Get the free property tax appeal letter sample

Show details

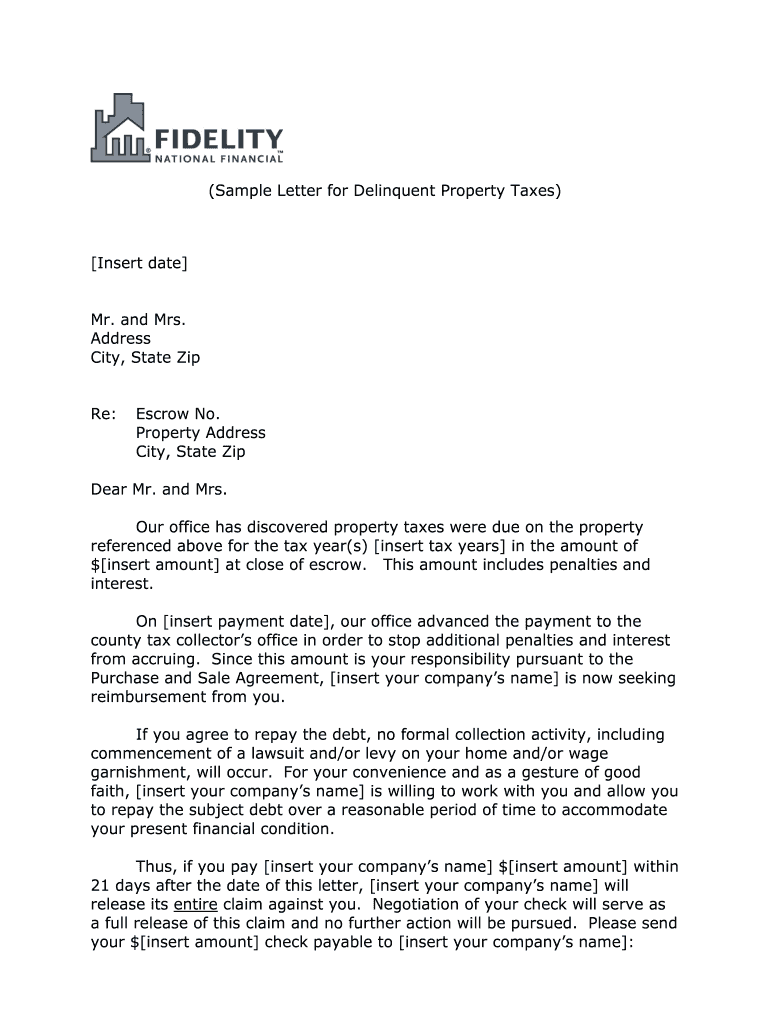

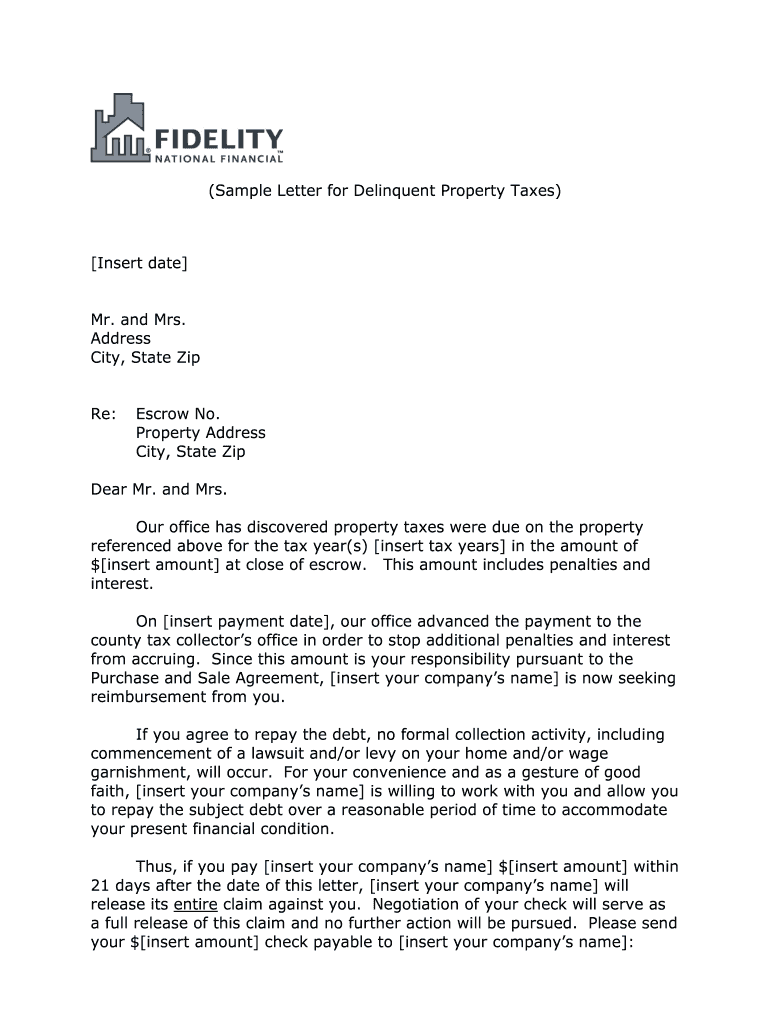

(Sample Letter for Delinquent Property Taxes) Insert date Mr. and Mrs. Address City, State Zip Re: Escrow No. Property Address City, State Zip Dear Mr. and Mrs. Our office has discovered property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign delinquent property tax letter form

Edit your delinquent property tax letter samples form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your delinquent tax letter template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sample letter for delinquent taxes online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit property tax appeal letter sample georgia form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sample letter delinquent property form

How to fill out Fidelity National Financial Sample Letter for Delinquent Property

01

Begin by addressing the letter to the appropriate department or individual at Fidelity National Financial.

02

Include your full name, address, and contact information at the top of the letter.

03

Clearly state the purpose of the letter as regarding a delinquent property.

04

Provide a detailed description of the property, including the address and any relevant identification numbers.

05

Include the specific dates of missed payments and any associated account numbers.

06

Clearly outline your situation, explaining any circumstances that have led to the delinquency.

07

Request assistance or provide a proposal for how you plan to address the delinquency moving forward.

08

Conclude the letter with a polite closing, and sign your name.

Who needs Fidelity National Financial Sample Letter for Delinquent Property?

01

Property owners who have fallen behind on payments and need to communicate with Fidelity National Financial.

02

Individuals seeking to resolve issues related to delinquent property payments.

03

Anyone involved in a real estate transaction where Fidelity National Financial is the title company and there are delinquency issues.

Fill

letter delinquent property

: Try Risk Free

People Also Ask about property tax assessment appeal letter sample

How long can you not pay property taxes in MN?

If you don't pay the delinquent amounts before the redemption period expires or 60 days after a final warning about the redemption period expiring is sent, whichever is later, the property is forfeited to the state. (Minn. Stat.

How do I buy tax delinquent property in Florida?

Delinquent tax defaulted properties are sold at public auctions that anyone can attend and to qualify is simple. Register at the door. If you're buying tax deeds in Florida, some auctions may require that you demonstrate you have funds to bid, while others may not ask you.

What happens if you dont pay your property taxes in Minnesota?

If you don't pay your property taxes for long enough, then your house or property will go through the tax forfeiture process. The important step in the tax forfeiture process is to send you a letter which says “notice of expiration of redemption rights.”

Can a tax deed be redeemed in Florida?

Pursuant to section 197.472(1), Florida Statutes, “A person may redeem a tax certificate at any time after the certificate is issued and before a tax deed is issued unless full payment for a tax deed is made to the clerk of court, including documentary stamps and recording fees.”

How long do you have to pay delinquent property taxes in Texas?

Texas property tax bills are mailed out in October every year, and payment is due upon receipt. However, at the absolute latest, property owners have until January 31 of the following year to settle their tax bills in full before they are considered delinquent.

Does paying property tax give ownership in Florida?

To answer the original question, does paying property tax give ownership, yes, you can end up owning the property by just paying the back taxes.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit sample property tax appeal letter from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your property tax letter sample into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I execute delinquent letter sample online?

Easy online delinquent letter completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit payment delinquency letter samples straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing letter delinquent property taxes, you need to install and log in to the app.

What is Fidelity National Financial Sample Letter for Delinquent Property?

The Fidelity National Financial Sample Letter for Delinquent Property is a formal communication template used by property management to notify property owners regarding overdue payments or delinquencies related to their property.

Who is required to file Fidelity National Financial Sample Letter for Delinquent Property?

Property managers, landlords, or financial institutions who are responsible for managing or overseeing properties that have unpaid debts typically file this letter.

How to fill out Fidelity National Financial Sample Letter for Delinquent Property?

To fill out the letter, include relevant details such as the property owner's name, address, amount owed, due date, and any instructions for payment or further action required.

What is the purpose of Fidelity National Financial Sample Letter for Delinquent Property?

The purpose of the letter is to formally inform property owners of their outstanding payments, urging them to take action to resolve their delinquency.

What information must be reported on Fidelity National Financial Sample Letter for Delinquent Property?

The letter must report the property owner's name, property address, overdue amount, payment due date, and any late fees or penalties incurred.

Fill out your property tax appeal letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Appeal Letter Template is not the form you're looking for?Search for another form here.

Keywords relevant to delinquency letter template

Related to letter delinquent property sample

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.