Get the free CLOSED ACCOUNT REPORT

Show details

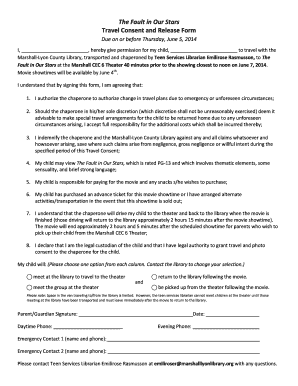

This report is to be completed for accounts that are closing or for a household terminating their relationship with Spire, to be submitted within 5 days of notification.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign closed account report

Edit your closed account report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your closed account report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing closed account report online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit closed account report. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out closed account report

How to fill out CLOSED ACCOUNT REPORT

01

Obtain the CLOSED ACCOUNT REPORT form from the relevant financial institution or regulatory body.

02

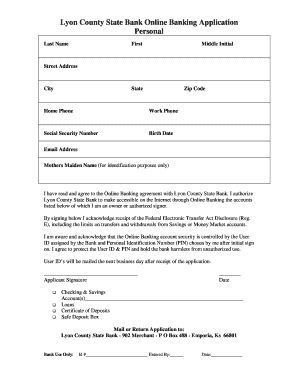

Fill in your personal information, including your name, address, and account number.

03

Specify the reason for the account closure, providing any necessary documentation if required.

04

Check the box confirming that you understand any fees or penalties associated with the account closure.

05

Review the completed form for accuracy and completeness.

06

Sign and date the report at the bottom of the form.

Who needs CLOSED ACCOUNT REPORT?

01

Individuals who have closed their bank or financial accounts.

02

Financial institutions that require documentation of closed accounts for record-keeping.

03

Regulatory bodies that monitor compliance with financial regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is a closed account on your report?

An account is technically closed when it cannot be used to make charges. Whether you closed the account or your creditor did, the effect of a closed account on your credit report may differ depending on the account standing. An account in positive standing won't have any negative payment history.

How to write a goodwill letter for a closed account?

How to write a goodwill letter List your account number and address. Briefly explain the situation that caused the error. Explain the steps you took to correct the issue and ensure it wouldn't happen again. Mention how it's negatively affecting you, like if it's hindering your ability to qualify for a mortgage.

Does a closed account mean it's in collections?

It means the issuer considers your account a loss. You still owe the credit card issuer when your debt has been charged off, but it's now reported to credit reporting agencies as “in collections.” The original account is now closed and will show as a closed account on your credit report.

Do closed bank accounts get reported?

If you've had your account closed due to an unpaid negative balance, the bank or credit union would typically report this “involuntary closure” to a checking account reporting company. You may also be reported if you were suspected of fraudulent activity by the bank or credit union.

How do I remove closed accounts from a report?

Closed accounts with a history of on-time payments may continue to boost your credit score slightly. You can try to remove closed accounts from your credit profile by asking a creditor for a “goodwill removal” or waiting for them to disappear on their own after 10 years.

How bad is a closed account on your credit report?

Closing an account could harm your credit score in two ways. First, it reduces the average length of your credit history. Secondly, it can change your credit utilization ratio.

What is the meaning of a closed account?

A closed account is any account that has been deactivated or otherwise terminated, either by the customer, custodian or counterparty. At this stage, no further credits and debits can be added.

What does it mean when they say your account is closed?

An account is technically closed when it cannot be used to make charges. Whether you closed the account or your creditor did, the effect of a closed account on your credit report may differ depending on the account standing. An account in positive standing won't have any negative payment history.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CLOSED ACCOUNT REPORT?

A CLOSED ACCOUNT REPORT is a formal documentation that outlines the details of accounts that have been closed by an institution, typically for compliance and regulatory purposes.

Who is required to file CLOSED ACCOUNT REPORT?

Financial institutions and certain businesses that manage client accounts are required to file a CLOSED ACCOUNT REPORT when they close accounts.

How to fill out CLOSED ACCOUNT REPORT?

To fill out a CLOSED ACCOUNT REPORT, gather account closure details including account holder information, closure date, reason for closure, and any remaining balances or transactions. Then, complete the form as per institutional guidelines.

What is the purpose of CLOSED ACCOUNT REPORT?

The purpose of a CLOSED ACCOUNT REPORT is to ensure transparency, track account closure activities, and comply with regulatory requirements to prevent fraud and safeguard financial integrity.

What information must be reported on CLOSED ACCOUNT REPORT?

The information that must be reported includes account holder's name, account number, closure reason, closure date, and any final transactions or balances associated with the closed account.

Fill out your closed account report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Closed Account Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.