Get the free Powers of Attorney with Respect to Borrowing/Mortgaging

Show details

This document discusses the purpose, implications, and best practices regarding powers of attorney in relation to borrowing and mortgaging, particularly in context of estate planning.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign powers of attorney with

Edit your powers of attorney with form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your powers of attorney with form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing powers of attorney with online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit powers of attorney with. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out powers of attorney with

How to fill out Powers of Attorney with Respect to Borrowing/Mortgaging

01

Determine the need for a Power of Attorney (POA) for borrowing or mortgaging.

02

Choose a suitable agent who will act on your behalf.

03

Gather necessary documentation including identification and property information.

04

Select the type of Power of Attorney: General or Specific.

05

Complete the POA form, ensuring all required fields are filled out accurately.

06

Specify the powers granted to the agent with respect to borrowing and mortgaging.

07

Have the POA document reviewed by a legal professional, if necessary.

08

Sign the document in the presence of a notary public or witnesses, as required by local law.

09

Provide copies of the signed POA to relevant parties, such as lenders or real estate agents.

Who needs Powers of Attorney with Respect to Borrowing/Mortgaging?

01

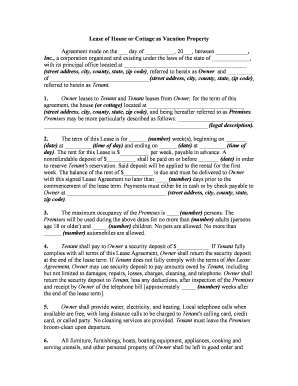

Individuals looking to obtain a loan or mortgage but unable to attend the closing in person.

02

People who want to authorize someone else to manage their borrowing or mortgage matters.

03

Those engaged in real estate transactions requiring representation.

04

Anyone needing a trusted individual to handle financial matters due to health issues or travel.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

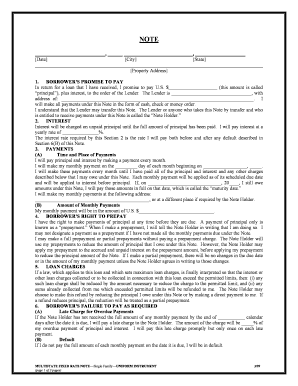

What is Powers of Attorney with Respect to Borrowing/Mortgaging?

A Power of Attorney with respect to borrowing/mortgaging is a legal document that allows one person to authorize another to act on their behalf in securing a loan or mortgage. This can include signing documents, negotiating terms, and executing agreements.

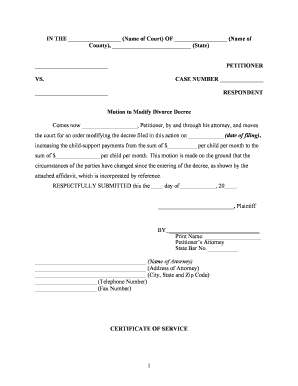

Who is required to file Powers of Attorney with Respect to Borrowing/Mortgaging?

Typically, a person who is unable to attend to their financial matters, such as securing a mortgage, may need a Power of Attorney. This can include individuals with health issues, those traveling abroad, or anyone wishing to delegate this responsibility to another party.

How to fill out Powers of Attorney with Respect to Borrowing/Mortgaging?

To fill out a Power of Attorney for borrowing/mortgaging, provide the name and contact information of the principal (the person granting authority), the agent (the person receiving authority), and specify the powers granted. Include any relevant details about the mortgage or loan. Ensure the document is signed and dated, often in the presence of a witness or notary.

What is the purpose of Powers of Attorney with Respect to Borrowing/Mortgaging?

The purpose is to enable a trusted individual to manage and secure loans or mortgages on behalf of another person. This is crucial in cases where the principal is unable to act due to various reasons, ensuring that financial matters can still be addressed efficiently.

What information must be reported on Powers of Attorney with Respect to Borrowing/Mortgaging?

Required information typically includes the names and addresses of both the principal and agent, a clear description of the authority being granted, the specific powers related to borrowing/mortgaging, and any limitations or conditions. Additionally, execution details and witness/notary acknowledgments may be necessary.

Fill out your powers of attorney with online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Powers Of Attorney With is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.