Get the free Business Banking Terms and Conditions

Show details

This document outlines the terms and conditions governing the relationship between the Royal Bank of Scotland International Limited (NatWest) and its business customers, detailing account operations,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business banking terms and

Edit your business banking terms and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business banking terms and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business banking terms and online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business banking terms and. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

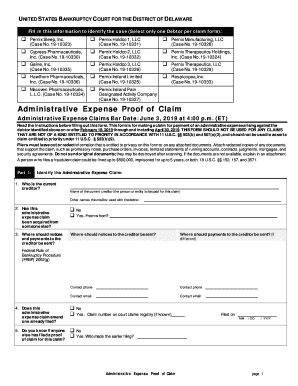

How to fill out business banking terms and

How to fill out Business Banking Terms and Conditions

01

Start by reading the introduction to understand the purpose of the Terms and Conditions.

02

Fill in the business name and contact information in the designated fields.

03

Review the definitions section to familiarize yourself with key terms used in the document.

04

Carefully read through each clause, including fees, services, and responsibilities.

05

Provide any required financial information or documentation as specified.

06

Confirm your understanding of the terms by signing the agreement.

07

Keep a copy for your records after submission.

Who needs Business Banking Terms and Conditions?

01

Businesses that are opening a bank account.

02

Entrepreneurs seeking business loans.

03

Companies interested in banking services and credit facilities.

Fill

form

: Try Risk Free

People Also Ask about

What are the 7 P's of banking?

The study synthesizes insights from various national and international sources, including journals, reports, and theses, to evaluate how banks utilize the 7 P's — Product, Price, Place, Promotion, People, Process, and Physical Evidence — in shaping their marketing strategies.

Is it a legal requirement to have a business bank account in the UK?

If you have set your business up as a limited company then you must use a business bank account to run it.

What are the terms used in banking?

Some of the most common banking terminologies include UPI, ATM, debit card, bancassurance, repo rate, mortgage, PoS, Non Performing Assets, CRR, SLR, etc.

What are the 5 C's in banking?

The 5 Cs are Character, Capacity, Capital, Collateral, and Conditions. The 5 Cs are factored into most lenders' risk rating and pricing models to support effective loan structures and mitigate credit risk.

What are terms and conditions in a contract?

“Terms and Conditions” is the document governing the contractual relationship between the provider of a service and its user. On the web, this document is often also called “Terms of Service” (ToS), “Terms of Use“, EULA (“End-User License Agreement”), “General Conditions” or “Legal Notes”.

What are terms and conditions in banking?

Bank Product Terms and Conditions means the terms and conditions, loan agreement or disclosure documents that apply to the Bank Product you hold. Biller means an organisation which tells you that you can make payments to them through the BPAY Scheme.

What does business banking include?

Business banking is a range of services provided by a bank to a business or corporation. Services offered under business banking include loans, credit, savings accounts, and checking accounts, all of which are tailored specifically to the business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Business Banking Terms and Conditions?

Business Banking Terms and Conditions are the legal agreements and guidelines that outline the rights, responsibilities, and obligations of both the bank and the business customers regarding banking products and services.

Who is required to file Business Banking Terms and Conditions?

Business clients that engage in banking services with financial institutions such as loans, accounts, and other financial products are typically required to acknowledge and file the Business Banking Terms and Conditions.

How to fill out Business Banking Terms and Conditions?

To fill out Business Banking Terms and Conditions, businesses need to review the document carefully, provide the necessary information about their business and financial activities, and sign where indicated to confirm their acceptance of the terms.

What is the purpose of Business Banking Terms and Conditions?

The purpose of Business Banking Terms and Conditions is to clearly define the expectations, rules, and processes governing the relationship between banks and their business clients, ensuring transparency and legal protection for both parties.

What information must be reported on Business Banking Terms and Conditions?

The information that must be reported typically includes details about the business, types of accounts or services used, fees, interest rates, obligations of both parties, and any relevant compliance or regulatory information.

Fill out your business banking terms and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Banking Terms And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.