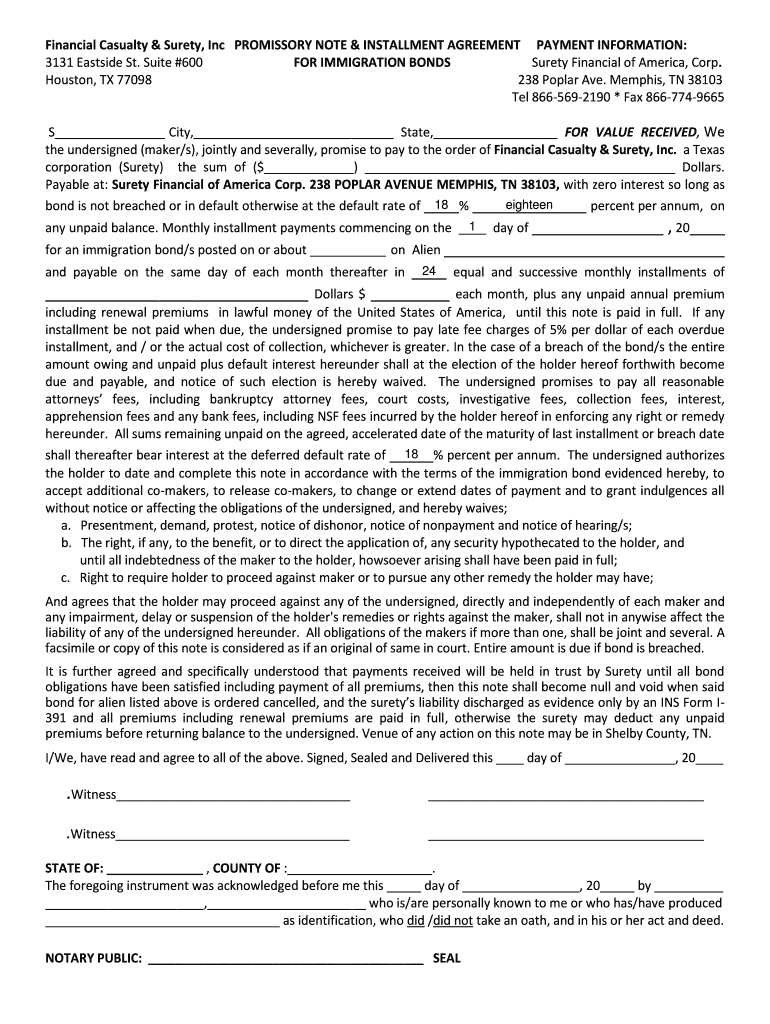

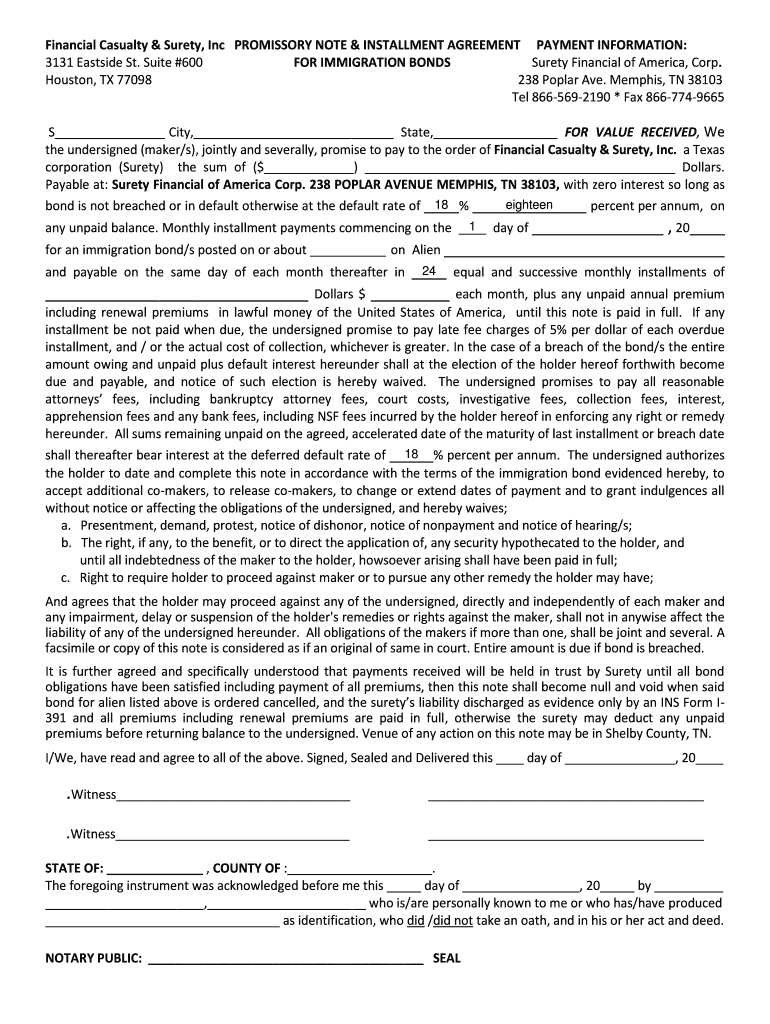

This document serves as a promissory note and installment agreement for immigration bonds, detailing the payment structure, penalties for late payments, and obligations related to the bond.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign promissory note installment agreement

Edit your promissory note installment agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your promissory note installment agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing promissory note installment agreement online

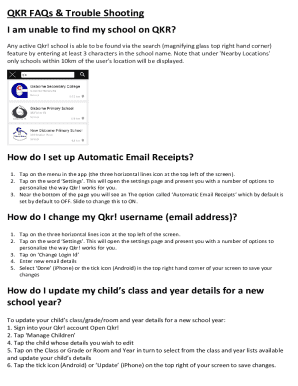

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit promissory note installment agreement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out promissory note installment agreement

How to fill out PROMISSORY NOTE & INSTALLMENT AGREEMENT

01

Identify the parties involved in the agreement and include their full names and addresses.

02

State the principal amount being borrowed.

03

Specify the interest rate on the loan, if applicable.

04

Outline the repayment schedule including payment amounts and due dates.

05

Include any late fees or penalties for missed payments.

06

Mention any collateral if the loan is secured.

07

Specify the governing law and jurisdiction for the agreement.

08

Provide space for signatures of all parties involved.

Who needs PROMISSORY NOTE & INSTALLMENT AGREEMENT?

01

Individuals taking a loan from a friend or family member.

02

Small businesses seeking to formalize a loan agreement with an investor or lender.

03

Borrowers who want to ensure the terms of repayment are clear and enforceable.

04

Lenders who want to protect their investment by having a documented agreement.

Fill

form

: Try Risk Free

People Also Ask about

Is an installment note the same as a promissory note?

Some promissory notes require the payment of the full amount owed, plus interest, on a certain date. If the promissory note requires that periodic payments be made, such as quarterly, monthly, or even weekly, it is called an installment promissory note.

What is another name for a promissory note?

In common speech, other terms, such as "loan", "loan agreement", and "loan contract" may be used interchangeably with "promissory note". The term "loan contract" is often used to describe a contract that is lengthy and detailed.

What is the difference between a promissory note and an agreement?

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

What is the main purpose of a promissory note?

The main purpose of a promissory note is to serve as a legally binding written promise to repay a specified sum, providing clarity and security in financial transactions.

What is the difference between a note and a promissory note?

While all mortgage notes are promissory notes, not all promissory notes are mortgage notes. A promissory note is a legally binding, written promise from a borrower to repay a loan to their lender. A mortgage note is a document that outlines the terms of a mortgage.

What is the difference between installment and promissory note?

Some promissory notes require the payment of the full amount owed, plus interest, on a certain date. If the promissory note requires that periodic payments be made, such as quarterly, monthly, or even weekly, it is called an installment promissory note.

What's the difference between promissory notes and loans?

Promissory notes are more suited to smaller, informal, and unsecured lending, whereas loan agreements are better for complicated situations involving more significant sums of money. However, occasionally, lenders and borrowers may wish to include both a promissory note and a loan agreement.

Which is better, a promissory note or a loan agreement?

In most cases, only one of these will be necessary. Promissory notes are more suited to smaller, informal, and unsecured lending, whereas loan agreements are better for complicated situations involving more significant sums of money.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PROMISSORY NOTE & INSTALLMENT AGREEMENT?

A promissory note is a written promise to pay a specified amount of money to a certain person or bearer at a specified time or on demand. An installment agreement, on the other hand, is a contract that outlines the terms for repayment of a loan or debt in regular, scheduled payments.

Who is required to file PROMISSORY NOTE & INSTALLMENT AGREEMENT?

Typically, individuals or businesses engaging in a loan or financing arrangement, where one party agrees to pay the other over time, are required to file a promissory note and installment agreement.

How to fill out PROMISSORY NOTE & INSTALLMENT AGREEMENT?

To fill out a promissory note and installment agreement, parties should provide information such as the names and addresses of both the borrower and lender, the loan amount, interest rate, repayment terms, due dates, and any other relevant terms or conditions of the loan.

What is the purpose of PROMISSORY NOTE & INSTALLMENT AGREEMENT?

The purpose of a promissory note and installment agreement is to create a legally binding document that lays out the terms of a loan or debt repayment, protecting the rights of both the lender and the borrower.

What information must be reported on PROMISSORY NOTE & INSTALLMENT AGREEMENT?

The information that should be reported on a promissory note and installment agreement includes the names of the parties involved, the principal amount, interest rate, repayment schedule, total repayment amount, any penalties for late payments, and a signature from both parties.

Fill out your promissory note installment agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Promissory Note Installment Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.