Get the free Corporate Partnership Trust

Show details

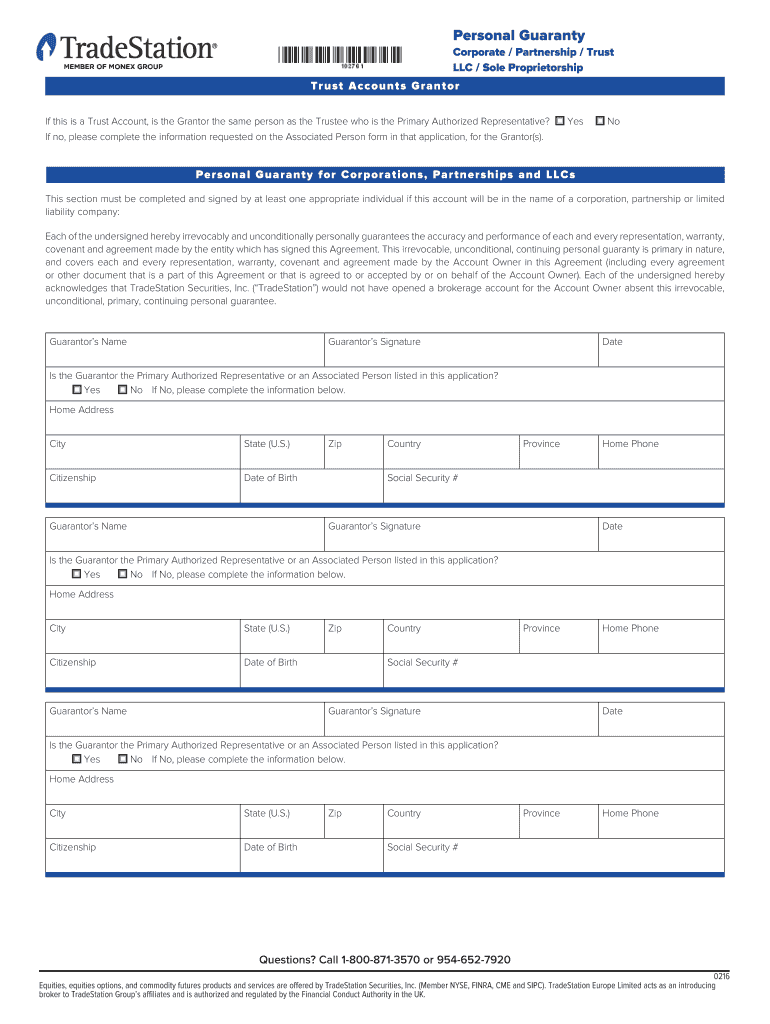

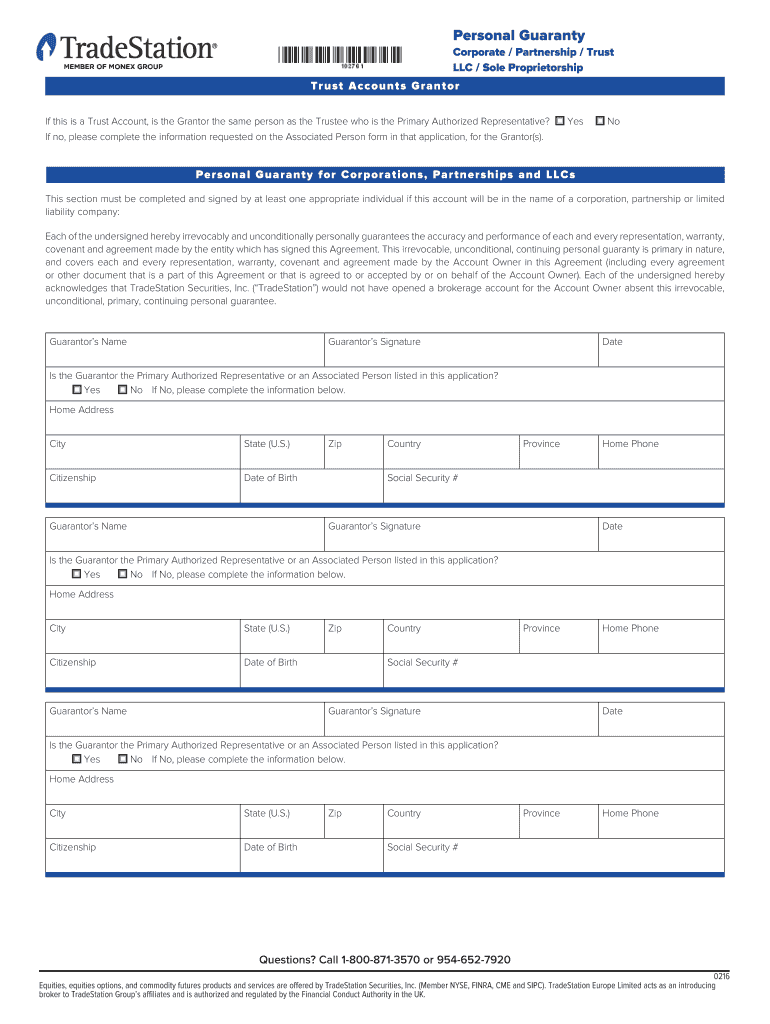

Personal Guaranty Corporate / Partnership / Trust LLC / Sole Proprietorship T rust A c c o UNT s G r ant o r If this is a Trust Account, is the Granter the same person as the Trustee who is the Primary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate partnership trust

Edit your corporate partnership trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate partnership trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporate partnership trust online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit corporate partnership trust. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate partnership trust

How to fill out corporate partnership trust:

01

Gather all necessary documents and information: Before filling out the corporate partnership trust, make sure you have all the relevant documents and information at hand. This may include the partnership agreement, financial statements, tax identification numbers, and any other relevant legal documents.

02

Identify the beneficiaries: Determine who will be the beneficiaries of the corporate partnership trust. These are the individuals or entities that will receive the benefits or assets held in the trust.

03

Appoint a trustee: Select a trustee who will be responsible for managing the trust and its assets. The trustee should be someone trustworthy and knowledgeable about trust administration. This could be a person or a professional trust company.

04

Determine the terms of the trust: Specify the terms and conditions of the corporate partnership trust. This may include how the trust assets will be managed and distributed, any restrictions or limitations, and the duration of the trust.

05

Draft and execute the trust agreement: Prepare a written trust agreement that outlines all the details discussed above. It is crucial to ensure the agreement is properly executed and signed by all relevant parties, including the trustee, beneficiaries, and partners involved in the corporate partnership.

06

Fund the trust: Transfer the partnership assets into the trust. This usually involves formalizing the transfer of ownership, updating relevant legal documents, and notifying any necessary parties, such as banks or financial institutions.

07

Maintain and review the trust: Regularly review and update the trust as necessary. This may include revisiting the beneficiaries, trustee appointments, or adjusting the terms of the trust based on changing circumstances.

Who needs a corporate partnership trust?

01

Partners in a business: A corporate partnership trust can be beneficial for partners in a business as it allows for the efficient management and distribution of assets held within the partnership.

02

High-net-worth individuals: Individuals with significant wealth may utilize a corporate partnership trust to protect and manage their assets, especially if they hold business interests or partnerships.

03

Estate planning purposes: Incorporating a corporate partnership trust into an estate plan can help ensure smooth and efficient transfer of assets to beneficiaries upon death, while providing potential tax benefits.

In conclusion, filling out a corporate partnership trust involves gathering the necessary documents, identifying the beneficiaries, appointing a trustee, determining the terms of the trust, drafting and executing the trust agreement, funding the trust, and maintaining and reviewing it regularly. This type of trust can be beneficial for partners in a business, high-net-worth individuals, and for estate planning purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my corporate partnership trust directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your corporate partnership trust and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I complete corporate partnership trust online?

Completing and signing corporate partnership trust online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I edit corporate partnership trust on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign corporate partnership trust on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is corporate partnership trust?

Corporate partnership trust is a legal entity that combines the features of a corporation and a partnership, often used for holding assets or conducting business operations.

Who is required to file corporate partnership trust?

The partners of the corporate partnership trust are required to file the necessary documents and tax returns.

How to fill out corporate partnership trust?

Corporate partnership trust can be filled out by providing information about the trust's partners, assets, income, expenses, and any other required details on the appropriate forms.

What is the purpose of corporate partnership trust?

The purpose of a corporate partnership trust is to provide a legal structure for holding assets, conducting business operations, and managing the interests of the partners involved.

What information must be reported on corporate partnership trust?

Information such as the trust's partners, assets, income, expenses, and any other relevant financial and operational details must be reported on the corporate partnership trust.

Fill out your corporate partnership trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Partnership Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.