Get the free APPLICATION FOR New Century Senior Protector Guaranteed Issue Whole Life

Show details

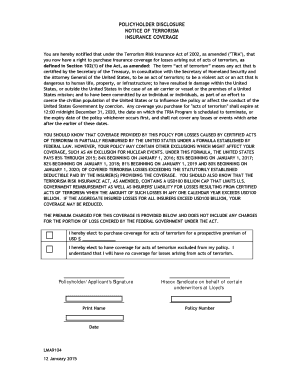

This document serves as an application for a guaranteed issue whole life insurance policy specifically designed for seniors aged 50 to 80 in the District of Columbia. It outlines the necessary information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for new century

Edit your application for new century form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for new century form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for new century online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for new century. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for new century

How to fill out APPLICATION FOR New Century Senior Protector Guaranteed Issue Whole Life

01

Begin by obtaining the APPLICATION FOR New Century Senior Protector Guaranteed Issue Whole Life form.

02

Carefully read the instructions included with the application form.

03

Fill out your personal information in the designated sections, including your full name, address, and contact details.

04

Provide your date of birth and gender as required.

05

Indicate the coverage amount you are applying for.

06

Answer any health-related questions truthfully, as these may affect your eligibility.

07

Complete the payment details section if required, including payment method and frequency.

08

Review your application for accuracy and completeness.

09

Sign and date the application at the designated areas.

10

Submit the completed application as instructed, either by mail or electronically.

Who needs APPLICATION FOR New Century Senior Protector Guaranteed Issue Whole Life?

01

Individuals aged 50 and above who are seeking permanent life insurance coverage.

02

Those looking for a guaranteed issue policy without medical underwriting.

03

People who want to ensure financial security for their beneficiaries after their passing.

04

Individuals with pre-existing health conditions who may not qualify for other life insurance options.

Fill

form

: Try Risk Free

People Also Ask about

What is the best whole life insurance company for seniors?

Best Life Insurance Companies for Seniors of 2025 Best Life Insurance Companies for Seniors. Best Overall: State Farm. Best Term: MassMutual. Best Universal: Pacific Life. Best Whole: USAA. Best for Final Expense Policies: Mutual of Omaha. Best for No-Exam Policies: Nationwide. Best for Coverage Amounts: Protective.

What is the catch of the whole life insurance?

Con: Higher premiums Due to the lifelong coverage and cash value component, whole life insurance comes with higher premiums.

What does Martin Lewis say about life insurance?

What does Martin Lewis say about Life Insurance? Martin Lewis says that parents should really have some life insurance in place to protect their children and the general rule for him is 'Ten Times the main breadwinners salary'.

How to claim whole life insurance?

In general, you'll need two specific things to get a life insurance claim started. The first is the life insurance claim form, which asks for some personal information about the deceased and your relationship to them. The only other documentation you'll need is a certified copy of the death certificate.

What is guaranteed issue life?

Guaranteed issue life insurance is a type of whole life insurance policy that allows you to skip health questions and or undergo a medical exam. In some spaces, you may hear it referred to as guaranteed life insurance or guaranteed acceptance life insurance.

Is whole life insurance good for seniors?

Whole life insurance is another great option for seniors that will provide coverage for the entire life cycle of a policyholder. Unlike term life insurance, the benefits of whole life insurance will be received by your beneficiary, no matter when you pass.

What is the waiting period for guaranteed life insurance?

Waiting Periods Many guaranteed issue life insurance policies come with a waiting period, usually ranging from 2 to 3 years. If the insured person passes away during this period, the beneficiaries may only receive a return of the premiums paid or a reduced benefit rather than the full death benefit.

What is the best whole life insurance for seniors?

Our Best Life Insurance Companies for Seniors Best Overall. State Farm» State Farm» Best Term. MassMutual» MassMutual» Best Universal. Pacific Life» Pacific Life» Best Whole. USAA» USAA»

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR New Century Senior Protector Guaranteed Issue Whole Life?

The APPLICATION FOR New Century Senior Protector Guaranteed Issue Whole Life is a formal document that individuals fill out to apply for a guaranteed issue whole life insurance policy designed specifically for seniors, providing them with lifelong coverage without medical underwriting.

Who is required to file APPLICATION FOR New Century Senior Protector Guaranteed Issue Whole Life?

Individuals aged 50 and above who wish to obtain the New Century Senior Protector Guaranteed Issue Whole Life insurance policy are required to file this application.

How to fill out APPLICATION FOR New Century Senior Protector Guaranteed Issue Whole Life?

To fill out the application, the applicant must provide personal information such as their name, address, date of birth, and contact information, along with selecting the desired coverage amount and signing the form to confirm their eligibility for the policy.

What is the purpose of APPLICATION FOR New Century Senior Protector Guaranteed Issue Whole Life?

The purpose of the application is to initiate the process of obtaining permanent life insurance coverage for seniors, ensuring that they have financial protection for their beneficiaries without the need for medical exams.

What information must be reported on APPLICATION FOR New Century Senior Protector Guaranteed Issue Whole Life?

The application must report personal details including the applicant's name, age, gender, health status, and beneficiary information, along with any other specifics required to accurately assess the application for coverage.

Fill out your application for new century online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For New Century is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.