Get the free FIDELITY LIFE

Show details

This document is a new agent appointment form for Fidelity Life and outlines the requirements, authorization for release of information, obligations of the agents, and the ethical and operational

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fidelity life

Edit your fidelity life form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fidelity life form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fidelity life online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fidelity life. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

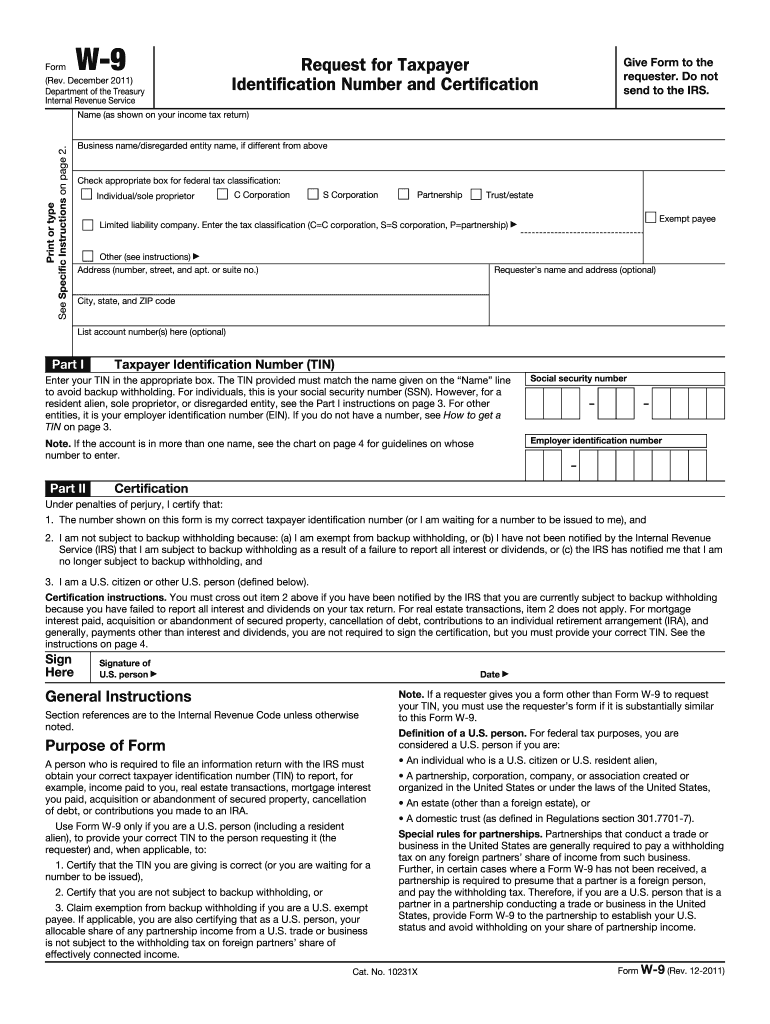

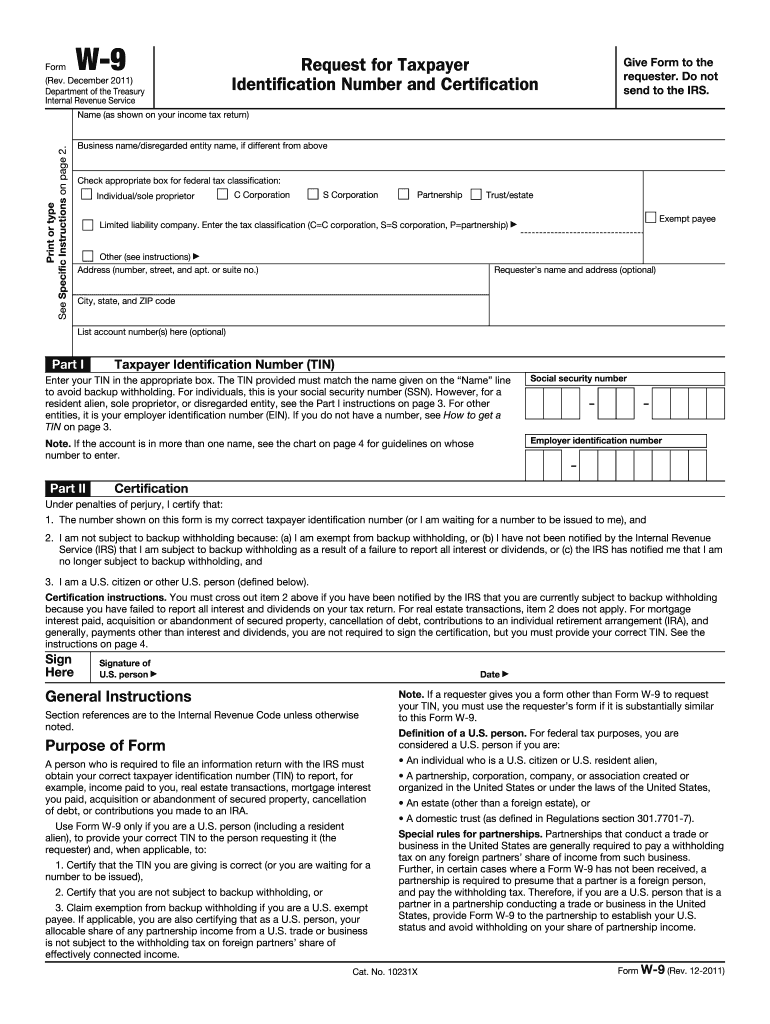

How to fill out fidelity life

How to fill out FIDELITY LIFE

01

Gather your personal information, including identification documents.

02

Visit the Fidelity Life website or contact a representative for the necessary forms.

03

Fill out the application form accurately, ensuring all required fields are completed.

04

Review your application for any errors or omissions before submission.

05

Submit your application either online or via mail, as instructed.

06

Await confirmation and any follow-up communication from Fidelity Life regarding your application status.

Who needs FIDELITY LIFE?

01

Individuals seeking life insurance coverage for financial protection.

02

Parents wanting to secure their children's future in case of untimely demise.

03

Families looking for assistance in covering funeral costs and debts.

04

People with dependents who require income support.

05

Anyone planning for long-term financial security and peace of mind.

Fill

form

: Try Risk Free

People Also Ask about

What is fidelity and what does it do?

Fidelity operates a brokerage firm, manages mutual funds, provides fund distribution and investment advice, retirement services, index funds, wealth management, securities execution and clearance, asset custody, and life insurance.

Is Fidelity Life insurance a real company?

Founded in 1896, Fidelity Life Association is a life insurer based in Illinois. The company offers term products and a range of permanent options aimed at older customers. While its no-exam life insurance policies may be appealing to some shoppers, Fidelity Life draws a high number of consumer complaints.

What does Fidelity Life do?

Life insurance. It pays out a lump sum that can be used to support your family who may rely on your income to: pay off a mortgage, cover household bills and expenses or pay-off any debts. It pays either when you die or have been diagnosed as terminally ill and given less than 12-months to live.

Can you withdraw money from Fidelity Life insurance?

Withdraw some of the money from your policy Under a type of insurance called universal life, you may be able to take a portion of your cash value as a partial withdrawal. However, you cannot do this for a whole life policy, where the only way to access the cash value without lapsing the policy is through a policy loan.

Can I cash out my Fidelity life insurance?

Withdraw some of the money from your policy Under a type of insurance called universal life, you may be able to take a portion of your cash value as a partial withdrawal. However, you cannot do this for a whole life policy, where the only way to access the cash value without lapsing the policy is through a policy loan.

Who owns Fidelity Life insurance?

FILI is a wholly owned subsidiary of FMR LLC, the parent company of the Fidelity Investments companies. Empire Fidelity Investments Life Insurance Company® (EFILI), in New York, is a wholly owned subsidiary of Fidelity Investments Life Insurance Company.

What is the purpose of fidelity insurance?

Fidelity insurance is a crucial form of coverage that safeguards businesses against financial losses resulting from acts of dishonesty or fraud committed by employees. In India, where instances of employee misconduct can have severe implications, having fidelity insurance is essential.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FIDELITY LIFE?

FIDELITY LIFE is a type of insurance policy provided by Fidelity Life Association, designed to offer financial protection and support to beneficiaries upon the policyholder's death.

Who is required to file FIDELITY LIFE?

Individuals who have taken out a FIDELITY LIFE insurance policy or are managing the estate of a deceased policyholder are typically required to file FIDELITY LIFE.

How to fill out FIDELITY LIFE?

To fill out FIDELITY LIFE, you need to provide personal information such as your name, address, and policy number, along with details about the insured individual and beneficiaries.

What is the purpose of FIDELITY LIFE?

The purpose of FIDELITY LIFE is to provide a financial safety net for families by ensuring that funds are available to cover expenses and provide support after the death of a policyholder.

What information must be reported on FIDELITY LIFE?

Information that must be reported on FIDELITY LIFE includes personal details of the policyholder and beneficiaries, policy number, death benefits, and any relevant health information and medical history.

Fill out your fidelity life online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Life is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.