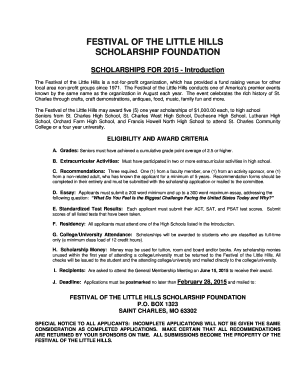

Get the free 1099 Letter 12-2010.doc. Insights on Metal Roof Performance in High-Wind Regions

Show details

This document provides essential information for clients regarding year-end payroll reporting and tax obligations, including withholding, filing requirements, and updates on relevant tax laws.

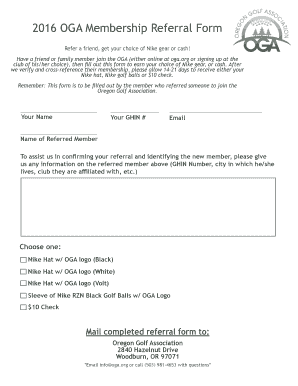

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1099 letter 12-2010doc insights

Edit your 1099 letter 12-2010doc insights form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1099 letter 12-2010doc insights form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1099 letter 12-2010doc insights online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 1099 letter 12-2010doc insights. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1099 letter 12-2010doc insights

How to fill out 1099 letter 12-2010doc insights:

01

Obtain the necessary form: You can download the 1099 letter 12-2010doc insights form from the Internal Revenue Service (IRS) website or request a copy from the IRS.

02

Gather required information: Collect all the necessary information to complete the form, including your name, address, Social Security Number or Employer Identification Number, and the recipient's name, address, and taxpayer identification number.

03

Determine the type of income: Identify the type of income you are reporting on the 1099 letter 12-2010doc insights form. There are specific boxes for different types of income, such as compensation, rent, royalties, or nonemployee compensation.

04

Fill out the form: Enter the required information in the appropriate fields on the 1099 letter 12-2010doc insights form. Make sure to accurately report all the necessary details, such as the amount of income and any withheld taxes.

05

Check for accuracy: Review the completed form to ensure accuracy and verify that all necessary information has been provided. Inaccurate or incomplete forms can result in penalties or delays in processing.

06

Submit to the IRS and recipient: Send a copy of the completed 1099 letter 12-2010doc insights form to the IRS by the designated deadline. Additionally, provide a copy to the recipient of the income, so they can report it on their tax return.

Who needs 1099 letter 12-2010doc insights:

01

Freelancers and independent contractors: Individuals who receive income from freelancing or working as independent contractors may need to fill out the 1099 letter 12-2010doc insights form to report their earnings.

02

Businesses paying non-employee compensation: Businesses that pay individuals or entities more than $600 for services provided outside of an employer-employee relationship are required to issue a 1099 letter 12-2010doc insights form.

03

Landlords and rental property owners: Landlords or rental property owners who receive rental income of $600 or more in a year need to report this income by filling out a 1099 letter 12-2010doc insights form.

04

Royalty recipients: Individuals who receive royalties for the use of their intellectual property, such as patents, copyrights, or trademarks, may need to fill out the 1099 letter 12-2010doc insights form to report this income.

05

Other miscellaneous income recipients: There are various other types of income that may require the use of a 1099 letter 12-2010doc insights form, such as income from fishing activities, healthcare payments, or legal settlements. If you receive such income, consult the IRS guidelines to determine if you need to fill out the form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 1099 letter 12-2010doc insights directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your 1099 letter 12-2010doc insights and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I get 1099 letter 12-2010doc insights?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the 1099 letter 12-2010doc insights. Open it immediately and start altering it with sophisticated capabilities.

How do I complete 1099 letter 12-2010doc insights on an Android device?

Use the pdfFiller mobile app to complete your 1099 letter 12-2010doc insights on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is 1099 letter 12-doc insights?

The 1099 letter 12-doc insights is a specific type of form used for reporting certain types of income that you receive. It provides detailed insights into your financial transactions and helps in tax reporting.

Who is required to file 1099 letter 12-doc insights?

Individuals or businesses who have received income in the form specified by 1099 letter 12-doc insights are required to file this form.

How to fill out 1099 letter 12-doc insights?

To fill out 1099 letter 12-doc insights, you need to provide the required information such as your name, address, taxpayer identification number, and the details of the income received. You should also include any applicable deductions or credits.

What is the purpose of 1099 letter 12-doc insights?

The purpose of the 1099 letter 12-doc insights is to accurately report and document income received by individuals or businesses for tax purposes.

What information must be reported on 1099 letter 12-doc insights?

The 1099 letter 12-doc insights requires reporting of various types of income, including but not limited to wages, salaries, interest, dividends, self-employment income, and rental income. Additionally, it may require reporting of any taxes withheld.

Fill out your 1099 letter 12-2010doc insights online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1099 Letter 12-2010doc Insights is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.