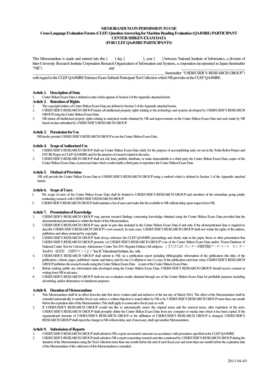

Get the free Research expense tax credit worksheet for tax year 2015 36 mrs bb

Show details

RESEARCH EXPENSE TAX CREDIT. WORKSHEET FOR TAX YEAR 2015. 36 M.R.S. 5219-K. TAXPAYER NAME: ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign research expense tax credit

Edit your research expense tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your research expense tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing research expense tax credit online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit research expense tax credit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out research expense tax credit

Answer 1:

To fill out the research expense tax credit, follow these steps:

01

Organize and gather all necessary documentation, such as receipts, invoices, and financial records related to your research expenses.

02

Determine if you meet the eligibility criteria for claiming the research expense tax credit. This could include being engaged in qualified research activities, having qualified research expenses, or meeting specific industry or business requirements.

03

Consult with a tax professional or accountant to ensure you understand the specific rules and regulations related to the research expense tax credit. They can guide you through the process and help maximize your eligible deductions.

04

Complete the appropriate tax forms, such as Form 6765 - Credit for Increasing Research Activities, or any other forms as required by your country's tax authority.

05

Provide accurate and detailed information about your research expenses, including the nature of the research, the amount spent, and any supporting documentation requested on the tax forms.

06

Double-check and review your completed tax forms for any errors or omissions before submitting them. It's essential to ensure the accuracy of your information to avoid any potential penalties or audits.

Answer 2:

The research expense tax credit is beneficial for various individuals or entities, including:

01

Small businesses or startups engaged in research and development activities. This credit can incentivize innovation and provide financial support to companies investing in research.

02

Scientists, researchers, and engineers conducting qualified research activities. This credit can help offset the high costs associated with research and encourage further advancements in various fields.

03

Universities, research institutions, and non-profit organizations involved in research projects. The research expense tax credit can assist these entities in funding their scientific studies and technological advancements.

04

Industries or sectors that heavily rely on research and development, such as pharmaceutical, technology, aerospace, or biotech industries. These sectors can benefit from the tax credit to encourage further investment in innovative projects.

05

Governments may also offer this tax credit to attract businesses or promote research and development within their jurisdictions, thereby stimulating economic growth and competitiveness.

Overall, the research expense tax credit is designed to support and encourage research activities across different sectors, benefiting individuals, businesses, and the overall economy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in research expense tax credit without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing research expense tax credit and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit research expense tax credit on an Android device?

You can make any changes to PDF files, such as research expense tax credit, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I complete research expense tax credit on an Android device?

On an Android device, use the pdfFiller mobile app to finish your research expense tax credit. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is research expense tax credit?

Research expense tax credit is a tax credit that allows businesses to claim a portion of their research and development expenses as a credit against their tax liability.

Who is required to file research expense tax credit?

Businesses that have incurred research and development expenses during the tax year are required to file research expense tax credit.

How to fill out research expense tax credit?

To fill out research expense tax credit, businesses need to provide detailed information about their research and development expenses, including the amount spent and the nature of the activities.

What is the purpose of research expense tax credit?

The purpose of research expense tax credit is to incentivize businesses to invest in research and development activities by providing them with a tax credit for a portion of their expenses.

What information must be reported on research expense tax credit?

Businesses must report detailed information about their research and development expenses, including the amount spent, the activities conducted, and the impact of the research on their business.

Fill out your research expense tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Research Expense Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.