Get the free ABN 25 541 678 478 Tax Invoice Payment Form Conflict - aeusa asn

Show details

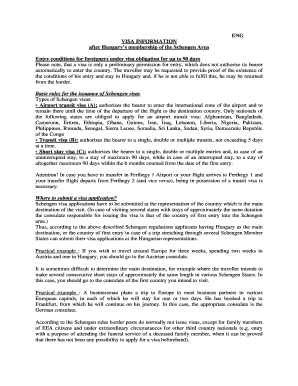

Australian Education Union (SA Branch) ABN: 25 541 678 478 Tax Invoice / Payment Form Conflict Resolution Through Mediation over 3 days, from Wednesday 20 Friday 22 July 2011 Time 9.15am 4.00pm Venue

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign abn 25 541 678

Edit your abn 25 541 678 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your abn 25 541 678 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit abn 25 541 678 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit abn 25 541 678. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out abn 25 541 678

How to fill out abn 25 541 678:

01

Begin by accessing the official Australian Business Register (ABR) website.

02

Click on the "Apply for an ABN" option on the website's homepage.

03

You will be directed to a page where you need to select the entity type. Choose the appropriate option that aligns with your business structure, such as sole trader, partnership, company, trust, or other organization types.

04

Next, enter the necessary personal and business details as requested on the application form. This typically includes the legal name, trading name, business address, contact information, and your Tax File Number or exemption details.

05

Provide accurate and up-to-date information to ensure a smooth application process. Double-check all details for errors or typos before proceeding.

06

Select the reasons for applying for an ABN. This could include starting a new business, taking over an existing business, or changing the structure of an existing business.

07

Depending on your business type, you may need to provide additional information or documents. For example, if you are a partnership, you may need details of all partners involved.

08

After reviewing and confirming all the information provided, submit your application.

09

You will receive a confirmation message that your application has been received and is being processed. You will also be provided with a reference number for future correspondence.

Who needs abn 25 541 678:

01

Business Owners: Anyone starting a new business or taking over an existing business in Australia generally needs an ABN. This unique identifier allows you to conduct business legally and is required for various activities like invoicing, tax reporting, and claiming credits.

02

Self-employed Individuals: Sole traders and freelancers who work for themselves and provide services to clients usually require an ABN. It helps differentiate personal income from business income and enables tax obligations to be fulfilled correctly.

03

Partnerships: If you are entering into a partnership with one or more individuals to operate a business, obtaining an ABN is necessary. This allows the partnership to be identified as a separate entity for tax purposes.

04

Companies: Registered companies in Australia must obtain an ABN. It is an essential requirement for conducting business activities, managing taxation, and complying with various legal obligations.

05

Trusts: Trusts that are involved in business operations or receive income need an ABN. This includes family trusts, discretionary trusts, or unit trusts.

In summary, anyone planning to start or operate a business in Australia, regardless of the business structure, generally needs an ABN. It is an important aspect of managing taxation, invoicing, and other legal requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my abn 25 541 678 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your abn 25 541 678 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I edit abn 25 541 678 on an Android device?

You can edit, sign, and distribute abn 25 541 678 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I fill out abn 25 541 678 on an Android device?

Use the pdfFiller mobile app to complete your abn 25 541 678 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is abn 25 541 678?

ABN 25 541 678 is an Australian Business Number (ABN) issued to a specific business entity.

Who is required to file abn 25 541 678?

Any business entity operating in Australia and earning income is required to have an ABN and file it as per the regulations.

How to fill out abn 25 541 678?

ABN 25 541 678 can be filled out online through the Australian Business Register (ABR) website or manually by submitting the relevant forms.

What is the purpose of abn 25 541 678?

The purpose of ABN 25 541 678 is to uniquely identify a business entity for tax and other business purposes in Australia.

What information must be reported on abn 25 541 678?

ABN 25 541 678 requires basic information about the business entity such as business name, address, contact details, and nature of business.

Fill out your abn 25 541 678 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Abn 25 541 678 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.