Get the free ROTH IRA APPLICATION

Show details

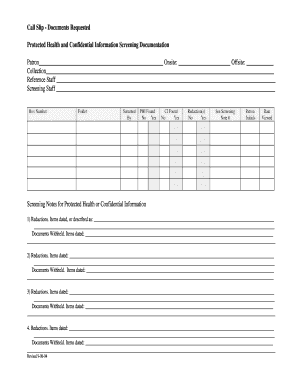

This document serves as an application form for opening a Roth Individual Retirement Account, detailing necessary identification requirements, account information, investment options, and custodial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign roth ira application

Edit your roth ira application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your roth ira application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing roth ira application online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit roth ira application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out roth ira application

How to fill out ROTH IRA APPLICATION

01

Gather necessary personal information, including your Social Security number, date of birth, and contact details.

02

Decide on your contribution amount and be aware of the annual contribution limits for a Roth IRA.

03

Choose a financial institution or brokerage that offers a Roth IRA account.

04

Complete the Roth IRA application form with your personal information and account preferences.

05

Select your investment options within the Roth IRA, such as stocks, bonds, or mutual funds.

06

Review your application for accuracy and completeness.

07

Submit the application along with any required identification or documentation.

08

Fund your Roth IRA by transferring money from your checking or savings account.

Who needs ROTH IRA APPLICATION?

01

Individuals looking for tax-free growth on their retirement savings.

02

Younger individuals who expect to be in a higher tax bracket in retirement.

03

People who want to diversify their retirement income sources.

04

Individuals with earned income who wish to save for retirement.

Fill

form

: Try Risk Free

People Also Ask about

What disqualifies you from opening Roth IRA?

Roth IRA income limits for 2025 If you're a single filer and your MAGI is $165,000 or more, or if you're a joint filer and your MAGI is $246,000 or more, you're ineligible to contribute to a Roth IRA. Still, you can make contributions to a traditional IRA.

Which bank is best open a Roth IRA with?

Vanguard, Fidelity, and Schwab are good to go for ROTHs. Just remember to actually select what the roth is composed (index funds for example). Some people make the mistake of just opening and putting money in the roth ira but won't grow because it is not invested in anything.

How much does it cost to open a Roth IRA?

Ready to open a Roth IRA? Choosing the type of IRA account. Providing your personal, employment, and financial information. Selecting specific account features. Creating login credentials and providing contact information for your account. Verifying your identity. Indicating how you'll fund the account.

How do I enroll in a Roth IRA?

You can't go wrong with Fidelity, Schwab, or Vanguard. Go with whatever one you feel is the best. In this subreddit, you'll probably get the most recommendations for Vanguard. Since you have other accounts with Fidelity, I'd probably stick with them if I was in your situation.

What bank should I open a Roth IRA with?

Income: To contribute to a Roth IRA, you must have compensation (i.e. wages, salary, tips, professional fees, bonuses). Your modified adjusted gross income must be less than: $160,000 - Married filing jointly. $10,000 - Married filing separately (and you lived with your spouse at any time during the year).

How do I apply for a Roth IRA?

Ready to open a Roth IRA? Choosing the type of IRA account. Providing your personal, employment, and financial information. Selecting specific account features. Creating login credentials and providing contact information for your account. Verifying your identity. Indicating how you'll fund the account.

How much money is needed to open a Roth IRA?

How much money is needed to open a Roth IRA? Different firms require different minimum investments, but most online brokers or robo-advisors usually have no minimum to open a Roth IRA. Others will waive them if you set up automatic monthly contributions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ROTH IRA APPLICATION?

A ROTH IRA application is a form used to open a ROTH Individual Retirement Account, allowing individuals to contribute after-tax income towards retirement savings.

Who is required to file ROTH IRA APPLICATION?

Individuals who wish to open a ROTH IRA and contribute to it are required to fill out a ROTH IRA application. There are also income eligibility requirements to consider.

How to fill out ROTH IRA APPLICATION?

To fill out a ROTH IRA application, provide personal information such as name, address, social security number, and income details. Select a financial institution and the type of contributions you wish to make.

What is the purpose of ROTH IRA APPLICATION?

The purpose of the ROTH IRA application is to formalize the opening of a ROTH IRA account, allowing individuals to save for retirement with tax-free growth and withdrawals under certain conditions.

What information must be reported on ROTH IRA APPLICATION?

The information reported on a ROTH IRA application typically includes personal identification details, income information, contribution amounts, and the chosen financial institution for the account.

Fill out your roth ira application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Roth Ira Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.