Get the free Application for Theater School Property Tax Exemption

Show details

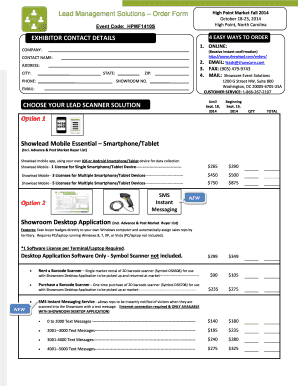

This document serves as an application for obtaining property tax exemption for theater schools in Texas, requiring the owner to certify various aspects of their educational programs and property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for formater school

Edit your application for formater school form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for formater school form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for formater school online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for formater school. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for formater school

How to fill out Application for Theater School Property Tax Exemption

01

Begin by downloading the Application for Theater School Property Tax Exemption form from the official website.

02

Fill in the basic information including the name of the theater school, address, and contact details.

03

Provide a detailed description of the property for which the exemption is being sought.

04

Indicate the purpose of the property and how it is used for educational purposes.

05

Attach necessary documentation proving the theater school's nonprofit status and educational programs.

06

Complete any sections related to financial information, such as annual operating expenses and sources of funding.

07

Review the form for accuracy and completeness before submitting.

08

Submit the application by the specified deadline, either online or by mail, as directed on the form.

Who needs Application for Theater School Property Tax Exemption?

01

Theater schools and educational institutions that conduct theater arts education and seek property tax exemptions to support their operations.

Fill

form

: Try Risk Free

People Also Ask about

At what age do seniors stop paying property taxes in Texas?

ing to the Comptroller, there is no provision for the cessation of property taxes at any stage. However, there is a Texas property tax exemption for people over the age of 65, which offers temporary tax relief for seniors. At the age of 65, seniors can apply for an exemption from Texas property taxes.

What documents do I need to file a homestead exemption in Texas?

REQUIRED DOCUMENTATION Attach a copy of each property owner's driver's license or state-issued personal identification certificate. The address listed on the driver's license or state-issued personal identification certificate must correspond to the property address for which the exemption is requested.

Is there a fee to file a homestead exemption in Texas?

The exemption typically remains on the property until the owner moves or sells the property. There are no fees required to file an exemption application with an Appraisal District. Application Form 50-114 can also be filed online to expedite processing.

Is it free to file homestead?

In some cases, you may need to pay a small recording fee to file a homestead exemption. However, some states don't charge any fee at all.

What is the deadline to file a homestead exemption in Texas?

Per the Texas Comptroller, the completed application and required documentation are due no later than April 30 of the tax year for which you are applying. A late homestead exemption application, however, may be filed up to two years after the delinquency date, which is usually Feb. 1.

How much does homestead reduce property taxes in Texas?

Now, let's apply the standard Homestead Exemption of $100,000. Your new taxable value would be $150,000: $150,000 x 1.5% = $2,250 annually. In this example, the Homestead Exemption saves you $1,500 per year in property taxes.

Does Texas homestead exemption need to be filed every year?

You Only Need to Apply Once The homestead exemption is a onetime exemption - no need to re-apply every year. Likewise, if you believe you qualified for the homestead exemption in prior years, simply fill out one application and enter the first year you believe you qualified when filling out the application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Theater School Property Tax Exemption?

The Application for Theater School Property Tax Exemption is a form that allows theater schools to request an exemption from property taxes, recognizing their role in providing educational opportunities and cultural enrichment in the community.

Who is required to file Application for Theater School Property Tax Exemption?

Theater schools that own property and seek an exemption from local property taxes are required to file the Application for Theater School Property Tax Exemption.

How to fill out Application for Theater School Property Tax Exemption?

To fill out the Application for Theater School Property Tax Exemption, provide specific information such as the school's name, address, tax identification number, details about the property, and relevant financial information. Ensure all required fields are completed accurately.

What is the purpose of Application for Theater School Property Tax Exemption?

The purpose of the Application for Theater School Property Tax Exemption is to allow eligible theater schools to reduce their financial burden from property taxes, thereby supporting their operations and enhancing their ability to offer educational programs.

What information must be reported on Application for Theater School Property Tax Exemption?

The information that must be reported includes the theater school's legal name, address, type of organization, description of property usage, financial statements, and any other documentation required to demonstrate eligibility for exemption.

Fill out your application for formater school online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Formater School is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.