Get the free L-4025 SEV

Show details

This form is used to calculate taxable valuations including additions, losses, and totals for units that were not equalized as assessed in 2004 or 2005, mandated by the Michigan Department of Treasury.

We are not affiliated with any brand or entity on this form

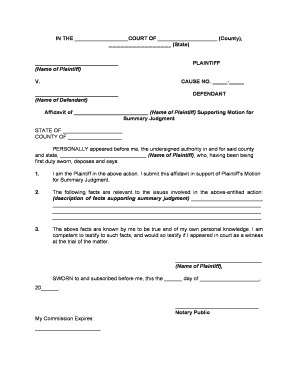

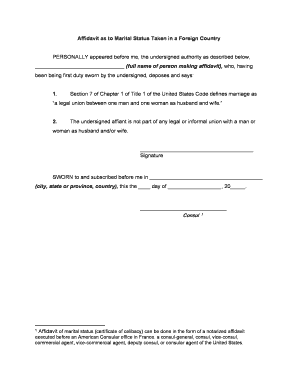

Get, Create, Make and Sign l-4025 sev

Edit your l-4025 sev form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your l-4025 sev form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit l-4025 sev online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit l-4025 sev. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out l-4025 sev

How to fill out L-4025 SEV

01

Obtain the L-4025 SEV form from the Michigan Department of Treasury website or your local assessor's office.

02

Fill in the property description, including the parcel number and the address of the property.

03

Indicate the owner’s name and contact information.

04

Complete the sections related to the property type and classification.

05

Provide details about any changes in ownership, if applicable.

06

Sign and date the form to certify the information provided.

07

Submit the completed form to your local assessing officer by the specified deadline.

Who needs L-4025 SEV?

01

Property owners in Michigan who are claiming a homestead exemption or making changes to their property classification.

02

Individuals who have recently purchased a home and need to report ownership changes.

03

Anyone seeking to clarify property tax assessments or apply for exemptions.

Fill

form

: Try Risk Free

People Also Ask about

Why are Michigan taxes so high?

0:11 2:11 This creates a direct link between property taxes. And school funding additionally Michigan has aMoreThis creates a direct link between property taxes. And school funding additionally Michigan has a diverse range of municipalities. Each municipality may set its own tax rates.

What is the truth in taxation in Michigan?

5, "Truth in Taxation" This act required a public hearing to levy a millage rate that would result in increased tax revenue on base tax properties due to increased valuation.

What is not taxed in Michigan?

Some goods are exempt from sales tax under Michigan law. Examples include prescription medications, groceries, newspapers, medical devices, and some agricultural and industrial machinery.

Is Michigan a good state for taxes?

Michigan's tax code includes all major tax types and has traditionally ranked well on the Index. The state's individual income tax is flat with a relatively low rate of 4.25 percent (temporarily reduced to 4.05 percent in 2023), along with a modest personal exemption.

How do taxes work in Michigan?

The Michigan individual income tax was first adopted in 1967 . It is a direct flat-rate tax, which means that everyone is assessed the same tax rate (4 . 25 percent for 2024), regardless of their level of income .

What is notice of assessment, taxable valuation, and property classification?

0:23 1:37 This classification is used to determine the tax rate that will be applied to the property. ThereMoreThis classification is used to determine the tax rate that will be applied to the property. There are different classifications for different types of properties. Such as residential commercial.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is L-4025 SEV?

L-4025 SEV is a specific form used in the state of Michigan to report the State Educational Tax and to provide information related to property tax assessments.

Who is required to file L-4025 SEV?

L-4025 SEV must be filed by local assessors and municipalities in Michigan to report the taxable value of properties in their jurisdiction.

How to fill out L-4025 SEV?

To fill out L-4025 SEV, local assessors should enter information related to property assessments, including property descriptions, tax allocation, and the assessed values for the properties.

What is the purpose of L-4025 SEV?

The purpose of L-4025 SEV is to ensure accurate reporting of the taxable value of properties for state educational tax purposes and to facilitate the distribution of educational funds.

What information must be reported on L-4025 SEV?

L-4025 SEV requires the reporting of property identification numbers, assessed values, tax district information, and relevant property characteristics and classifications.

Fill out your l-4025 sev online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

L-4025 Sev is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.