NY NYCERS F302 2013 free printable template

Show details

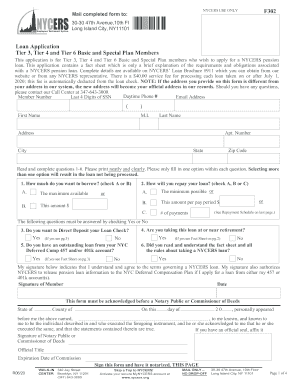

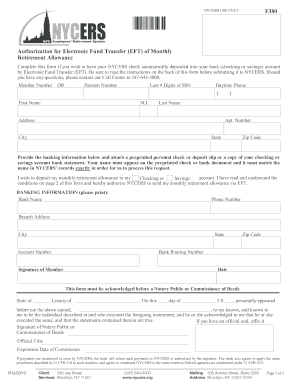

F302 NYCERS USE ONLY Loan Application Tier 3 Tier 4 and Tier 6 Basic and Special Plan Members This application is for Tier 3 Tier 4 and Tier 6 Basic and Special Plan members who wish to apply for a NYCERS pension loan. This application contains a fact sheet which is only a brief explanation of the requirements and obligations associated with a NYCERS pension loan. Complete details are available on NYCERS Loan Brochure 911 which you can obtain from our website or from any NYCERS...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY NYCERS F302

Edit your NY NYCERS F302 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY NYCERS F302 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY NYCERS F302 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY NYCERS F302. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY NYCERS F302 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY NYCERS F302

How to fill out NY NYCERS F302

01

Obtain the NY NYCERS F302 form from the NYCERS website or your employer.

02

Read the instructions carefully to understand the requirements.

03

Fill out your personal information in the designated fields, including your name, address, and employee identification number.

04

Provide details about your employment history with relevant dates and positions held.

05

If applicable, indicate any prior service credit you may have.

06

Review the information for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the completed form to the appropriate NYCERS office, either in person or via mail.

Who needs NY NYCERS F302?

01

Employees who are members of the New York City Employees Retirement System (NYCERS) and need to report service credit or other information for retirement calculations.

02

Individuals who are applying for pensions or other benefits associated with their employment history within NYCERS.

Instructions and Help about NY NYCERS F302

Fill

form

: Try Risk Free

People Also Ask about

Can you borrow money from pension fund?

Pension loans are legally allowed in many cases, but plan sponsors determine whether they're allowed. If your employer does allow loans, it will likely be limited to a percentage of the balance up to a fixed amount.

How much pension loan can I get?

Maximum Loan Amount: Age up to 70 years: Rs. 10 lakh or 18 times of Net Monthly Pension (For Defence pensioners, 20 times net monthly pension), whichever is lower. Age above 70 years and up to 75 years: Rs 7.50 lakh or 18 times their Net Monthly Pension (20 times in case of Defence Pensioners), whichever is lower.

Who is eligible for NYCERS?

Generally, NYCERS membership is open to all employees of the City of New York and Participating Employers except those who are eligible for membership in the Police or Fire Department pension fund, or the Teachers or Board of Education retirement system.

How long does it take to process a NYCERS loan?

Once you submit your application, NYCERS will process it in approximately 10 business days (or, if you are applying in advance, within 10 days after your eligibility date). If you apply online and select EFT, your loan will be processed in three (3) business days.

What type of pension is NYCERS?

NYCERS is a defined benefit retirement plan. Defined benefit retirement plans for public sector employees offer benefits which are defined in law. Generally, retirement allowances payable from such plans are based on a member's years of service, age and compensation base.

Can you borrow against your pension?

Pension loans are unregulated in the United States. Lump-sum loans as an advance on your pension may result in unfair payment plans. The Consumer Financial Protection Bureau (CFPB) warns customers of taking out loans against their pensions. Most pension plans are protected if you are forced to file for bankruptcy.

What is the maximum loanable amount for pension loan program?

The loan amount that may be availed is up to six months times his /her Basic Monthly Pension (BMP) but not more than P 500,000.00.

Can I borrow out of my pension?

Pension loans are legally allowed in many cases, but plan sponsors determine whether they're allowed. If your employer does allow loans, it will likely be limited to a percentage of the balance up to a fixed amount.

Which loan is best for pensioners?

Top Banks Offers for Personal Loan for Pensioners SBI Pension Loan. Central or State government pensioners, defence pensioners, and family pensioners upto the age of 76 years can avail of SBI personal loan to fulfil their financial needs. PNB Personal Loan Scheme for Pensioners. United Pension Loan Scheme for Pensioners.

Who does NYCERS cover?

NYCERS covers most civilian employees or employees who are not eligible to participate in retirement plans for specific uniformed agencies and educational institutions. Learn more at NYCERS.

What is the average New York City pension?

Among those “full-career” retirees: The average pension received was $57,516, compared to $53,539 for last year's retirees; Those who had been employed by the Department of Corrections (DOC) had the highest average pension (among the ten largest agencies), with 400 individuals being paid an average of $82,947.

How is NYC pension calculated?

Your pension is based on your years of credited service, your age at retirement and your final average salary (FAS). FAS is the average of the wages you earned during any 36 consecutive months of service when your earnings were highest.

What is NYC retirement plan?

The New York State Common Retirement Fund is one of the largest public pension plans in the United States, providing retirement security for over one million New York State and Local Retirement System (NYSLRS) members, retirees and beneficiaries.

How does NYCERS pension loan work?

This type of loan will not be issued until after your retirement date as NYCERS completes a review of your account. It may take up to one month to complete the review and issue your loan check. After you retire, any outstanding loan will reduce your pension unless you pay off the loan in a lump sum.

How long do you have to work for NYC to get a pension?

You will be eligible for a service retirement benefit when you reach age 55 and have five or more years of credited member service.

Can you cash out from NYCERS?

You may choose to: Terminate your membership and withdraw your accumulated contributions plus interest; or. Leave your contributions in your account and qualify for a retirement benefit when you are age 55.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY NYCERS F302 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your NY NYCERS F302 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Where do I find NY NYCERS F302?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the NY NYCERS F302 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out NY NYCERS F302 on an Android device?

Complete your NY NYCERS F302 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is NY NYCERS F302?

NY NYCERS F302 is a form used by the New York City Employees' Retirement System (NYCERS) for members to report service credit and contributions.

Who is required to file NY NYCERS F302?

Employees who are members of NYCERS and wish to update or verify their service credit or contributions may be required to file the NY NYCERS F302.

How to fill out NY NYCERS F302?

To fill out the NY NYCERS F302, members should carefully complete the form by providing accurate personal information, service details, and contributions, and follow the instructions provided on the form.

What is the purpose of NY NYCERS F302?

The purpose of NY NYCERS F302 is to track and verify an employee's service credit and contributions to ensure accurate retirement benefits.

What information must be reported on NY NYCERS F302?

The information that must be reported on NY NYCERS F302 includes personal identification details, employment history, service dates, and any contributions made towards retirement.

Fill out your NY NYCERS F302 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY NYCERS f302 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.