Get the free Tuition Reimbursement Assistance Program

Show details

The Tuition Assistance Program is designed to give employees the opportunity to increase their knowledge and skills through participation in educational programs, contributing to the Medical Center

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tuition reimbursement assistance program

Edit your tuition reimbursement assistance program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

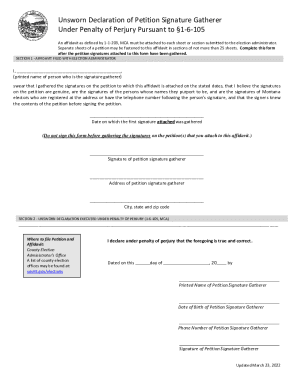

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tuition reimbursement assistance program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tuition reimbursement assistance program online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tuition reimbursement assistance program. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

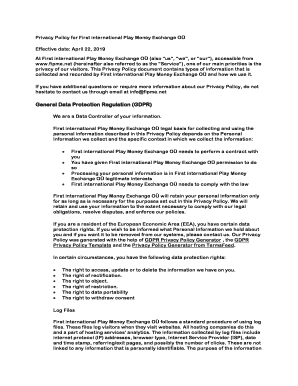

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tuition reimbursement assistance program

How to fill out Tuition Reimbursement Assistance Program

01

Review your employer's Tuition Reimbursement Assistance Program policy.

02

Gather necessary documentation, including proof of enrollment and course information.

03

Complete the application form provided by your employer.

04

Attach required documents to your application, such as receipts and transcripts.

05

Submit your application by the specified deadline.

06

Follow up with HR to confirm receipt and status of your application.

Who needs Tuition Reimbursement Assistance Program?

01

Employees seeking to further their education while working.

02

Individuals looking to enhance their skills for career advancement.

03

Employees enrolled in courses directly related to their job roles.

04

Workers aiming to improve their qualifications for potential promotions.

Fill

form

: Try Risk Free

People Also Ask about

Who has the best tuition reimbursement program?

Amazon. Amazon covers tuition and fees for front-line employees after 90 days of employment. Apple. Apple offers a few ways to help full-time employees with their education. AT&T. Bank of America. Best Buy. . Chick-fil-A. Chipotle.

What does it mean to reimburse tuition fees?

Tuition reimbursement is an employee benefit where an employer reimburses employees for the cost of taking courses and pursuing education. Tuition reimbursement aims to help employees gain new skills and knowledge that can be used in their current positions or to prepare for a new role within the company.

Is tuition reimbursement taxable in the USA?

Undergraduate tuition benefits are generally not subject to withholding for employees using the tuition benefit for themselves. Graduate tuition benefits for employees using the benefit for themselves are taxable at the federal and local level once you exceed $5,250 in graduate benefits for the calendar year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tuition Reimbursement Assistance Program?

The Tuition Reimbursement Assistance Program is a benefit provided by employers that reimburses employees for the cost of tuition and educational expenses related to their job, facilitating their professional development and skills enhancement.

Who is required to file Tuition Reimbursement Assistance Program?

Typically, employees who have incurred educational expenses and seek reimbursement from their employer for courses, training, or degree programs that comply with the employer's policies are required to file for the Tuition Reimbursement Assistance Program.

How to fill out Tuition Reimbursement Assistance Program?

To fill out the Tuition Reimbursement Assistance Program forms, employees usually need to complete a designated application form, attach receipts or proof of payment for tuition, provide details of the course or training taken, and submit it to the HR department or relevant body for approval.

What is the purpose of Tuition Reimbursement Assistance Program?

The purpose of the Tuition Reimbursement Assistance Program is to encourage employee education and professional development by offsetting the costs associated with obtaining further education, thereby enhancing the skills and knowledge of the workforce.

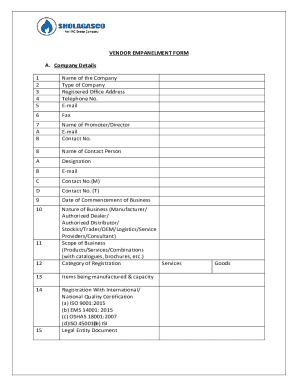

What information must be reported on Tuition Reimbursement Assistance Program?

Information that must be reported typically includes employee details, course information (such as the name and description of the course), total cost of tuition, payment proof, and the connection of the course to job-related skills or career development.

Fill out your tuition reimbursement assistance program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tuition Reimbursement Assistance Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.