Get the free Financial Regulation Standards and Accreditation (F) Committee

Show details

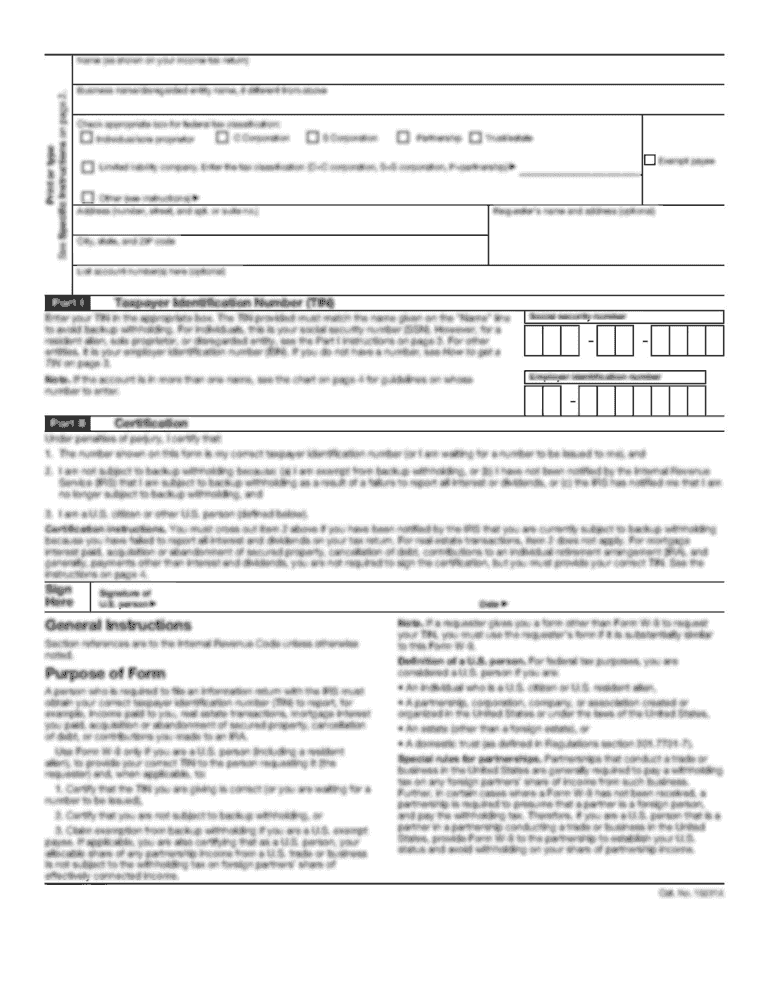

This document contains the minutes from the Financial Regulation Standards and Accreditation (F) Committee meeting held on December 5, 2009, including discussions on proposed company licensing implementation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial regulation standards and

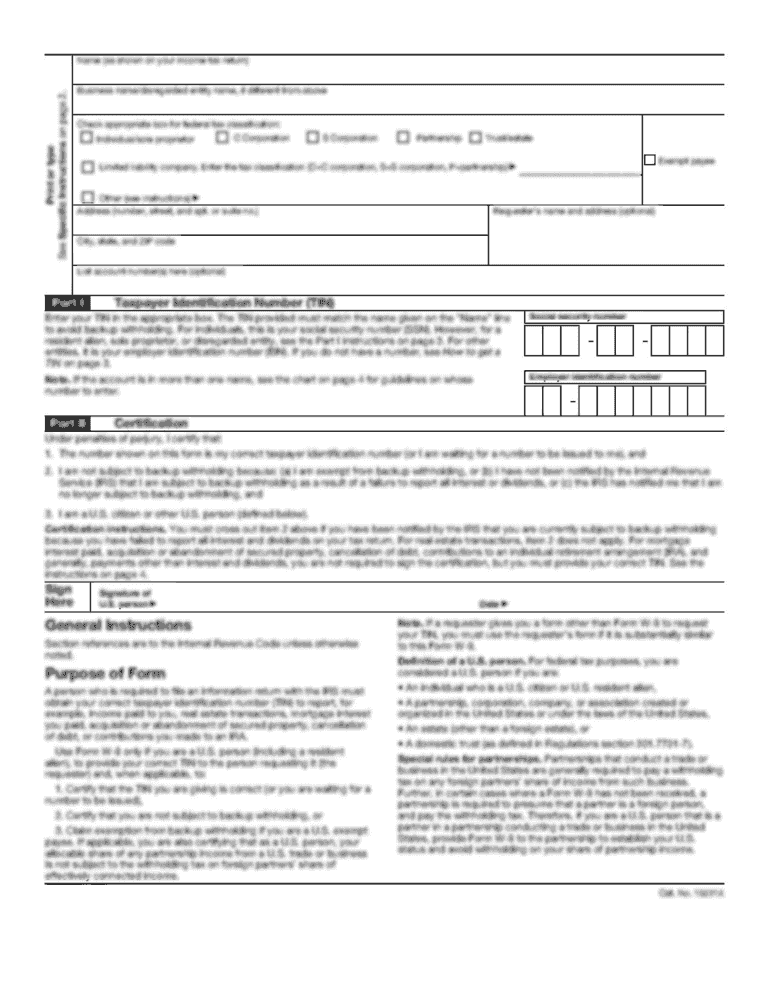

Edit your financial regulation standards and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial regulation standards and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial regulation standards and online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit financial regulation standards and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial regulation standards and

How to fill out Financial Regulation Standards and Accreditation (F) Committee

01

Gather the necessary documents related to financial regulations and accreditation standards.

02

Create a checklist of specific requirements that need to be addressed.

03

Fill in the required information in the application form, ensuring accuracy and completeness.

04

Attach supporting documents as specified in the guidelines.

05

Review the filled application form for any errors or missing information.

06

Submit the application by the specified deadline through the appropriate channel.

Who needs Financial Regulation Standards and Accreditation (F) Committee?

01

Financial institutions seeking to comply with regulatory requirements.

02

Organizations aiming to obtain accreditation for their financial practices.

03

Companies interested in enhancing their credibility and trustworthiness in financial operations.

04

Stakeholders involved in governance and oversight of financial standards.

Fill

form

: Try Risk Free

People Also Ask about

What is the FSR financial regulation?

Broad market oversight The FSR grants general powers to the Commission to investigate all market situations suspected of benefiting from distortive foreign subsidies, including M&A deals and public tenders that fall below the respective thresholds.

Who is the financial regulator in Brazil?

In 1964, the Banking Law (No. 4,595) created the National Monetary Council (CMN) — as the highest macroeconomic and financial regulatory authority — and the Banco Central do Brasil (BCB).

What is the purpose of FCA regulation?

The FCA aims to ensure honest and fair markets by protecting consumers, protecting the financial markets, and promoting competition. The FCA is a public body under the purview of the U.K.'s Treasury and Parliament.

What is the financial regulation standard?

Financial regulation is a broad set of policies that apply to the financial sector in most jurisdictions, justified by two main features of finance: systemic risk, which implies that the failure of financial firms involves public interest considerations; and information asymmetry, which justifies curbs on freedom of

What is the international financial regulation standard?

The International Financial Reporting Standards (IFRS) are accounting rules for public companies with the goal of making company financial statements consistent, transparent, and easily comparable around the world. This helps with auditing, tax purposes, and investing.

What is the UK financial regulation exam?

UKFR is assessed by a two-hour Pearson VUE electronic exam, split into two sections: Unit 1, Introduction to Financial Services Environment and Products (ITFS) – 50 multiple-choice questions. Unit 2, UK Financial Services and Regulation (UKFR) – 50 multiple-choice questions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Regulation Standards and Accreditation (F) Committee?

The Financial Regulation Standards and Accreditation (F) Committee is a governing body that establishes and oversees compliance standards and accreditation processes for financial institutions, ensuring they adhere to regulatory requirements and best practices.

Who is required to file Financial Regulation Standards and Accreditation (F) Committee?

Financial institutions, including banks, credit unions, and other entities that handle monetary transactions, are typically required to file with the Financial Regulation Standards and Accreditation (F) Committee to demonstrate compliance with established financial regulations.

How to fill out Financial Regulation Standards and Accreditation (F) Committee?

To fill out the Financial Regulation Standards and Accreditation (F) Committee forms, institutions need to provide detailed information about their operational practices, financial reporting, compliance measures, and any processes in place to meet regulatory standards.

What is the purpose of Financial Regulation Standards and Accreditation (F) Committee?

The purpose of the Financial Regulation Standards and Accreditation (F) Committee is to ensure that financial institutions operate within legal frameworks, maintain high standards of transparency, and protect the interests of consumers and stakeholders.

What information must be reported on Financial Regulation Standards and Accreditation (F) Committee?

Financial institutions must report information concerning their financial condition, operational procedures, compliance measures, risk management strategies, and any incidents of non-compliance or regulatory breaches.

Fill out your financial regulation standards and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Regulation Standards And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.